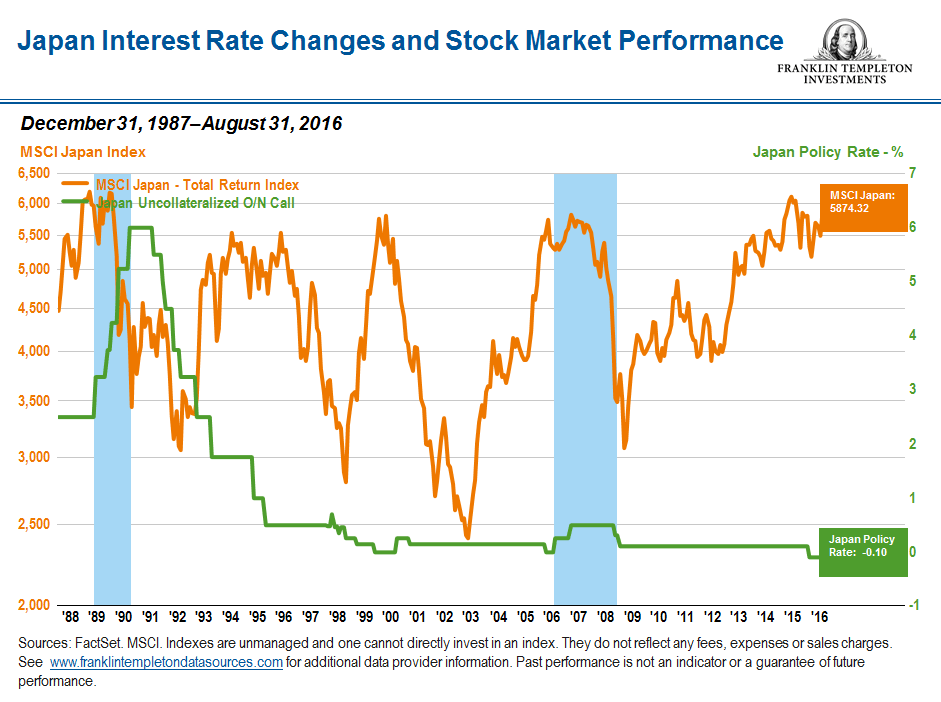

The impact of falling and rising interest rates on equity markets vary by country. Stocks do not always rise when interest rates fall and vice versa. In the case of Japan, an article by Franklin Templeton Investments noted that falling interest rates did not lead to positive long-term performance of the equity markets.

The benchmark index topped out at over 37,000 in Jan, 1990. This past Friday it closed at 18.381. So after more than 25 years the Nikkei is still lower than where it was back then. Anyone who bought stocks at that peak are still sitting on a loss.

The chart below shows the changes in interest rates and the equity market performance using the MSCI Japan Total Return Index:

Click to enlarge

From the article:

The BOJ has become a top shareholder in the one of the world’s largest equity markets and already is one of the top five owners of 81 companies listed on Japan’s Nikkei 225 Index.2 The central bank is also on its way to becoming the number one shareholder of more than 50 of those firms, according to various estimates. Market bulls are happy with the BOJ purchases, but opponents say the central bank is artificially inflating valuations and ironically discouraging companies from becoming more efficient. Interestingly, Japan’s Nikkei 225 Stock Average is actually down more than 8% year-to-date, although one might argue its fate could have been worse without central-bank buying.3

2. Ibid.

3. Source: Bloomberg, as of November 1, 2016. Indexes are unmanaged and one cannot directly invest in an index. They do not reflect any fees, expenses or sales charges.

Source: Central Banks and Stock Markets: a BOJ Case Study, Franklin Templeton Investments, November 22, 2016

A few points to remember about the Japan equity market:

- Foreign investors are big owners in the domestic stock market. So stocks tend to follow the whims of these investors. So in this scenario, Japan is more of an emerging or frontier market than a developed market like the UK, Canada, USA, etc.

- Retail investor participation in Japan is very low by developed market standards. So years of stocks going nowhere does not affect the average citizen.

- Japanese companies tend to give lower priority to shareholders than other stakeholders.

- Dividend yields of stocks also are low relative to other major markets. The dividend for the Nikkei was just 1.83% in July, 2016.

Related ETFs:

- iShares MSCI Japan ETF (EWJ)

Disclosure: No Positions