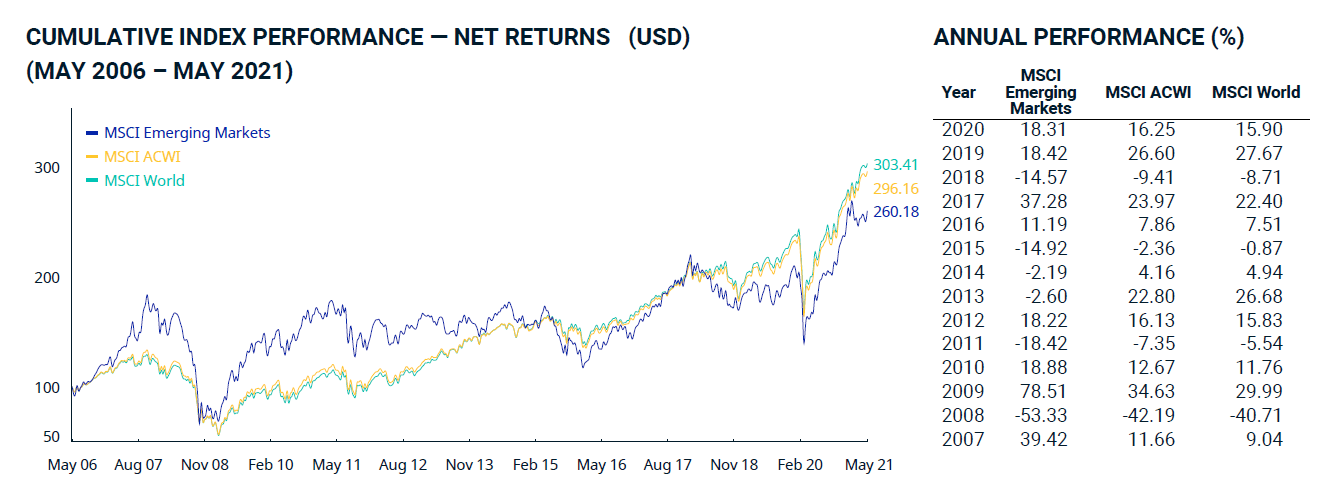

The MSCI Emerging Markets Index is one of the most popular indices for tracking the performance of emerging markets. Many ETFs and mutual funds are benchmarking against this index. The index is comprised of 1,424 companies across 24 emerging markets. The performance of the index relative to the MSCI World and MSCI ACWI indices over from May,2006 thru May, 2021 in US dollar terms is shown in the chart below:

Click to enlarge

Source: MSCI

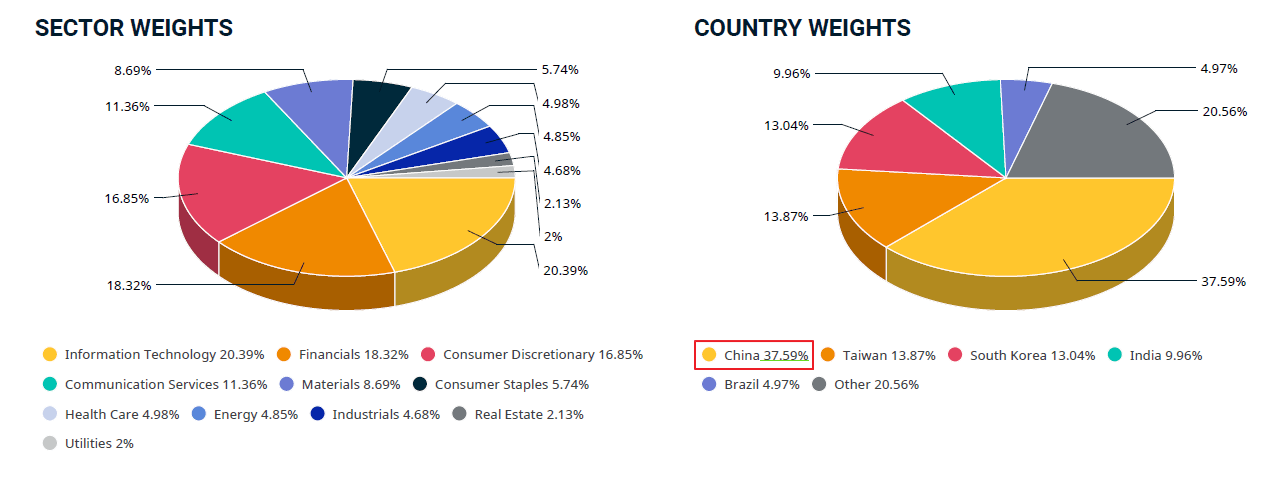

Despite the popularity of The MSCI Emerging Markets Index there are many risks and disadvantages of using this as the benchmark for emerging markets. The following are five concentration risks that investors need to be aware of when investing in a fund that is based on this index:

- From a country weights perspective, just China accounts for about 38% of the index.

- In addition, five countries – China, Taiwan, South Korea, India and Brazil – account for about 80% the index leaving just 20% for all the remaining countries.

- The top five holdings amount to more than one-fourth of the index composition.

- Moreover stocks from China, Taiwan and South Korea make up almost two-thirds of the index.

- Just four firms – Taiwan Semiconductor Manufacturing Co.(TSM), Tencent(TCEHY), Alibaba Group(BABA) and Samsung Electronics – account for 20% of the index. Or to put it another way, tech dominates the index. Any correction or major decline in this sector will have a higher impact on the performance of the index.

Related ETFs:

Disclosure: No Positions