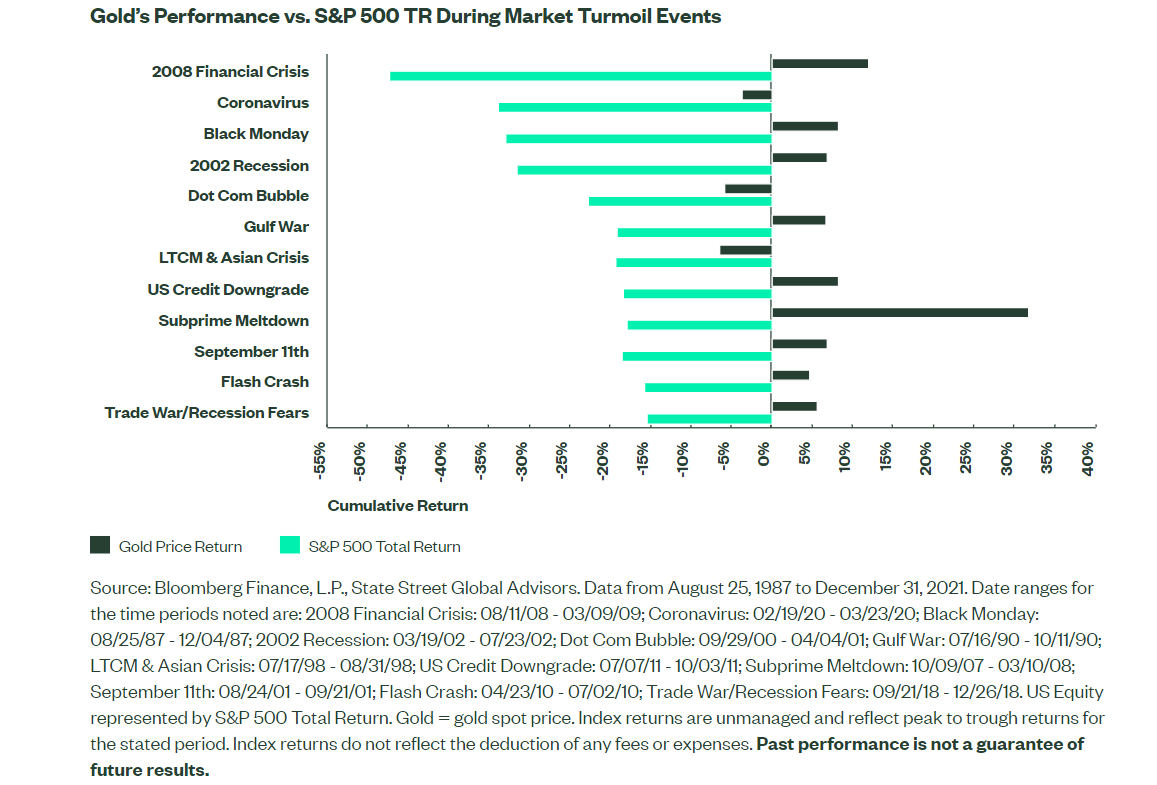

Gold is an important asset class to own in a well diversified portfolio. How much gold should one have depends on depends on many factors including an individual’s circumstances. While gold does not produce income such as dividends, it can offer a cushion to a portfolio especially when equity markets turn volatile. During market downturns when most stocks decline gold has the ability to stay strong and offer much needed stability or even a decent return.

The following chart shows the performance of gold vs. S&P 500 Total Return Index during adverse market conditions:

Click to enlarge

Source: Gold as a Strategic Asset Class, State Street Global Advisors

Related ETFs:

Disclosure: No positions