The enemy of the average individual investor is no one but himself. The average investor underperforms over almost every other asset class in terms of returns over the long run. This is because investors get distracted by a variety of things that are detrimental to their returns. Some of the things that retail investors do that reduces their returns include:

- Market Timing

- Chasing Returns

- Trading often

- Worrying about things beyond his control – such as Trump’s tweets, Trade Wars, politics in general

- Hot stocks or sectors such as Real Estate, Technology, Biotechs, etc. – in general whatever seems to be “hot” at the moment

- IPOs

- Failing to have a goal

- Brexit drama

- Unable to control emotions

Of course, these are just a few factors. There are millions of other factors that adversely affect an investor’s return.

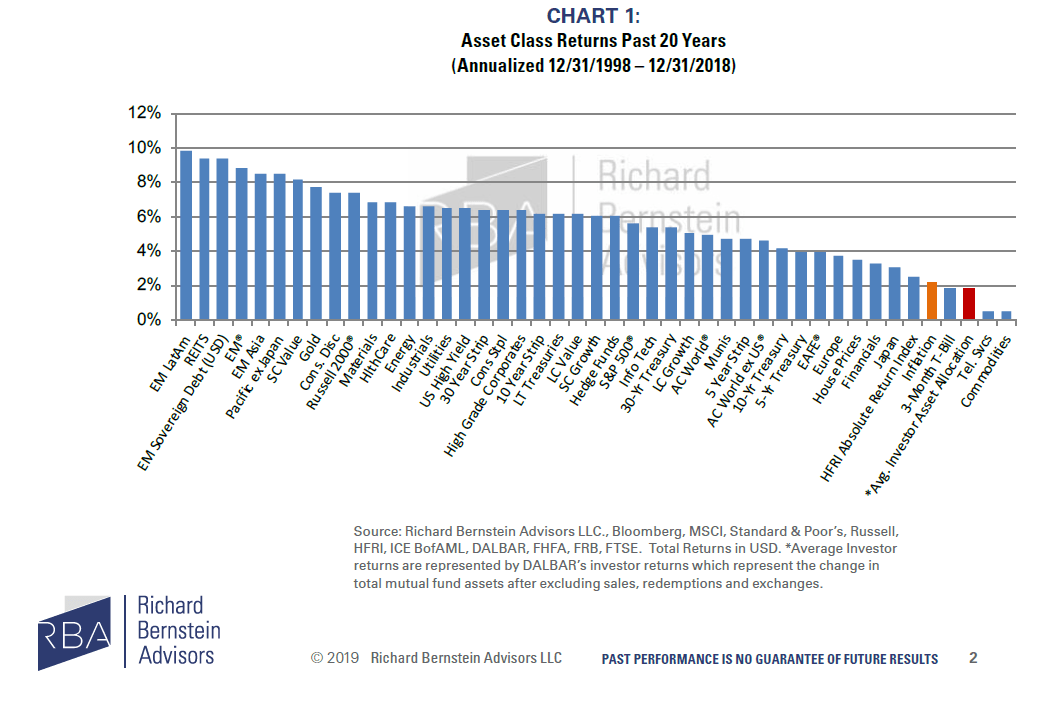

The following chart shows how poorly an average investor under-performed (shown in red) over the past 20 years when compared to other asset classes:

Click to enlarge

Source: Insights, July 2019, Richard Bernstein Advisors LLC

An excerpt from the above piece:

Trying to time their investments and ultimately buying high and selling low has effectively ruined investment performance. Chart 1 quantifies “ruined”. Investors underperformed nearly every category. Only Telecom Services and Commodities performed worse than individual investors over the past 20 years. Investors even slightly underperformed cash during the past 20 years, meaning hey would have performed better if they had simply left their money in a money market account for the full 20 years! (emphasis mine)

Perhaps most important, individual investors didn’t outperform inflation (i.e., they had negative real returns). So, not only did investors underperform just about every asset class and sub-class by trying to time investments, but they also lost the purchasing power of their savings. In other words, they made themselves poorer.

This is indeed shocking. In their attempt to beat the market or even multiply their money many times over, investors lose.

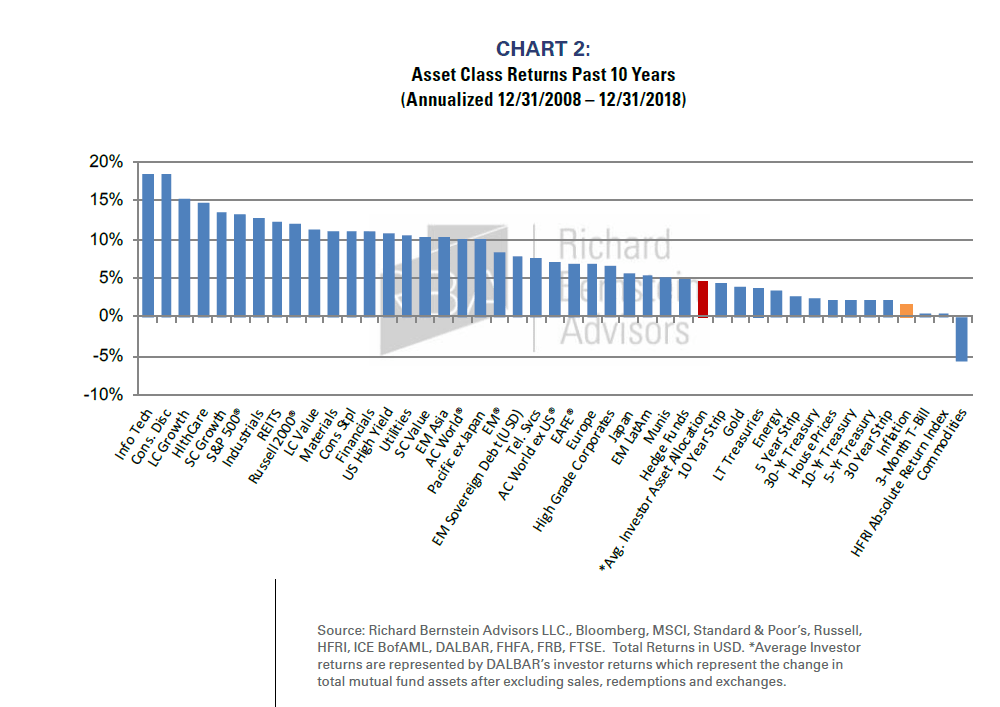

Over the 10-year period also average investors’ returns are poor relative to other asset classes as shown in the chart below:

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- S&P MidCap 400 SPDR ETF (MDY)

- SPDR Consumer Discretionary Select Sector SPDR Fund (XLY)

- SPDR Consumer Staples Select Sector SPDR Fund (XLP)

- SPDR Energy Select Sector SPDR Fund (XLE)

- SPDR Financials Select Sector SPDR Fund (XLF)

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

Disclosure: No Positions