The S&P 500 is the benchmark index of the US equity market. The index is considered as the barometer of the economy. Since it is diversified with all the major industries represented it is a true representation of the American economy. However there is one major drawback in the construction of the S&P 500. This is because the index is Market-Cap Weighted. This means stocks with higher market capitalization have a bigger impact on the index. Or to out it in another way companies with largest market capitalizations have the largest weight in the index.

Currently the tech sector accounts for the largest weight in the index and the companies with the largest market caps are: These are Apple(AAPL), Amazon(AMZN), Microsoft(MSFT), Alphabet (GOOGL). Tesla(TSLA), Meta Platforms Inc (META) and NVIDIA Corp (NVDA). As these stocks have soared this year, so has the S&P 500. The index is up over 20% YTD. If we exclude these firms, the return of the index is average.

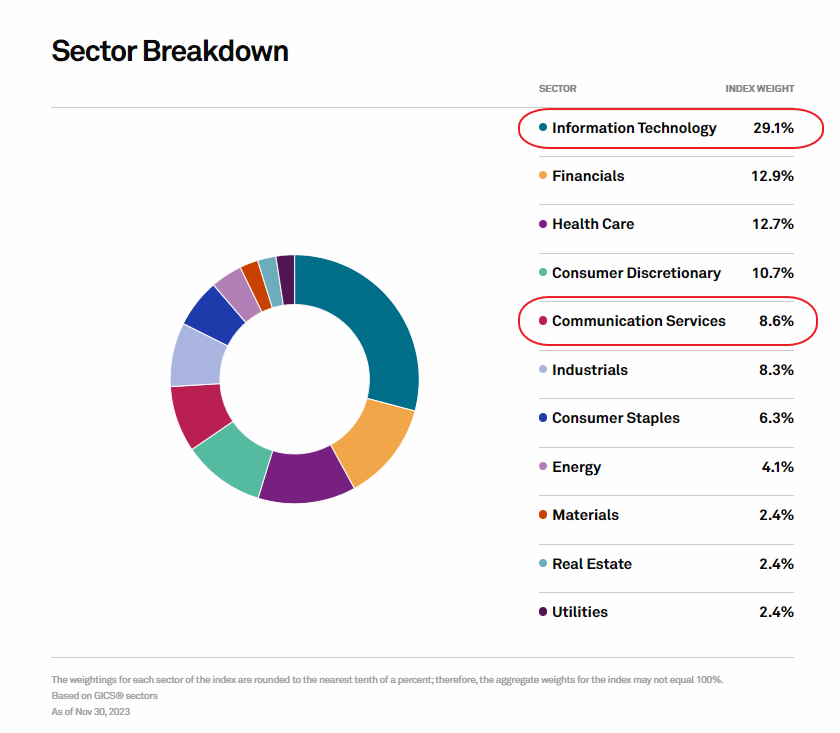

The sector composition of the S&P :

Source: S&P

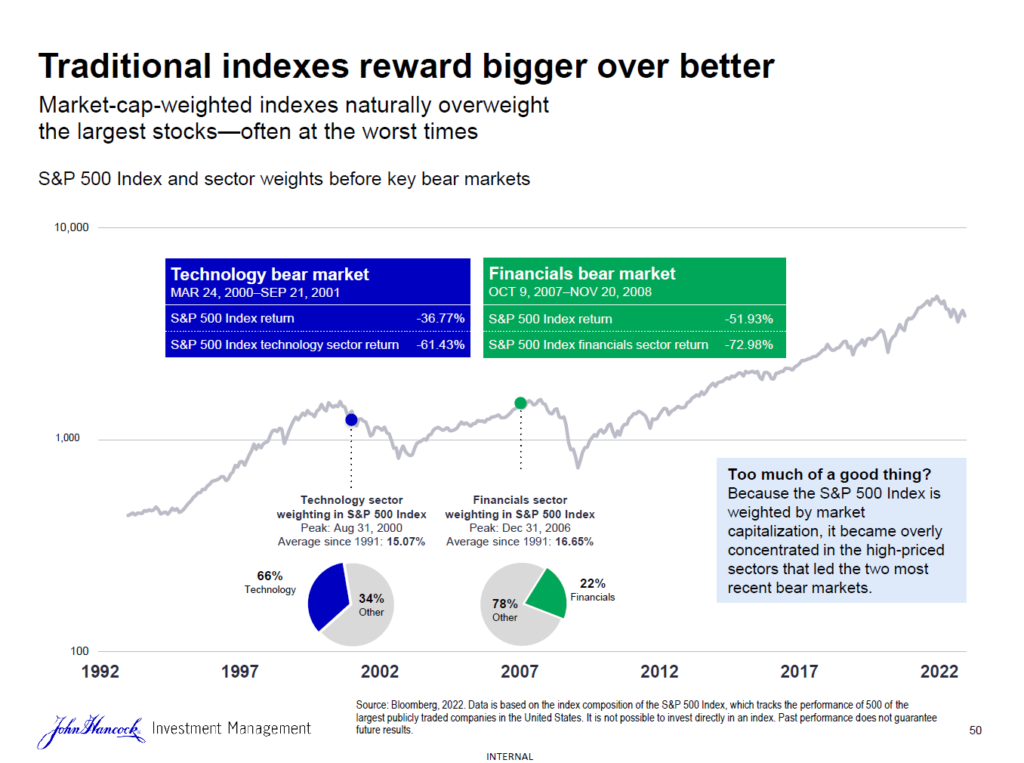

When the largest constituents in the S&P 500 go higher and higher in prices naturally the overall index price also increases. But high concentrations of certain sectors also can lead to dramatic crashes. The past two bear markets are examples of this scenario. High concentrations in the tech and financial sectors led to the two bear markets that were brutal to say the least.

Click to enlarge

Source: 10 things every investor should know about investing workbook, John Hancock Investments

Related ETFs:

Disclosure: No positions