The State of Israel has a population of 7.5 million. The GDP grew 0.5% in 2009 to reach about $207.0B. Just a couple of decades ago the economy of Israel used to be primary based on agriculture, clothing and other industries. However that has changed. In about twenty five years Israel has transformed its economy into a highly developed economy with greater emphasis on knowledge-based and high tech industries.Despite the occasional violence and constant security concerns, Israel offers many excellent investment opportunities.

Bahai Gardens, Mount Carmel, Haifa

Some of the reasons to invest in Israel are:

1. Israel runs a current account surplus. In 2009, the current account soared 243% to $7.2 billion.

2. Though currently classified as an emerging market, by the end of this month MSCI will upgrade Israel to a developed market. Hence Israel will join this select group of 23 other developed countries in the index.

3. The banking sector remained stable during the global credit crisis and emerged strong last year. Unlike many banks in the west, none of the banks had any large sub-prime exposure and needed to be bailed out by the state.The five largest banks – Hapoalim group, Bank Leumi Bank, Discount Bank, Mizrahi-Tfahot Bank group and First International Bank – are all well capitalized and their capital adequacy ratio is much higher than the minimum required by Basel standards.

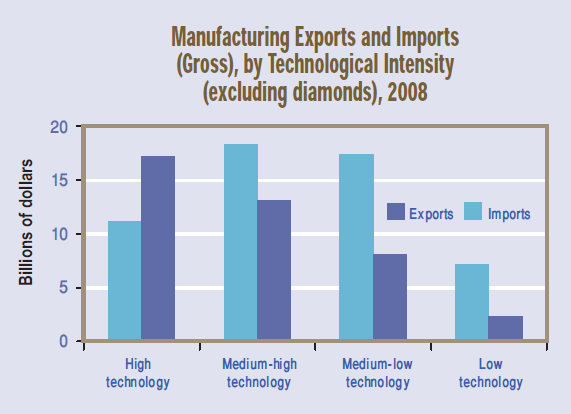

4. The high-tech industry forms a large part of the Israeli economy.While Germany is known for engineering, Israel can be called as a high-tech powerhouse. Some have called the incredible growth of the hi-tech industry in a short period of time as a hi-tech miracle.The country is a global leader in many hi-tech sectors such as electronics, generic pharmaceuticals, biotechnology and aeronautics. Exports of products by the hi-tech industry has been grown at an annual rate of 8.5% in the last five years. In March this year, the sector brought in $2.1B in export revenue. In the manufacturing sector, sale of hi-tech products forms the largest source of export revenue as the chart for 2008 shows below:

5. Because of limited natural resources, in terms of foreign trade Israel a imports raw materials such as crude oil, coal, raw diamonds, etc. and exports manufactured goods such as polished diamonds, aircraft parts, pharmaceutical products, chemicals, electronics, etc. This gives the country an advantage since raw materials are usually cheap but manufactured goods are offer high profits. For example, in March 2010 manufacturing goods (excluding diamonds) accounted for 80% for all exports.

Unlike the US which usually runs a large trade deficit because of imports from China, Israel’s trade deficit is very small.

The U.S. and Europe are the largest trade partners and also the largest export markets for Israel.

6. Israel has the largest number of companies listed on the NASDAQ than any other country except Canada. This is very significant considering the country’s population is relatively small compared to many other countries such as India, China, Brazil, UK, France, etc.A total of 62 Israeli companies are listed in the NASDAQ.

7. In a December, 2009 report titled “Playing Defense” Bank of America Merill Lynch recommended Israel as an attractive investment destination and recommended companies especially in the banks and telecom sector. According to Merril Lynch, some of the reasons for investing in Israel include were the strong currency vs. the US dollar, the resilient economic performance among other emerging markets and the strong leadership performance shown by The Bank of Israel and the Ministry of Finance in handling the economy.

8. The value of investment in research and development as percentage of GDP in Israel is the highest in the world. High R&D spending coupled with a highly skilled and educated workforce spawns hundreds of start-ups producing many successful commercial products. The country has the highest number of scientists and engineers per capita in the world. Hence one of the areas where Israel excels compared to other OECD countries is the Information and Communication Technologies(ICT) sector which forms a considerable portion of exports. Little wonder that after Silicon Valley, Israel has the highest concentration of start-ups anywhere in the world.

Best Invest In Israel – Video:

10. Some of the other factors that make Israel an attractive destination for investment are: general government consumption accounts for a small portion of the total GDP, relative low unemployment rate, stable and growing housing market, very low growth in debt to GDP during 2009, the Tel-Aviv 25 Index beating the S&P 500 over the last five years, etc.

Sources: Central Bureau of Statistics(CBS), Ministry of Finance, Bank of Israel, Vale-Columbia Center on Sustainable International Investment and others

How to invest in Israel?

One easy way to gain exposure to the Israeli equities is via the iShares MSCI Israel Capped Investable Market Index Fund (EIS) ETF. The fund has $250M in assets and contains 81 holdings. The Top 10 stocks in the portfolio include Teva, Israel Chemicals, Check Point Software(CHKP), Bank Leumi Le-Israel, Israel Telecom, Bank Hapolim, NICE Systems and Cellcom Israel Ltd (CEL). Teva alone accounts for about one-fourth of the fund’s holdings. As of March 31st, the fund is up by 9.01%.

Another option is to pick the closed-end fund Aberdeen Israel Fund, Inc. (ISL). The fund had an asset of $76M as of March and the expense ratio is 1.85%. The fund is heavily concentrated with the top 10 holdings accounting for 72% of the total holdings. Currently the fund trades at a 8% discount to NAV.

A third option is to select the AMIDEX35 Israel Mutual Fund. This fund invests in Israel’s 35 largest companies traded on the U.S. and Tel Aviv Exchanges. The advantage of this fund is that it allows investors to gain exposure to Tel Aviv traded Blue Chips and Israeli high-tech companies traded on the US markets in one transaction in US dollars.

Update:

A fourth option is to invest via The American Israeli Shared Values Capital Appreciation Fund.(Ticker: AISHX) This no-load fund is a unique mutual fund since it invests in both Israeli companies and US companies that do business in Israel. The aim of the fund is long-term capital appreciation.

For investors that prefer to invest in equities directly, there are over 60 Israeli companies traded on Wall Street.The complete list of Israeli stocks traded on the US organized exchanges can be found here.TeAMIDEX35 Israel Mutual FundAMIDEX35 Israel Mutual FundMIDEX35 Israel Mutual Fund

Other than Teva and SDL ( Delek), what is your suggestion where to invest in Israel? Can you send me please, by e-mail, weekly upgrade? Thank you.

Milan

I do not track the market in Israel very closely. However hi-tech stocks are the preferred sector to invest there. Here are some ideas:

Mellanox Technologies Ltd. (Nasdaq:MLNX), Radware, Protalix Biotherapeutics Inc. (AMEX:PLX), and EZchip Semiconductor Ltd. (Nasdaq:EZCH).

More details here:

http://seekingalpha.com/article/254351-4-israeli-firms-headed-to-1-billion

Thx.