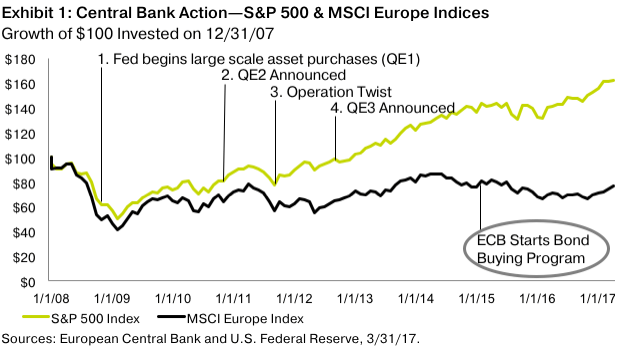

US stocks have soared since the Global Financial Crisis(GFC) of 2008-09. The multi-year bull year market continues to move forward breaking records. Though many experts have been calling for a correction for many months now stocks are going up proving them incorrect. European stocks on the other hand have langished for years until this year. Despite having similar economic systems and institutions like those in the US, developed European countries dithered for years going thru one crisis after another. As a result European economic growth stagnated and stocks performed miserably. According to an article published by Oppenheimer Funds back in June, the ECB started implementing real liquidity measures only in 2015 whereas the US Federal Reserve took swift action all the way back in 2008. The following chart shows the performance of US and European stocks since 2008 thru March this year:

Click to enlarge

Source: Welcome Back, Europe by George R. Evans, CFA and Brian Landy, CFA at Oppenheimer Funds

The key takeaway is that Central Banks have the power to lift asset prices by pumping liquidity into the markets. But how quickly they implement policies is important. In this regard Americans were far ahead of Europeans. Since the EU is made up of many countries decisions take much longer and the ECB has to consider all member nations’ interests. Then again the point of the EU and ECB is to act as one voice and not as individual countries. This is where Europeans failed. Unlike the US, Europe tends to get bogged down with talks after talks and unable to make quick decisions.