The top five U.S. tech giants collectively known as FAAMG have had astonishing grown in the past few years. The onset of the Coronovirus pandemic has led to further growth and concentration power for these tech leaders as most people working from home and cooped up at home depend increasingly more on technology to continue their daily lives. The current market cap of the FAAMG stocks show the strength and scope of these companies:

- Facebook(FB) – $684.0 Billion

- Amazon(AMZN) – $1.50 Trillion

- Apple(AAPL) – $1.60 Trillion

- Microsoft(MSFT) – $1.59 Trillion

- Alphabet(GOOG) – $1.02 Trillion

As a result of their sky-high growth, these firms have made many of the major equity indices highly concentrated. For example, they account for over 20% of the S&P 500 index.

Listed below are three charts from three different articles that discussed the market power of the FAAMG companies.

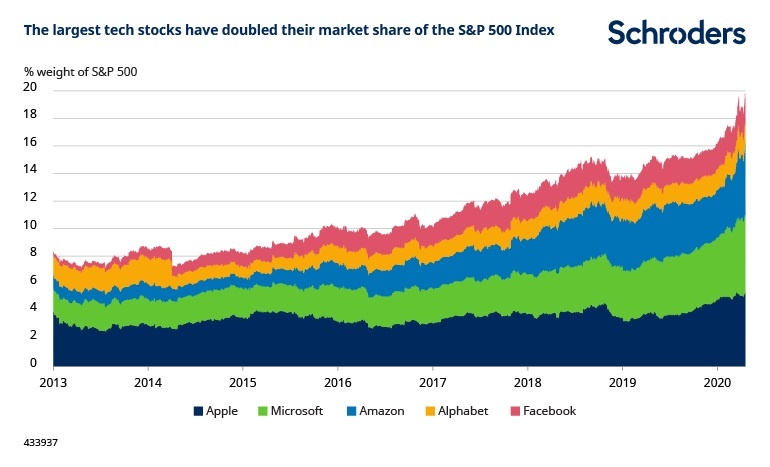

1.From an article at Schroder’s:

The rise of big tech

How big are these companies?

Sean Markowicz: “In terms of market weight, big tech has grown immensely over the last few years. Its combined weight in the S&P 500 index of US shares has more than doubled from roughly 8% in 2015. Today, FAMAGs make up 20% of the index in terms of market capitalisation.

“That means these five stocks account for a larger slice of the market than the five largest stocks at the peak of the dot com bubble in 1999 did.”

Source: Refinitiv Datastream and Schroders. Data as at 8 June 2020

Source: Big tech vs the market: what you need to know, David Breet, Schroders

2.Since 2013, the FAAMG’s market share of the S&P 500 has rises year after year as shown in the chart below:

The rich get richer and the poor get poorer:

Source:Stocks and the Matthew effect, Investment Office

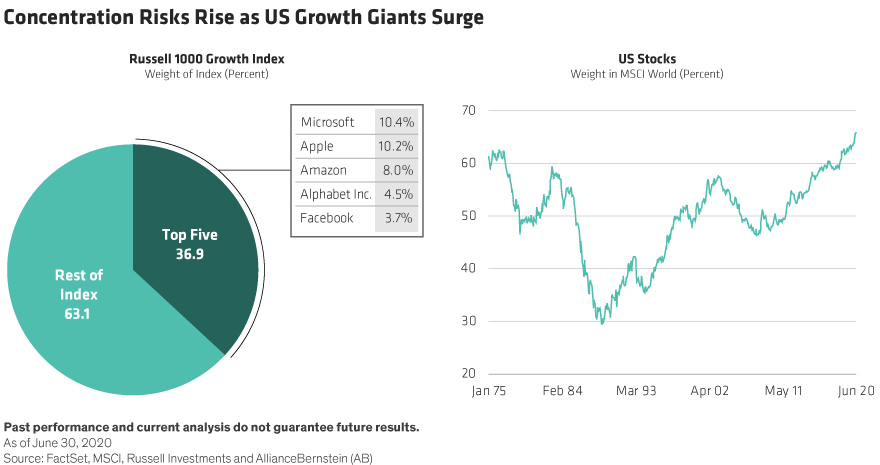

3. FAAMG stocks now account for an incredible 36.9% of the Russell 1000 Growth Index:

Just five companies accounting for about 37% of a major growth index is indeed extreme.

Source: Lopsided Equity Rally Highlights Growing Market Risks, Alliance Bernstein

It remains to be seen if growth is infinite for these tech titans. At the end of the day there is only a finite amount of ad dollars to go around and there is a limit to how much visitors can be bombarded with ads. So in some ways the growth is not endless for Alphabet and Facebook which are mainly advertising platforms that pretend to be high tech firms. They just use technology to show ads better than say a billboard on the highway and track users for better targeting.

Disclosure: No Positions