Crude oil prices seem to have stabilized with Brent closing at $66.76 on Friday for Jan, 2019 delivery. The dramatic over 25% plunge in oil prices since the peak reached in early October caught many off-guard. While further declines are possible some investors may be wondering if now is the time to add some positions in a phased manner. Nobody knows how low oil can go and if an investor waits to catch the bottom it may be too late before prices sharply rebound.

Russ Koesterich of Blackrock noted in a blog post that stocks are cheap now and the selling may be overdone. From the post:

-

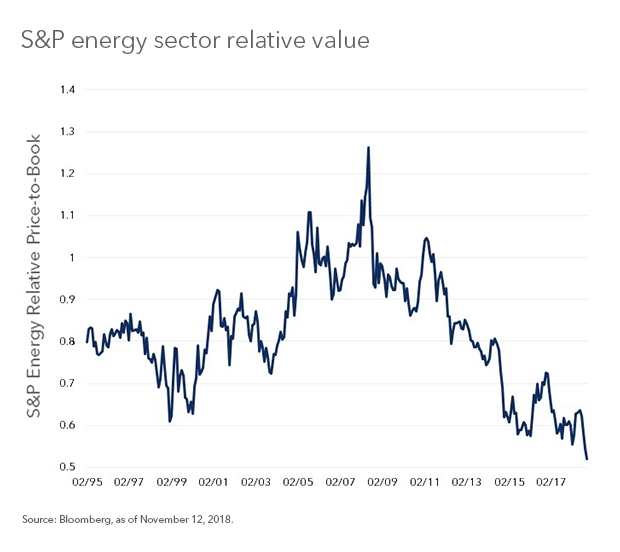

Based on price-to-book (P/B) the energy sector is now trading at the largest discount to the S&P 500 since at least 1995 (see Chart 1). Energy stocks are currently trading at roughly a 50% discount to the broader market.

-

The sector also appears unusually cheap on an absolute basis. At less than 1.7x earnings, the current valuation is the cheapest since early 2016 and is in the bottom 5% of all observations going back to 1995.

-

As you would expect, the valuation of the energy sector tends to move (roughly) in tandem with oil prices. When oil prices are lower, the sector’s relative value versus the market also tends to be lower. Since 1995, this relationship has explained approximately 20% of the relative multiple of the sector. Based on oil prices at $60/barrel, history would suggest that the sector should be trading at a 15% discount to the market, not a 50% one.

Source: Why the energy stock selloff may be overdone, Blackrock

Among the foreign oil ADRs trading on the US markets, Petrobras(PBR) and Ecopetrol(EC) are up by 40% YTD. Brazilian stocks shot up after the recent elections there and PBR has recovered nicely as well. However it is still far below the $60+ reached many years ago before the major fraud was uncovered and Operation Carwash launched to cleanup the mess.

Among the oil majors, Total SA (TOT) and Eni SpA (E) are in the positive territory YTD while BP PLC (BP) and Royal Dutch Shell PLC (RDS.A) and Royal Dutch Shell PLC (RDS.B) are in the red.

The complete list of integrated oil companies trading on the NYSE can be found here.

Disclosure: Long PBR and EC