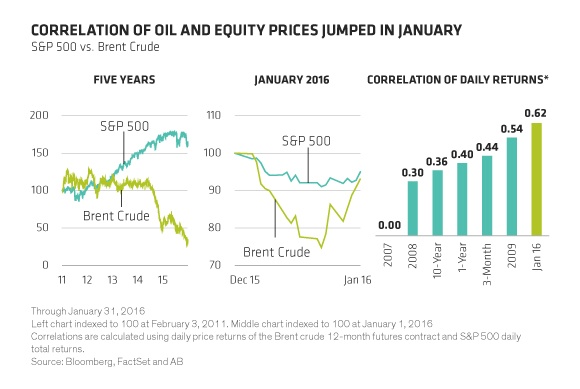

Brent crude oil prices closed at just over $33.00 today. Since late last year the price of oil and equity prices are moving in sync with each other. The correlation between oil prices and stocks jumped to high levels in January according to an article by James Tierney, Jr. of Alliance Bersntein. From the article:

Equity markets and oil prices are behaving lately as if they’re glued together. Our analysis suggests that the correlation is unjustified and investors should start thinking about what might happen when they become unstuck.

Recent concerns about the global economy are reasonable. Investors are digesting a complex array of macroeconomic challenges, from China’s slowdown to the Fed’s monetary policy direction. However, it feels like the oil price is dominating market sentiment. In January, return correlations between US stock prices and oil were almost twice the ten-year average (Display).

Click to enlarge

Source: Will Oil Prices and Equities Stay Hitched?, Context, AB blog

Though oil price movements affect the global economy and equity markets to some level, the scale of current lockstep movements between oil and stock prices is surprising. Oil is just one of the many commodities that are traded on a daily basis globally. But in the past few weeks, equities have declined as though oil is the only factor that matters.

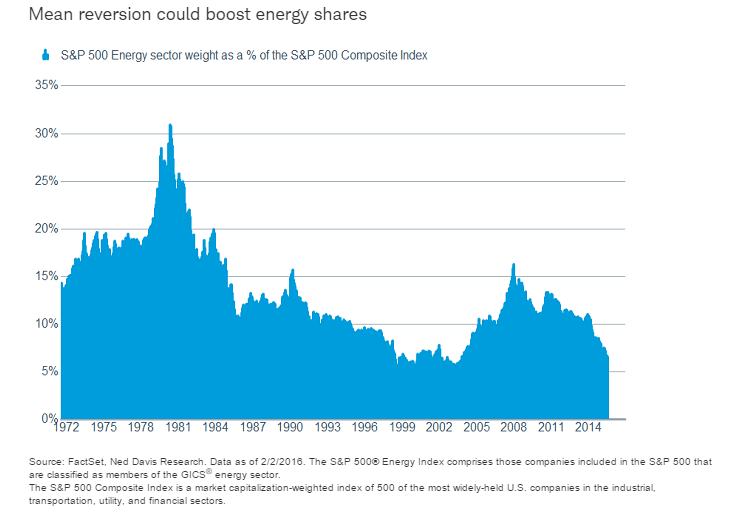

Taking a different angle on energy sector and share prices, Brad Sorensen of Charles Schwab wrote in a report that investors who are underweight in energy sector may want to add to their portfolios. From the report:

Going forward, we are likely to see more bankruptcies in the energy space, which will take some supply off the market. Investment in Canada’s oil and gas industry is expected to be 13% less in 2016 compared with 2015.3 While the reduced sanctions on Iran will put more oil onto the market, there are still major infrastructure issues in Iran that will limit the amount of oil it can pump. Rumors that OPEC could limit production also exist. Also, Iraq’s oil minister recently stated he was seeing more flexibility from Russia and Saudi Arabia with regard to potential production cuts.4 And in fact, Russian President Vladimir Putin has said Russia’s 2016 budget was calculated with an assumed $50/barrel oil price.5

So what does all this mean for investors? To us, it means that investors who are underweight to the energy sector should start to add to positions to bring their portfolios up to market weight. Interestingly enough, the weight of the energy sector within the S&P 500® Index has fallen to near its lowest level in at least the past 40 years. This leads us to believe there may not be more downside to go, and an oil price reversion could mean upside potential for those investors who are patient.

Click to enlarge

Notes:

³ Source: The Financial Times, “Investment in Canadian oil and gas to be further slashed,” 1/25/2016.

4 Source: Bloomberg Business, “Saudis, Russia seen by Iraq as more flexible on oil-output cuts,” 1/26/2016.

5 Source: BBC News, “Russian economy hit by oil price slide,” 1/25/2016.

Source: Schwab Sector Views: Cutting Through the Energy Noise, Charles Schwab

It is not just the oil sector that investors should be looking at due to the current volatility in the markets. Opportunities also exist in other sectors such as banking, chemicals, oil equipment and service providers and transportation. For instance, lower oil prices are bound to benefit many but not all chemical firms since oil and petroleum products are one of the key ingredients in the manufacture of chemicals.