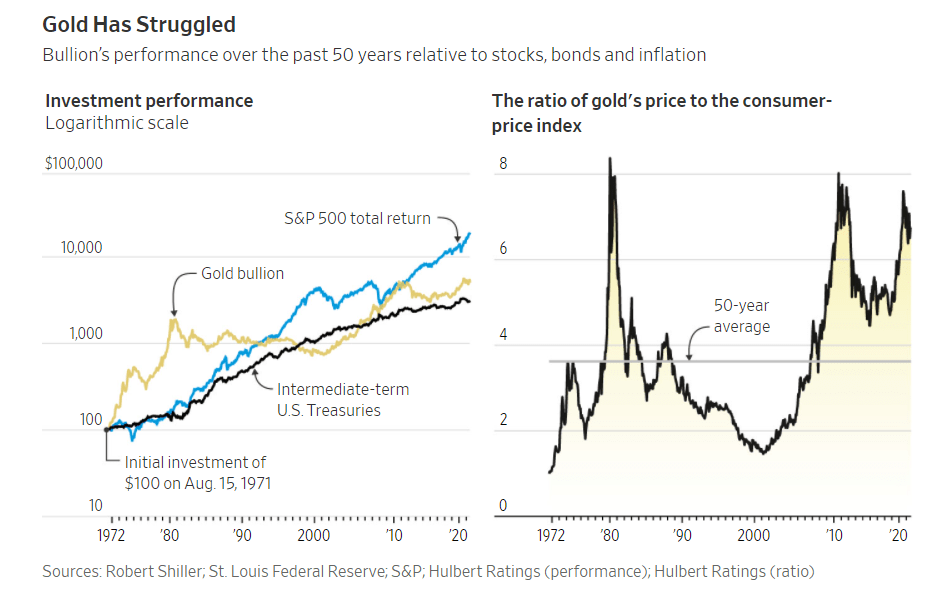

Gold is an important asset class to own in a well-diversified portfolio. However investors always wonder if gold is better than assets like stocks bonds, stocks and commodities. Gold is also known to be a great asset to beat the raves of inflation. An article in the journal last month noted that gold has underperformed stocks over the past 50 years. Since August 1971, the annualized return on the S&P 500 is 11.2% including dividends reinvested while gold produced an annualized return of just 8.2%.

Click to enlarge

Source: Gold as an Inflation Hedge: What the Past 50 Years Teaches Us, WSJ

From the article:

Gold is only a good inflation hedge over time frames far longer than any of our investment horizons, according to research conducted by Duke University professor Campbell Harvey and Claude Erb, a former commodities portfolio manager at TCW Group. They found that it’s only when measured over very long periods—a century or more—that gold has done a relatively good job maintaining its purchasing power. Over shorter periods its real, or inflation-adjusted, price fluctuates no less than that of any other asset.

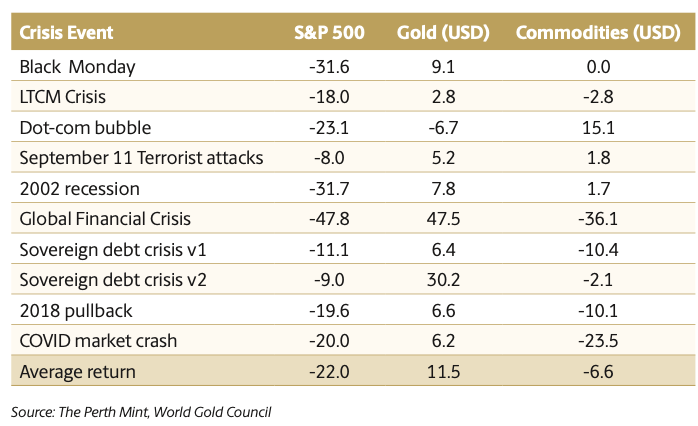

Even a small allocation of gold in a diversified portfolio can improve the risk adjusted returns. This is because historically gold has a positive correlation to rising risk assets and negative correlation to falling risk assets. To put it simpler ways, it means when risky assets such as stocks are falling then gold would rise and vice versa.

The following table shows the performance of gold vs. stocks and commodities during major risk-off crisis events in the past 30 years.

Click to enlarge

Source: The case for a modest allocation to gold in super funds, FirstLinks

During the Global Financial Crisis (GFC) of 2008-09, the S&P 500 plunged 48%. During this time gold almost increased by bout the same percentage.

Related ETFs:

Disclosure: No Positions