One of the factors that affects investors in the construction of a equity portfolio is the issue of home bias. Because of this issue investors to tend to avoid investing in foreign stocks.

An investor building a globally diversified portfolio must allocate assets based on the market-cap weighting of each country in a broad global index such as the the MSCI All Country World Index. To put it another way, if a country has a 5% market weighting in this index then an investor must invest of 5% of his/her portfolio in that country to truly achieve the benefits of diversification. However many investors have a home bias due to which they tend own more stocks from their own country than the market-cap weighting in an index.

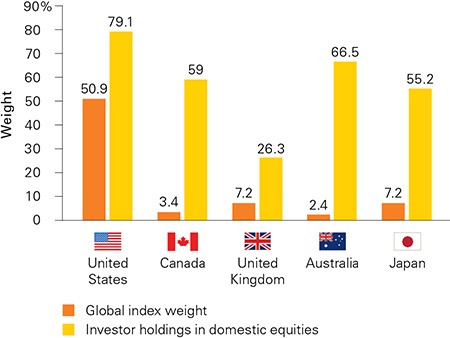

The chart below shows the home bias of equity investors in select countries:

Click to enlarge

Source: The global case for strategic asset allocation/home bias, Vanguard UK

The chart shows that though US accounts for only about half of the weighting in the global index, American investors own about 79% of their portfolio assets in domestic equities. So they own more than what is suggested by the global index. Hence US investors may lose out on gains from foreign stocks since they own less of them.Similarly Canadians own 59% of their portfolio in domestic stocks when the country accounts for about 3% in the global index. So they are over exposed to the local market.

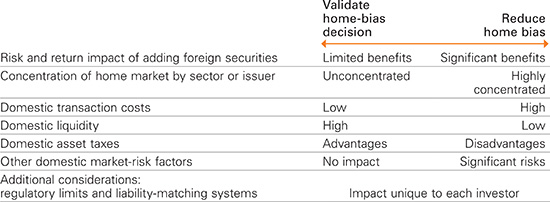

Some of the factors that influence investors in owing foreign stocks are shown below:

In general, it is not easy to overcome home bias.Most investors feel comfortable with the companies they know and are more familiar with than foreign companies. Moreover they may also use products of companies that are easier to access in the domestic market than some unknown company in a faraway land. For example, an average American may know popular companies Johnson&Johnson(JNJ), Starbucks(SBUX), Alphabet(GOOG), Home Depot(HD), General Mills(GIS), etc. than most of their foreign peers. Some of the foreign peers are firms like GlaxoSmithKline (GSK), Unilever PLC (UL), Nestle SA (NSRGY), UK-based Whitbread plc – owner of Costa Coffee(WTBCY), etc.

Disclosure: Long GIS