The Spanish banking sector has been hit hard in the past few years due to the Global Financial Crisis and then the European Sovereign Debt Crisis. Bank stocks in Spain have recovered from the March 2009 lows although they are nowhere near their pre-crisis levels.

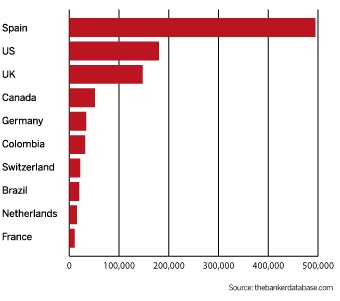

Despite all the continuing troubles at home, some investors are attracted to Spanish bank stocks due to their overseas exposure particularly to the fast-growing Latin American economies. Since Spain used to rule much of Latin American in the past, strong colonial ties still bind the region to Spain. The following chart shows the high exposure of Spanish banks to Latin America:

Click to enlarge

Source: Spanish banks boast strongest FOS network in Latam, The Banker

The Banker magazine noted:

With aggregate assets of $494.5bn, Spanish-owned banks have the strongest foreign-owned subsidiary presence in Latin America.

It is interesting to see U.S. banks having the second highest presence in the region. Bank of Novo Scotia (BNS), one of Canada’s top five banks, has a solid foot print in many Latin American and Caribbean countries.

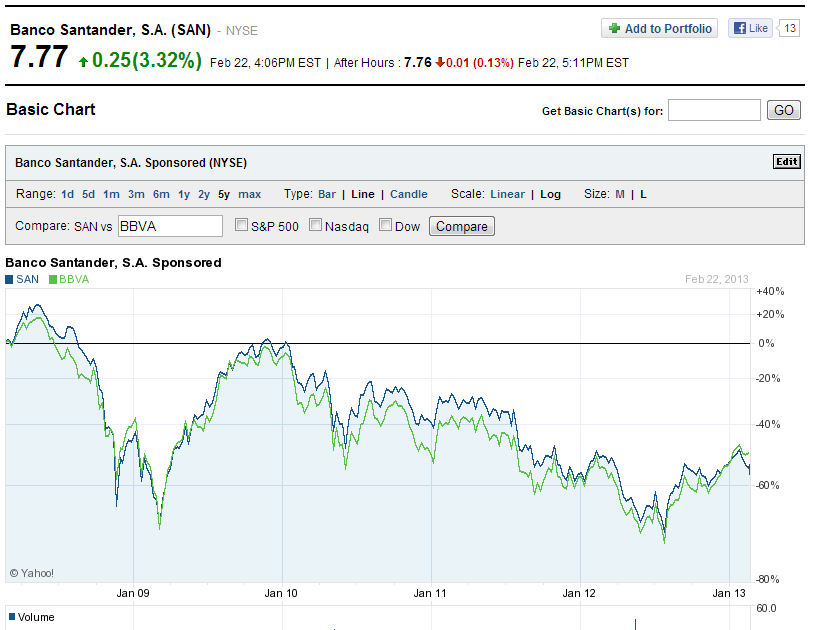

Currently Banco Santander SA (SAN) and Banco Bilbao Vizcaya Argentaria S.A (BBVA) have dividend yields of 11.16% and 5.31% respectively.

The five-year performance of SAN and BBVA is shown below:

Source: Yahoo Finance

Note: Dividend yields noted are as of Feb 22, 2013

Disclosure: Long SAN, BBVA, BNS