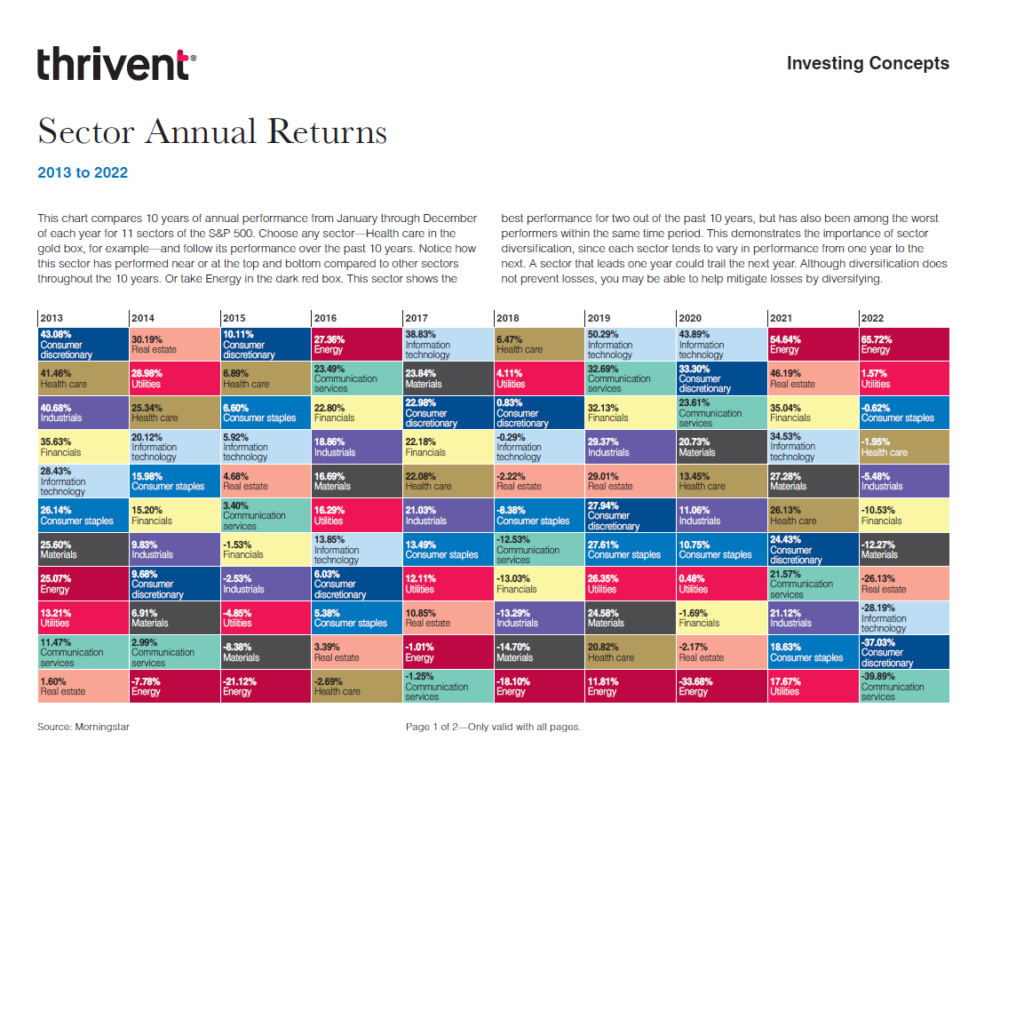

Allocating assets among various sectors is one way to implement the diversification strategy. This is because the sector that earns the best returns in one year might end up turning the worst the following year. For example, the below chart shows the annual sector returns of the S&P 500 index from 2013 to 2022. We can easily see that not one sector is the consistent best performer year after year.

Energy for instance had the best returns in 2016 but in 2017 it was the second worst performer. Similarly the sector plunged heavily in 2020 when the Covid-19 pandemic hit and had a loss of 34%. The following year however energy rebounded sharply and was the best sector in the S&P 500 with an astonishing return of 54%. Energy again surprised many investors in 2022 when it earned the highest sector returns of 66%. The sector is not having a great run so far this year. It is the second worst performer with a loss of 5.5% after utilities.

Annual Sector Returns of the S&P 500 from 2013 to 2022:

Click to enlarge

Source: Thrivent

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

Disclosure: No positions