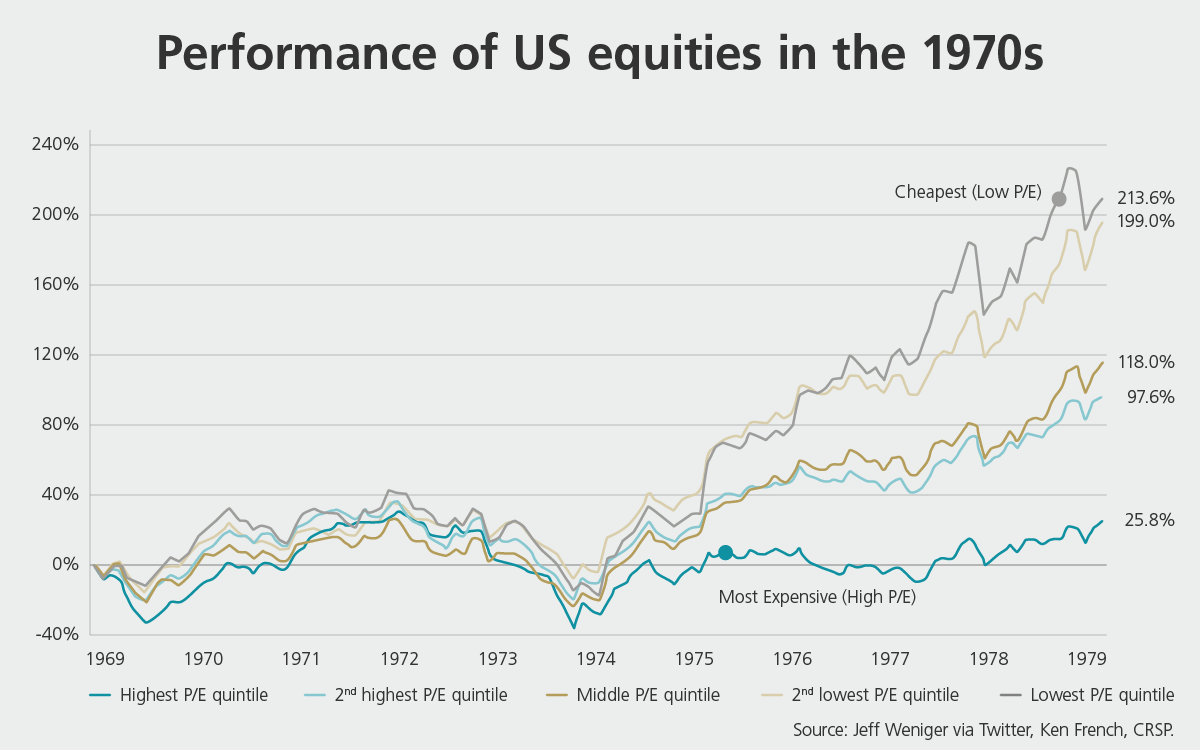

In the 1970s, the US economy was suffering from Stagflation. This was period of high inflation and unemployment. Many experts are predicting the current economic condition could lead to a similar scenario. If the US economy enters into a period of stagflation, which stocks will perform better?

According to a report by Marko Gränitz, “During the 1970s, when inflation rates were very high, the 20 percent of stocks with the lowest valuation – as measured by price-to-earnings ratios – performed significantly better than the highest-valued stocks.”

Click to enlarge

Source: “Stagflation, then and now“, by Marko Gränitz, guest author at LGT, May 18, 2022 via Investment Office

Here is an excerpt on Stagflation from an article at AP:

Saudi Arabia and other oil-producing countries imposed an oil embargo on the United States and other countries that supported Israel in the 1973 Yom Kippur War. Oil prices jumped and stayed high. The cost of living grew more unaffordable for many. The economy reeled.

Enter stagflation. Each year from 1974 through 1982, inflation and unemployment in the United States both topped 5%. The combination of the two figures, which came to be called the “misery index,” peaked at a most miserable 20.6 in 1980.

Stagflation, and especially chronically high inflation, became a defining feature of the 1970s. Political figures struggled in vain to attack the problem. President Richard Nixon resorted, futilely, to wage and price controls. The Ford administration issued “Whip Inflation Now” buttons. The reaction was mainly scorn.

Source: Worry about stagflation, a flashback to ’70s, begins to grow, AP

Related ETF:

- SPDR S&P 500 ETF (SPY)

Disclosure: No Positions