US equity markets have performed poorly so far this year to say the least and are the edge of tuning into a bear market. Last week was especially brutal as retail and consumer staples sector were also thrashed. Sectors such as utilities and energy have offered shelter from the carnage but it remains to be seem if their strength will continue to hold as volatility increases even more in the coming days and weeks.

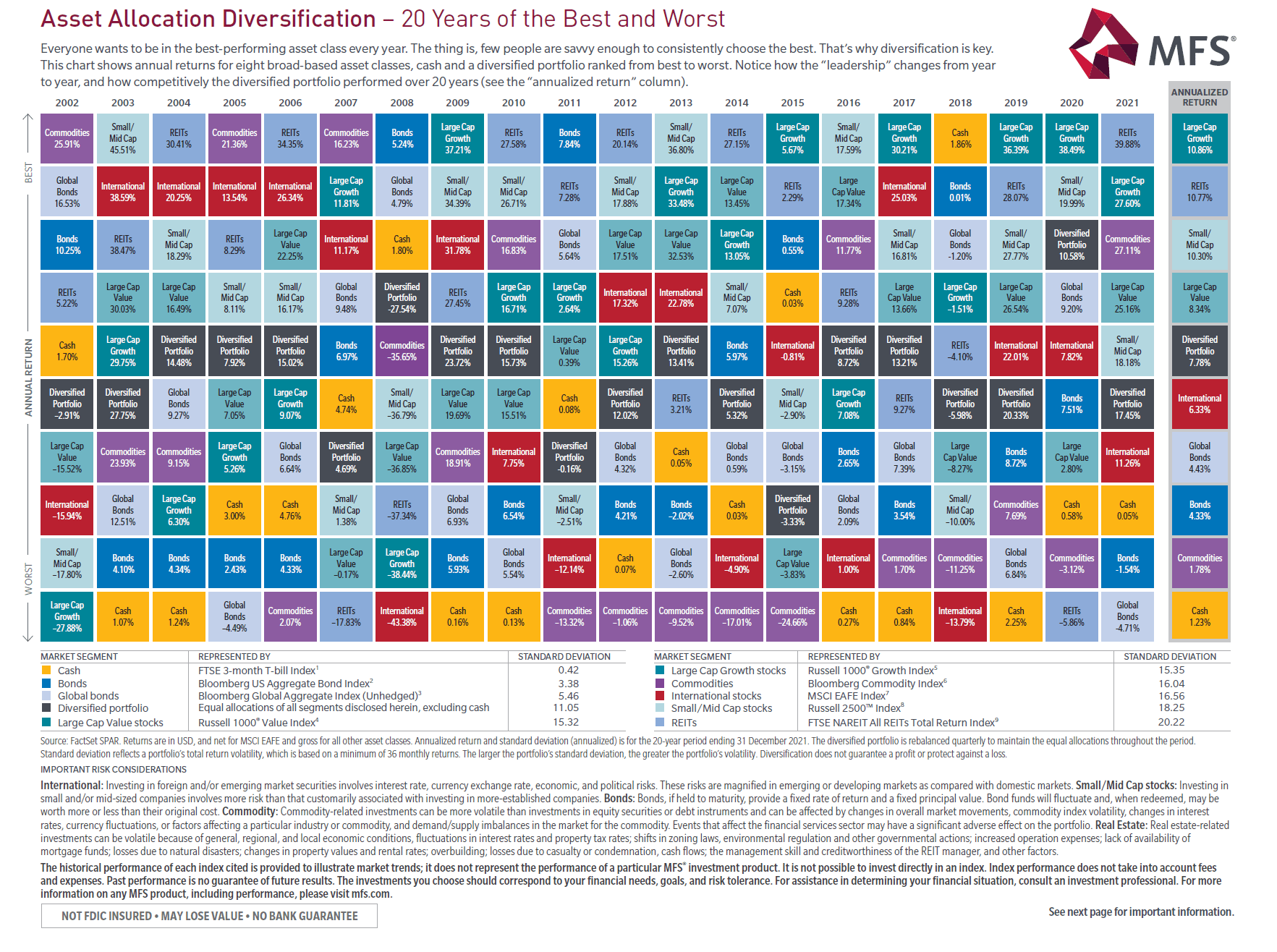

With that said, I have written many times before that one way to reduce risk and cushion a portfolio from the market’s wild gyrations is to diversify one’s assets. Diversification is the simplest and easiest option available for retail investors to avoid huge losses. The following chart shows the importance of diversification over various asset classes in terms of returns from 2000 to 2020:

Click to enlarge

Source: MFS

For example, though US large cap stocks have had excellent returns in the past few years, during the Global Financial Crisis (GFC) bear market of 2007-08 they were the second worst performers with a decline of over 38% in 2008.

Though we have many months to go in 2022, it remains to be seen how much growth stocks plunge by the end of the year should the equity markets end up in bear market.

Related ETFs:

- Vanguard Mid-Cap Growth ETF (VOT)

- iShares Russell Midcap Growth Index Fund (IWP)

- SPDR S&P 500 ETF (SPY)

- Vanguard Total Bond Market ETF (BND)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

Disclosure: No positions