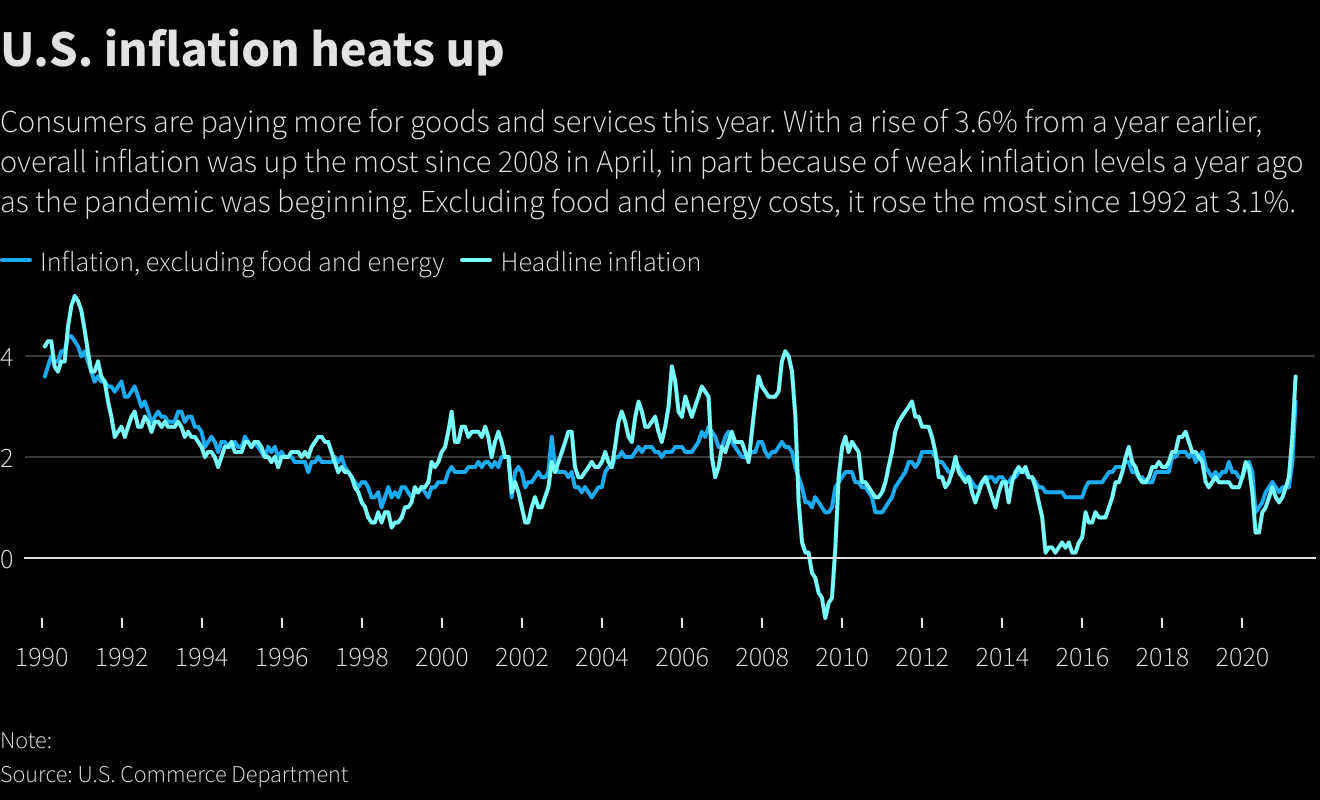

One of the factors that investors are having to deal with this year is Inflation. Soaring demand for goods and services as the economy opens up in the US and shortage of select items are driving prices higher. For example, used auto prices have shot up in recent months due to reduced supply of new autos which in turn was caused by lack of semiconductor chips. Similarly prices of food products are going up as well. Housing prices are in the stratosphere as prices of materials such as timber have increased many fold and also too many investors with too much money have turned housing into another avenue for speculation. Last month we learned that the Consumer-Price Index in April jumped 4.2% in April from a year earlier, the highest since 2008. From a journal article:

Food prices rose 2.4% from the same month a year ago, including a 3.8% jump in the cost for restaurant meals and other meals away from home. Car and truck rentals surged 82% compared with April 2020, and airline fares leapt 9.6%.

The annual inflation measurements are currently being affected by comparisons with the figures from last year early in the pandemic, when prices dropped steeply a demand collapsed for many goods and services during Covid-19 lockdowns, said Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives. This “base effect” is expected to influence inflation readings until the summer, she said. For example, gasoline prices soared 50% versus April 2020, though they decreased 1.4% versus March.

Compared with two years ago, overall prices rose a more muted 2.2% in April, on an annualized basis.

The Fed has said that it expects the inflation pickup to be temporary, and a top official on Wednesday said the central bank would need to see more data before changing course on monetary policy. It has said it would hold rates near zero until the central bank’s preferred inflation measure is averaging 2% and full employment has been achieved. A persistent, significant increase in inflation could prompt the central bank to tighten its easy-money policies earlier than planned, or to react more aggressively later, to achieve its 2% inflation goal.

Source: Consumer Prices Jumped as Economic Recovery Picked Up, WSJ, May 13, 2021

The below chart shows the dramatic spike in inflation:

Click to enlarge

Source: Pent-up demand, shortages fuel U.S. inflation, Reuters

It remains to be seen if the current trend is just transitory as the Fed states.

If inflation does keep rising or remains elevated, how to protect your investment from its adverse impacts?

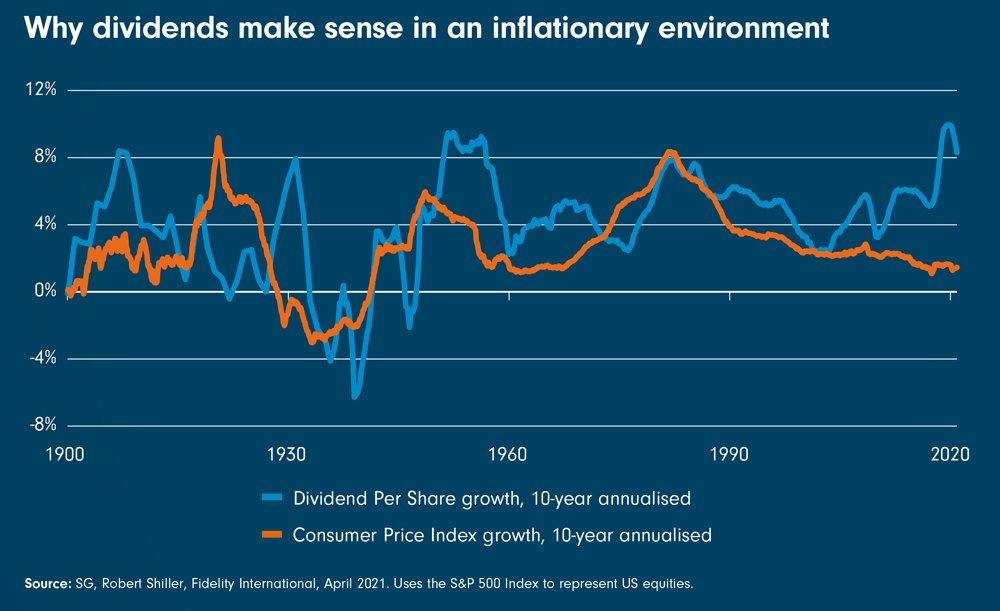

The answer lies in smartly picking and holding dividend-paying stocks. According to research by Fidelity Australia, annualized dividend growth since 1900 has outpaced CPI growth nearly 73% of the time. From the article:

This week’s Chart Room looks at the long-term relationship between dividends and inflation. Periods of inflation can be challenging for income-seeking investors, as inflation eats into the real purchasing power of bond coupons, which are generally fixed at a certain level. By contrast, dividends are a share of the corporate profit pool, and so when profits are rising, they can rise too. This growth means they can increase in line with, or ahead of, inflation, protecting the real purchasing power of these income streams. Since 1900, the 10-year annualised growth in dividends across the S&P 500 has outpaced CPI growth nearly three-quarters (73 per cent) of the time.

Click to enlarge

The market’s recent focus on themes like ‘stay at home’ and, more recently, ‘reopening and reflation’ has seen many stocks which don’t fit into these buckets falling out of favour. We think this is particularly true in defensive sectors like consumer staples, utilities and healthcare, where some high-quality companies with good dividend prospects now look undervalued. For income-focused investors, that means it’s a great time to take the long view.

Source: Why dividends make sense in an inflationary environment, Fidelity Australia

Earlier:

Related ETFs:

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- Vanguard High Dividend Yield ETF (VYM)

Disclosure: No Positions