Israel is one of the highly successful countries in the Middle East and the world. In just a few decades, the country transformed itself from an economy primarily based on agriculture, clothing and other industries to a hi-tech powerhouse with leadership positions in software engineering, computer component manufacturing, pharmaceuticals and medical technologies. This vibrant economy offers many excellent opportunities for investors. Last year I wrote an article about some of the reasons to invest in Israel.

In this post, let us review some of the impressive features of the economy of Israel:

- Inflation has remained well below 5% since the late 1990s.

- In addition to the industries noted above, the defense industry is an important part of economy and the country is a major player in the world diamond industry as well.

- Israel is described by some as an “island economy” since trade and investment flows with neighboring countries in the Middle East are relatively small but economic ties with the U.S. and Europe is strong.

- Net private transfers which includes government-to-government transactions and private households (including remittances) account for about 2% of the GDP.

- Compared to most other nations, land property rights are somewhat unique. Only 7% of the land is privately owned, 12% is owned by the Jewish National Fund and the remaining 81% is owned either by the State of Israel or by the Development Authority.

- The economy has maintained an average growth rate of nearly 4% per year since 1996, the sixth highest figure among OECD countries.

- The ratio of public debt to GDP was 75% in 2010 which is lower than many OECD countries.

- Unlike a few other developed countries, the domestic financial sector did not experience a critical failure leading to a strong and speedy recovery. In a January 2011 report the International Monetary Fund noted : “Banks proved resilient to global downturn and have strengthened further”. The report continued: “Financial stability indicators suggest hat the resilience of the banking system has increased over the past year. Capital adequacy ratios, notably including Tier 1 capital relative to risk-weighted assets, have risen for most banks, while impaired and non-performing loan ratios have declined. Indicators of credit risk also appear strong; although household leveraging has increased somewhat in recent years, the overall level is low, and mortgage loan-to-value ratios are also low by international standards. Banks maintain high liquidity, and interbank and direct exchange rate risk exposures are small”.

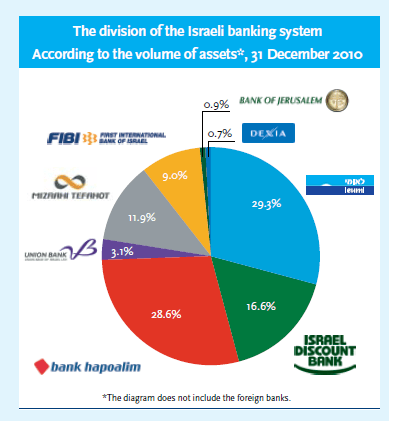

- The banking industry has played an important role in positioning the country as an advanced and developed economy that is attractive to international investors. The industry is comprised of 19 commercial banks with most of them concentrated into five banking groups: Leumi, Hapoalim,

Discount, Mizrahi-Tefahot and FIBI. Along with these groups, three independent banks (Union Bank, Bank of Jerusalem and Dexia) and four branches of foreign banks (HSBC, Citibank, BNP Paribas and State Bank of India) operate more than 1,100 branches in the country.

10. The recent discovery of offshore natural gas fields should reduce the need for imported energy and will help the already strong state fiscal balances with the associated tax and royal revenues.

10. The recent discovery of offshore natural gas fields should reduce the need for imported energy and will help the already strong state fiscal balances with the associated tax and royal revenues.

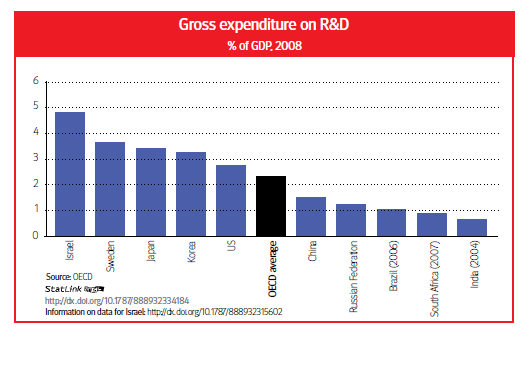

11. Widely praised as a “start-up nation”, Israel has the highest number of companies listed on the NASDAQ after Canada and the US and the highest level of venture capital as a share of GDP. Israel implemented a hands-on approach to innovation by creating the Office of the Chief Scientist in 1969 within the Ministry of Industry, Trade and Labour to promote innovation and development of commercial products in the high-tech industry.

12. The standard corporate tax rate currently stands at 24%, but will be reduced gradually to 18% by 2016 due to changes in tax laws. The income tax rate imposed on preferred income(i.e. income generated from activities in Israel only) may reach as low as 6%.

12. The standard corporate tax rate currently stands at 24%, but will be reduced gradually to 18% by 2016 due to changes in tax laws. The income tax rate imposed on preferred income(i.e. income generated from activities in Israel only) may reach as low as 6%.

13. The Labor force participation in Israel is 64% among the working-age population which is lower than the OECD average of 71% but still good.

14. A large number of immigrants into the country are highly educated, skilled and talented. For example, many of the Jews that emigrated after the breakup of the Soviet Union were engineers, scientists, etc. who further strengthened Israel’s “human capital”.

15. Due to cultural and religious attractions and increasingly leisure, tourism is also a major contributor to the economy with the industry experiencing an average growth of 12% in the last three years. Last year revenue from tourism totaled $4.3 billion.

In terms of investment options, generic drugs maker Teva Pharmaceutical Industries(TEVA) and security software company Check Point Software Technologies Ltd(CHKP) are two excellent candidates to consider. Some of the other companies that investors can review include Mellanox Technologies Ltd. (MLNX), Radware (RDWR), Protalix Biotherapeutics Inc. (PLX) and EZchip Semiconductor Ltd. (EZCH). According to an article by Shlomi Cohen in Seeking Alpha these four firms have a good chance of reaching a market capitalization of $1 billion this year.

The iShares MSCI Israel Capped Investable Market ETF (EIS) is a simple and easy way to invest in Israel. This ETF gives exposure to 86 companies with financials accounting for about 29% of the portfolio. The fund has an asset base of $93 million and the expense ratio is 0.61%.

Source: Spotlight on Israel, OECD Observer, Q2, 2011

Disclosure: No Positions

Make USA great again !

Praying for the peace of Jerusalem, and its prosperity!

Hope they got strong backs cause my pockets will only get heavier as I ride rabbinically to riches…hava nagila and hava some shekels too!!! Oh and uh free Palestine!