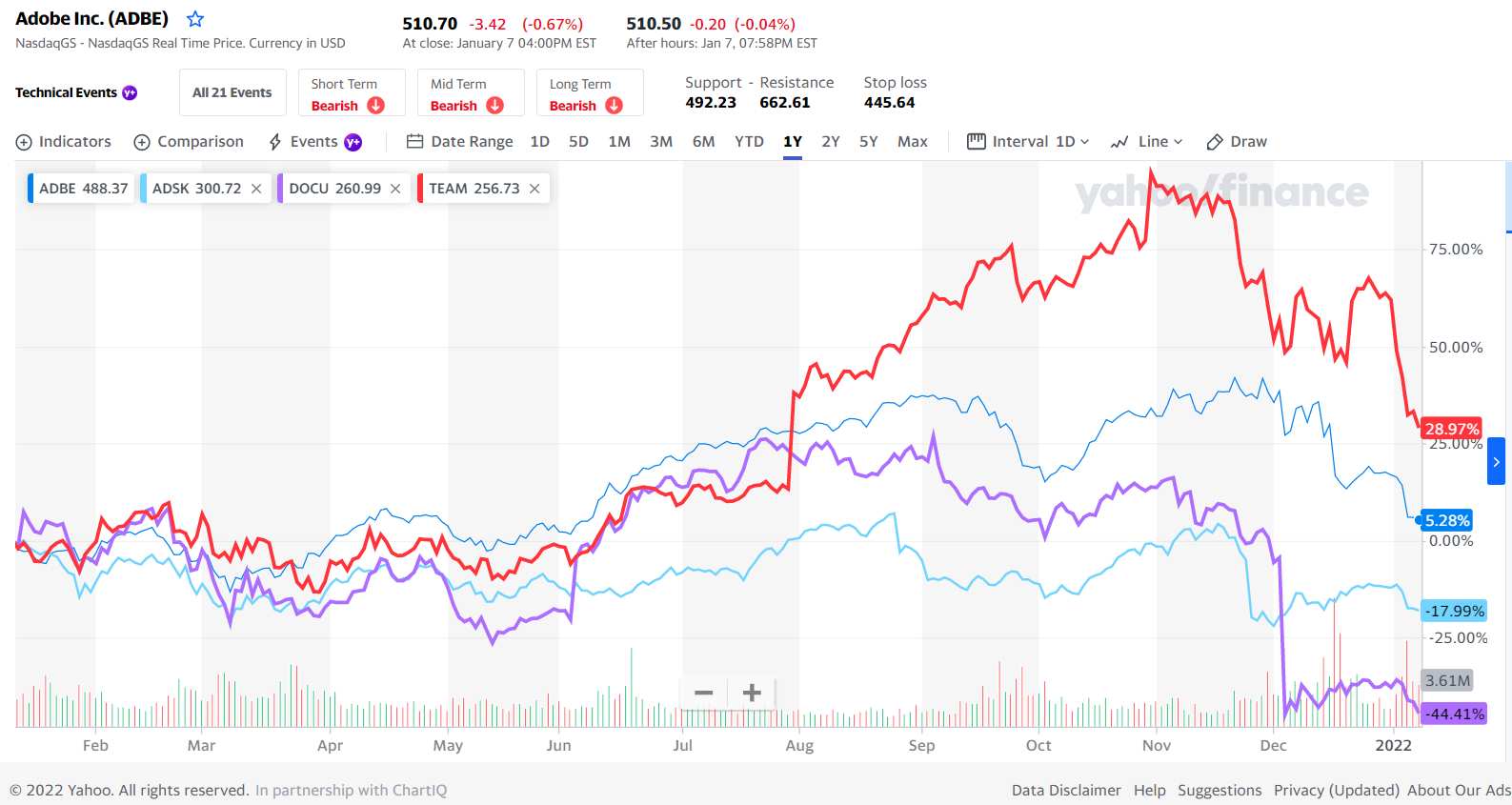

The US equity market has had a rough start to say the least this year. The S&P 500 is down 7.7% YTD on price return basis and the Dow Jones is off by 5.7%. Tech heavy NASDAQ is performing even worse with the NASDAQ Composite and the Nasdaq-100 falling 12% and 11.5% respectively.

Below are the returns of select indices:

- Dow Jones Transportation Average: -7.5%

- Utility Average: -3.8%

- KBW Bank: 0.1%

- PHLX Semiconductor: -13.0%

- PHLX Oil Service: 14.9%

Consumer staples, energy and financials are performing well. But software, technology, consumer discretionary are in correction territory.

Market breadth is awful.

NYSE:

- New 52-Week Highs: 8

- New 52-Week Lows: 526

NASDAQ:

- New 52-Week Highs: 22

- New 52-Week Lows: 1323

Source: WSJ Market Data

According to an article in the journal this weekend, 72% of stocks trading on the NASDAQ are in bear markets (or down at least 20%) from their recent highs. More than 40% of the NASDAQ stocks have declined by 40% or more.

Related ETFs:

- SPDR Dow Jones Industrial Average ETF (DIA)

- SPDR S&P 500 ETF (SPY)

- SPDR KBW Bank ETF (KBE)

- SPDR KBW Regional Banking ETF (KRE)

- Invesco QQQ Trust Series (QQQ)

Disclosure: No positions