Italy is one of the few countries that imposes a transaction tax for all financial transactions (FTT). This includes Italian ADRs trading on the US markets. The current FTT rate is 0.20% with a lower rate for certain transactions. This 20% rate will impact the overall return an investor earns on Italian ADRs. This tax is on top of the dividend withholding tax rate which is 26% for US investors. So investors need to consider these factors before buying Italian ADRs.

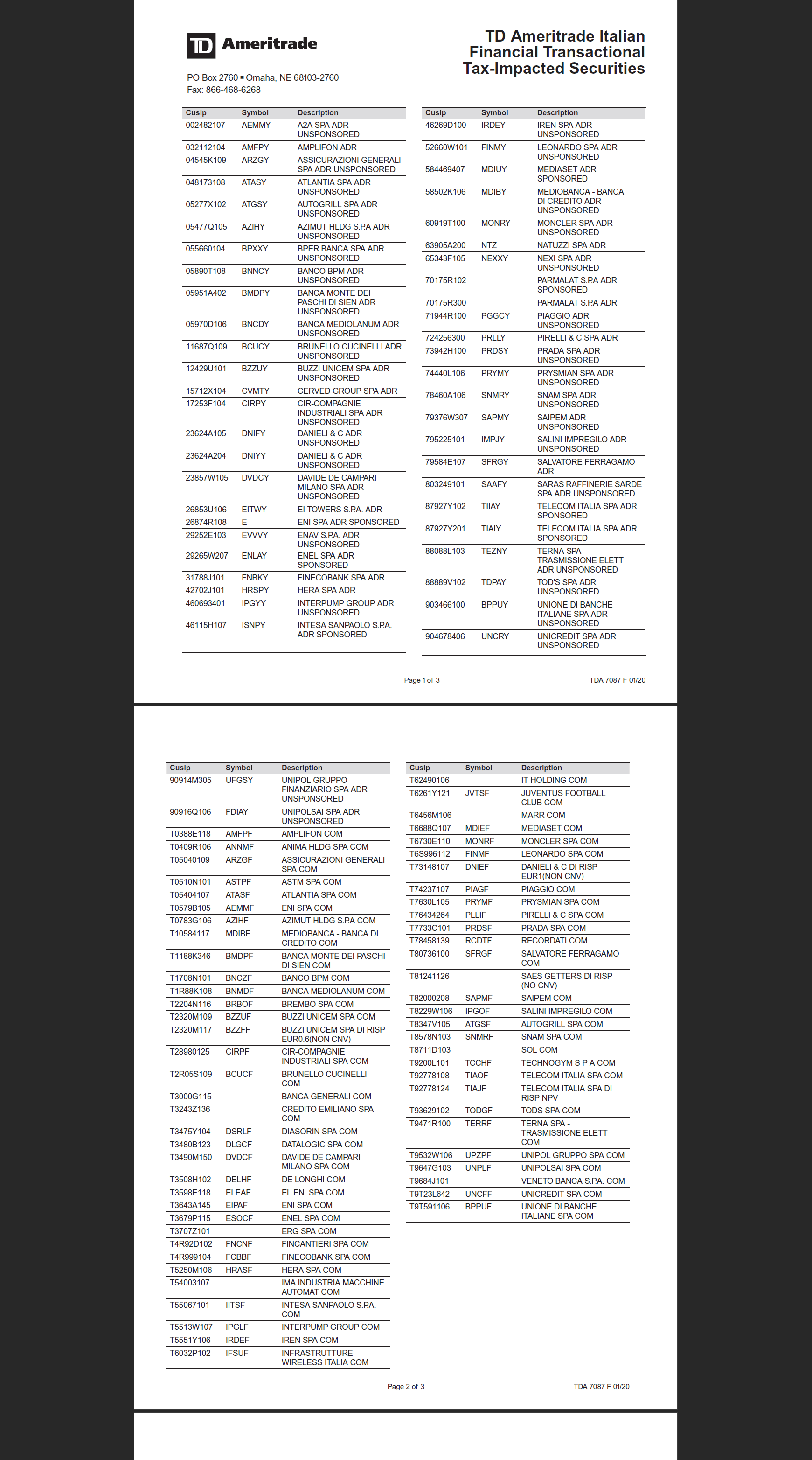

Which Italian ADRs are subject to Financial Transactional Tax?

The following table shows an updated list of Italian ADRs subject to Financial Transaction Tax:

Click to enlarge

Source: TD Ameritrade

Download List:

Earlier: