Gold prices closed at $1,312.30 an ounce yesterday. The yellow metal has been an average to poor performer over many years now. In fact, after the Global Financial Crisis of 2008-09 gold soared to sky-high levels with predictions of reaching over $5,000 an ounce, However that never came true.

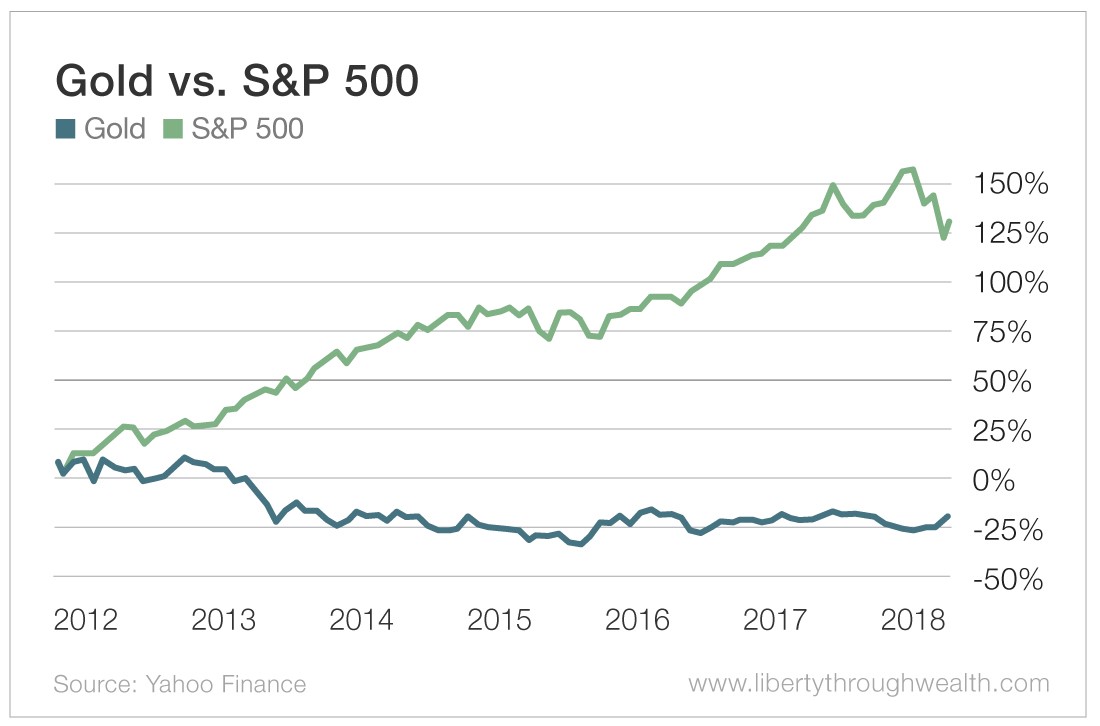

According to a recent post by Nicholas Vardy at Liberty Through Wealth site gold lagged the S&P 500 by a wide margin since 2012. From the article:

Gold enjoyed one of its greatest runs ever starting right around the dot-com bust in 2000.

Gold rose from $265 in 2001 to a high of $1,917 an ounce in August 2011. That was a massive sixfold increase.

That 12-year bull run made gold bugs seem like the smartest guys in the room.

Alas, things have been a lot tougher since gold peaked in 2011.

Had you invested in gold at its peak in 2011, you’d have lost more than 20% of your investment.

And had you listened to the late John Bogle and invested in an S&P 500 index fund, you’d be up by more than 140%.

In short, gold has been a lousy investment for close to eight years.

Source: Why It’s Time to Invest in the “Barbarous Relic”, Liberty Through Wealth

Though gold has yielded a lousy return in recent years Mr,Nicholas is bullish on gold now.

I have noted many times on this site that gold is not an income producing asset but it does have a place in a diversified portfolio. It remains to be seem if gold can regain its mojo again.

David Lennox of Fat Prophets, Australia is also bullish on gold noting several factors such as the dollar impact, supply and demand. Basically he states gold has a place in a portfolio during these uncertain times.

From the article:

Solid gains in precious metal likely – but keep a close eye on the US dollar.

The gold price disappointed in 2018. The precious metal turned in a negative performance for the year, registering a 1.0 per cent fall on 2017 to US$1,280 an ounce by the end of 2018.

So, what should we expect in 2019?

The US dollar was a key factor in the gold price last year and should continue to be so this year (Editor’s note: Gold historically has an inverse relationship with the US dollar; it rises when the Greenback falls and vice versa, although the relationship is not always clear-cut.)

Source: Will gold shine in 2019? via ASX

Related ETF:

- SPDR Gold Trust Fund (GLD)

Disclosure: No positions