Some of the large companies in the world have partial or major state ownership. Unlike fully publicly-owned firms, these State-Owned Enterprises(SOEs) are subject to high involvement and control of politicians or government bureaucrats. As a result, investors in these SOEs have to keep track of political or policy changes and their impacts on these enterprises. For example, recently Brazilian President Jair Bolsonaro fired the market-friendly CEO of Petroleo Brasileiro S.A. (PBR) Roberto Castello Branco and replaced him with his ally the former Defense Minister Joaquim Silva e Luna due to a fuel price increase fight with Castello. As expected Petrobras stock fell heavily after this announcement.

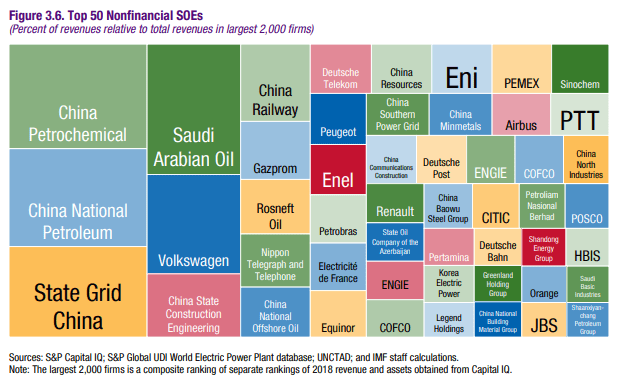

So what are the Top 50 State-Owned Enterprises(SOEs)? The following chart provides the answer:

Click to enlarge

Source: Analysis: After Brazil ructions, a rethink for investors in emerging market state firms, Reuters

From the above piece:

Utilities and power companies can be subject to politically motivated pricing directives, while financial disclosures and productivity can lag the private sector.

“First and foremost, investors need to figure out and understand where does this SOE fit into the agenda of the political and socio-and economic landscape of the country… its social importance as employer or as a contributor to the budget,” Sergey Dergachev, a fund manager at Union Investment, said.

China has ownership interests in some of the big companies such as China National Petroleum, China Petrochemical, etc. In the developed/western world, the following firms have some form of state ownership:

- Volkswagen AG (VLKAY) – Germany

- Gazprom(OGZPY) and Rosneft Oil Company (OJSCY) – Russia

- Electricite de France SA (ECIFY) and Engie SA (ENGIY) – France

- Equinor ASA (EQNR) – Norway

- Airbus SE (EADSY) – France, Germany and Spain

The key takeaway for investors is that state-ownership is a double edged sword. While it can provide stability, investors can be sidelined by the state which may use the enterprises for other purposes such as political gains in an election.

Disclosure: Long PBR