US equities have performed extremely well over the past decade relative to other developed markets. Even this year, US stocks have soared by nearly 20% so far this year. The reason for the out-performance is that the main US indices are dominated by high-growth sectors such as technology, health care and consumer tech. On the other hand, many of the foreign indices are highly concentrated in low-growth sectors like financials, materials and energy. As a result, American stocks have easily beaten their overseas peers over the years.

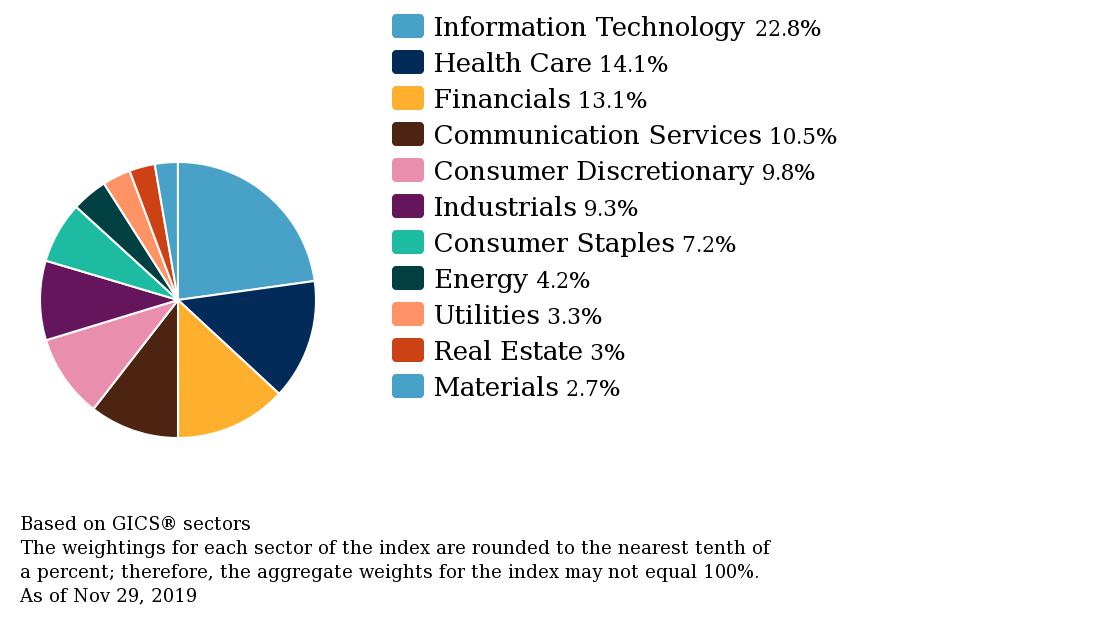

For example, the IT sector has a significant allocation in the S&P 500. This sector accounts for about 23% as shown in the chart below. Since tech firms like Facebook(FB), Amazon(AMZN), Alphabet(GOOG), Netflix(NFLX), Microsoft(MSFT), etc. are experiencing amazing growth these days the index as whole benefits from this leading to double digit returns.

Click to enlarge

Source: S&P

In many developed markets, tech sector is mostly non-existent or account for only a tiny portion of the market. For example, financials and energy are big sectors in the TSX Composite Index of Canada. In emerging countries, the tech sector is insignificant to say the least. There is no a Brazilian Apple or Microsoft for example to propel the Bovespa Index to astonishing record highs. Instead Brazil is more of a commodity-based market with oil major Petrobras(PBR) playing a major in the equity markets.

Below is an excerpt from a recent article at The Captial Group:

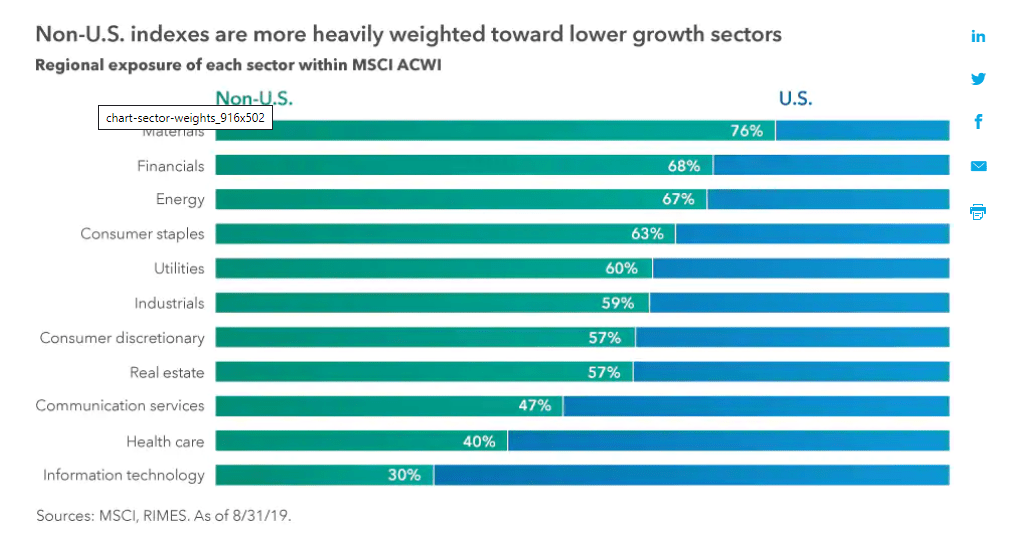

4. High-growth sectors are a smaller component of non-U.S. indexes

There are many reasons for lackluster non-U.S. returns over the last decade: a strong U.S. dollar, political turmoil and trade tariffs — just to name a few. But another factor is the way in which we typically measure international markets.

International indexes generally have a greater concentration of value-oriented stocks in “old economy” sectors such as materials, financials and energy. Contrast that with the U.S., where technology, health care and consumer tech dominate local indexes. That alone accounts for much of the decade-long return disparity between U.S. and non-U.S. stocks.

That’s not to say that growth can’t be found in international markets. It just requires more work to uncover promising companies that may be hidden within indexes. And that’s where company-by-company analysis becomes so critical. The average stock in Europe may be growing slower than one in the U.S., but growth can still be found by those who look past index averages and examine each opportunity based on its individual characteristics.

Source International investing in 2020: Your comprehensive guide by Rob Lovelace and David Polak, Capital Group

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- Vanguard MSCI Emerging Markets ETF (VWO)

- iShares MSCI Emerging Markets ETF (EEM)

- iShares MSCI Germany Index Fund (EWG)

- iShares MSCI Canada Index Fund (EWC)

- iShares MSCI Australia Index Fund (EWA)

- iShares MSCI United Kingdom Index (EWU)

- iShares MSCI Singapore Index (EWS)

Disclosure: Long PBR