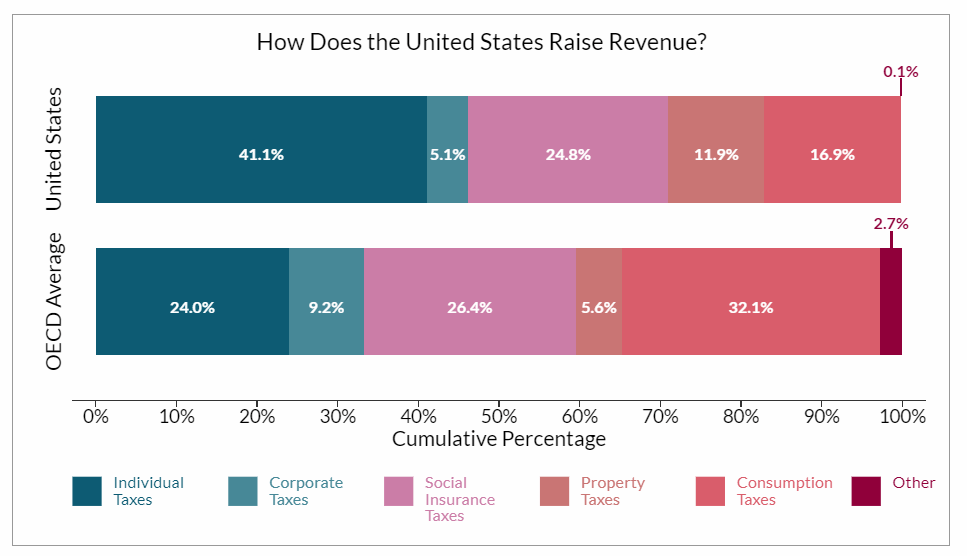

While researching on capital taxes around the world recently, I came across the below interesting graph that shows the sources of tax revenue in the US compared to the OECD countries. Tax revenues come in various categories such as Individual Taxes, Corporate Taxes, Property Taxes, etc. But they differ significantly in terms of reliance on each of these taxes by the US and other OECD countries.

Click to enlarge

Source: Taxes in the United States, Tax Foundation

I wrote an article about this fact many years ago. The US collects more taxes from individuals than from corporations as shown in the chart above. This is policy is highly beneficial to investors of corporations. By paying less taxes, corporations are able to keep more of their profits or pass it on to their owners in the form of dividends and share buybacks. OCED countries on an average raise nearly double the US rate in the form of Corporate Taxes.

Property Taxes are nearly double in the country relative to the OECD average. Property Taxes vary widely even within a state or a city. These taxes are used as a form of catch-all revenue sources by local governments. Any need for funds such as adding a new library to building a stadium to establishing a park and everything in between is easily achieved by adding them to property taxes owed by a owner of a property within the jurisdiction. Of course such levies are first put through a ballot for approval from voters. In addition, since annual property taxes are in the thousands of dollars just adding a dollar here and dollar there for some requirement can easily generate millions in additional revenue.

The American economy is a consumption-driven economy. Hence taxes on consumption are kept low when compared to OECD countries. High taxes on consumption such as consumer goods for example can slash demand. So lower consumption taxes indirectly encourages consumers to consume more of goods and services.