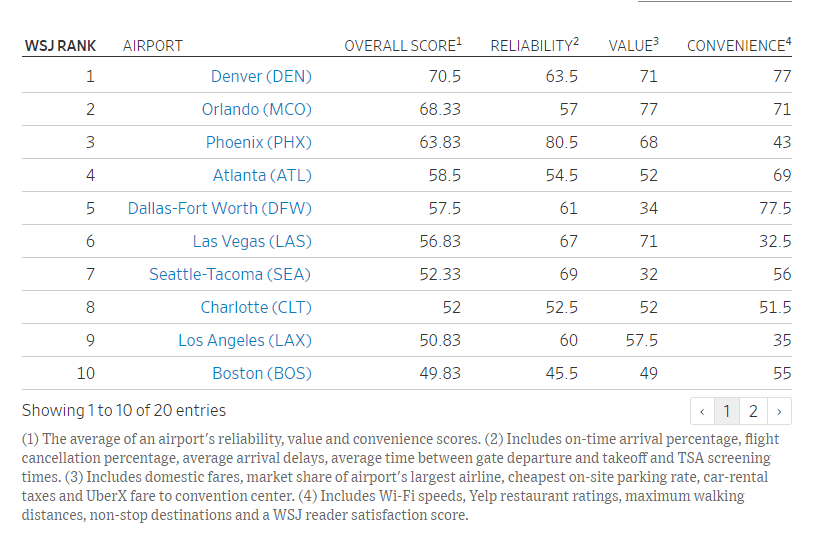

Investors have to brace themselves for plenty of risks in the coming year. From trade wars to real wars(Russia invading Ukraine, for example) and everything in between including further oil price collapse, currency risks, geopolitical risks, never-ending political drama in Western Europe, China collapse, even political risk in the US, etc. will be closely watched by investors. The following infographic shows some of the potential upside and downside risks globally in 2019:

Click to enlarge

Source: Alliance Bernstein