Over the long term dividends constitute a significant portion of the total returns of any dividend paying stock or investment. Due to the effects of compounding returns tend to multiple many times over the years even if the start point of the dividend yield is low. For instance, the current dividend yield on the S&P 500 is 1.62%. However over many years or decades the total return of the S&P 500 index would be higher than the price returns as reinvested dividends grow many times over.

Another way to earn higher total returns is by investing in companies that increase dividends consistently over time. This strategy easily beat the total returns on the S&P 500 index. According to an article by Yoichiro Kai at T.RowePrice the difference in returns between firms that increased dividends and the S&P 500 is substantial.

From the piece:

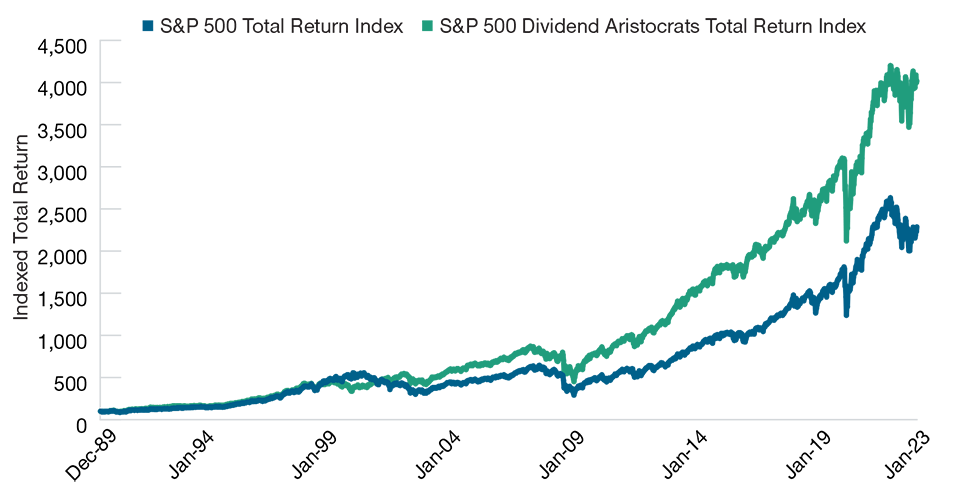

That importance is even clearer with sustained dividend growth. As an example, the S&P 500 Dividend Aristocrats Index, which represents over 60 S&P 500 companies with 25 consecutive years of dividend increases, has outperformed the S&P 500 Index by more than 75% since 1989 (Figure 4). By identifying companies with the ability to sustain and grow dividends and taking an active, global approach, we believe we have the potential to drive consistent long‑term returns.

(Fig. 4) Indexed total returns for S&P 500 Dividend Aristocrats Index and S&P 500 Index:

Click to enlarge

Source: Tapping the Power of Global Equity Dividends by Yoichiro Kai at T.RowePrice

Related ETF:

Disclosure: No positions