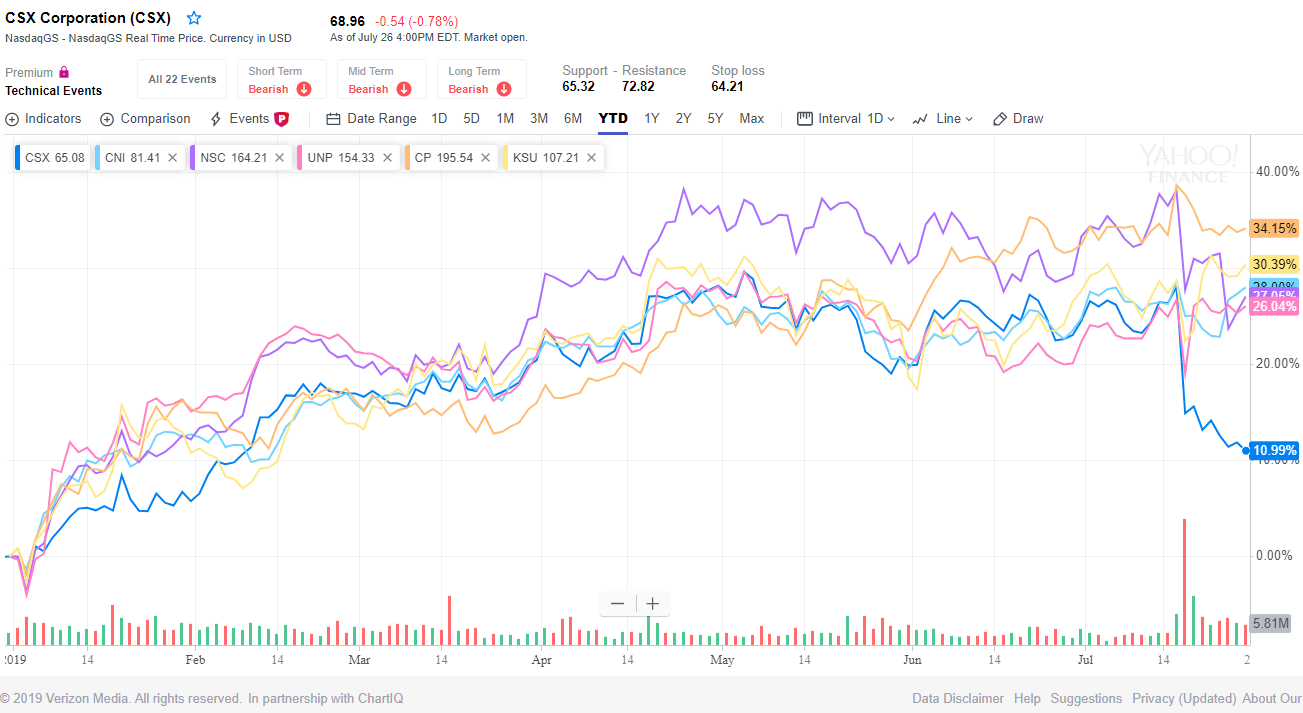

North American railroad stocks have performed very well so far this year. While the S&P 500 is up around 21% year-to-date, most of Class I railroads, with the exception of CSX, have shot up by over 26%. Canadian Pacific(CP) is the best of the group and has grown by over 34%. One reason CSX is lagging is that the railroad was a great winner last year. Regardless as I have discussed many this in this blog, railroads are one of the best sectors to own for the long term.

The following chart compares the returns of major railroads YTD:

Click to enlarge

Note: The returns shown above are price returns only (excluding dividends)

Source: Yahoo Finance

From an income standpoint, railroads offer stable and growing dividends year after year. For example, Norfolk Southern(NSC) increased its quarterly dividends by 9% this week. Union Pacific(UNP) also announced a dividend increase of 10%. These rates are excellent raises indeed.

Related Stocks:

- Canadian National Railway Co (CNI)

- Canadian Pacific Railway Ltd(CP)

- CSX Corp (CSX)

- Kansas City Southern (KSU)

- Union Pacific(UNP)

- Norfolk Southern Corp(NSC)

Disclosure: Long CSX, CNI, NSC and UNP