Greece is the birthplace of democracy. However modern-day Greece can be considered as a “failed state” by some measures. For example, the country is notorious for tax evasion from ordinary people to billionaire shipping magnates. No wonder, Greece is the poorest country in developed Europe. For better or worse, Greece was included in the European Union. In the past few years, the country has become the poster-child for ruining the EU economy with its on-again off-again debt crisis. Even with the current government, the Greek drama refuses to die once for all. It has become as a bad nightmare that simply won’t go away. It may not be a bad idea for the EU to kick out Greece of the union.

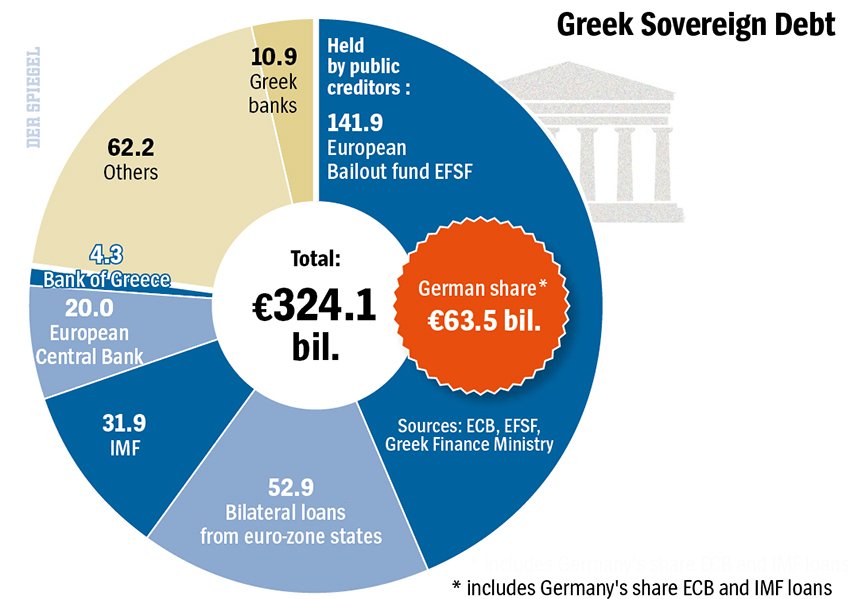

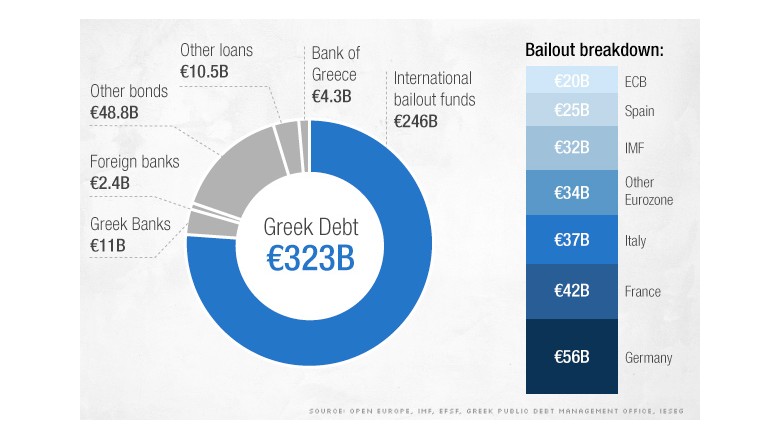

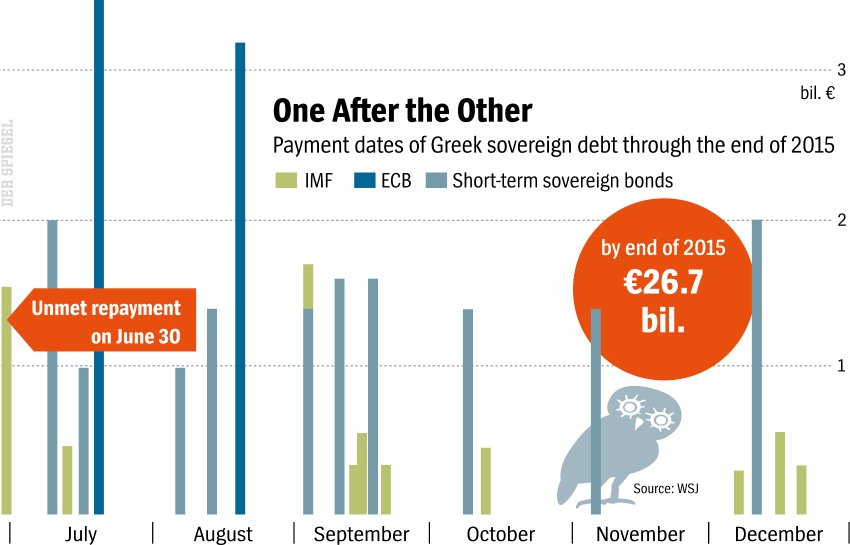

The following chart shows the Greek Sovereign Debt held by various creditors:

Click to enlarge

Source: EU Commission President Juncker: ‘I Don’t Understand Tsipras’, Der Spiegel

Related:

-

Greece: go your own way (Money Observer)

-

What are Greece’s default options? (Money Observer)

For investors willing to bet on Greek stocks, there are a few ADRs trading on the US markets. The complete list of Greek ADRs can be found here.

Updates:

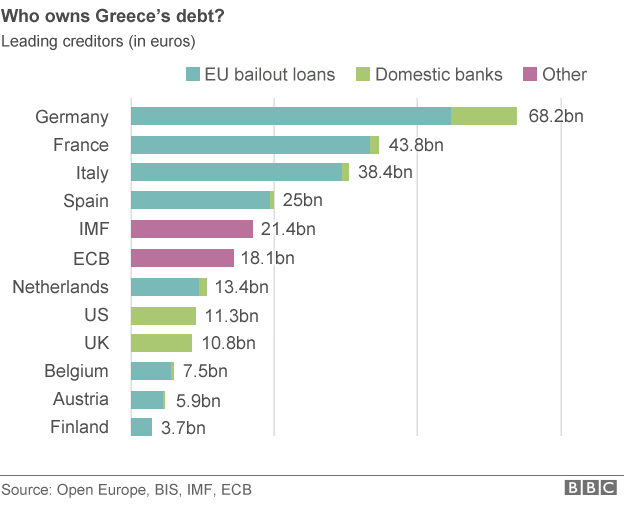

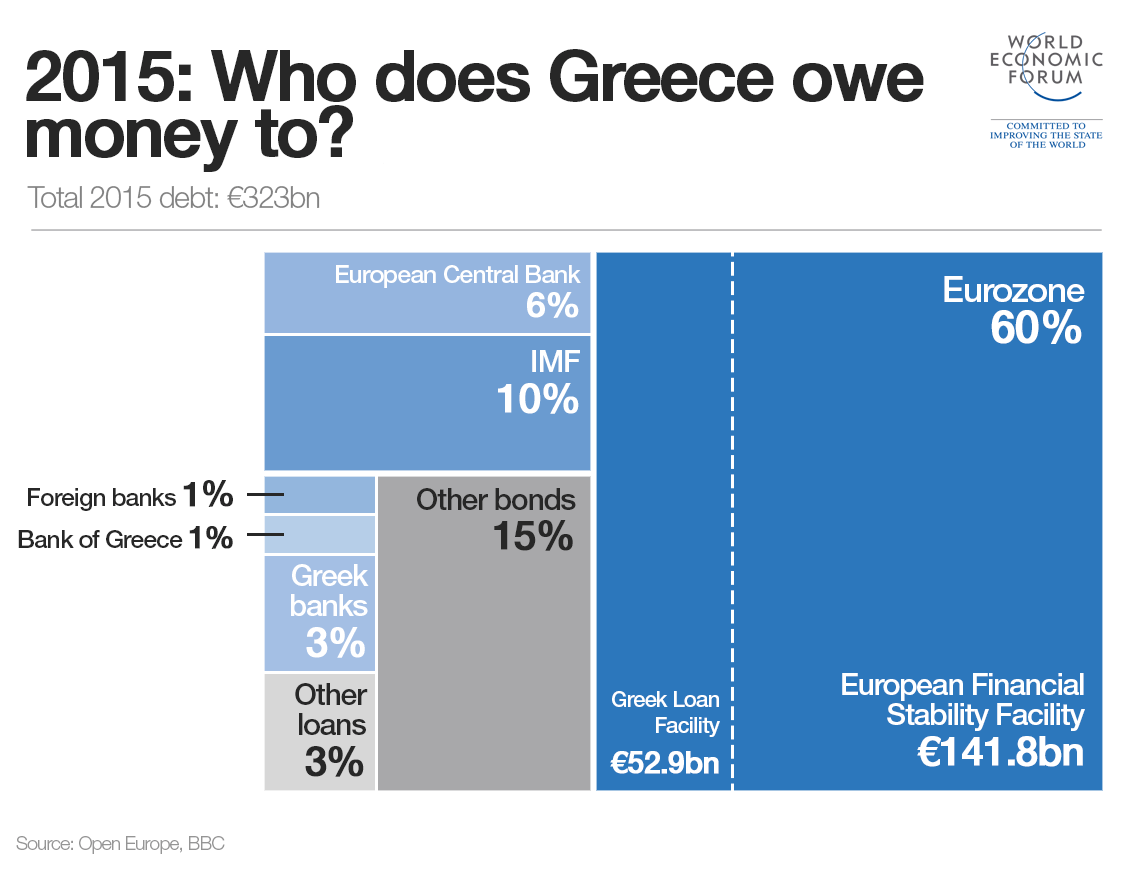

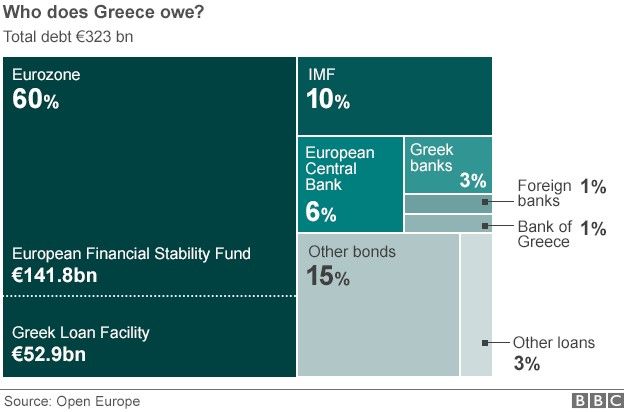

Click to enlarge

Source: BBC

Source: BBC

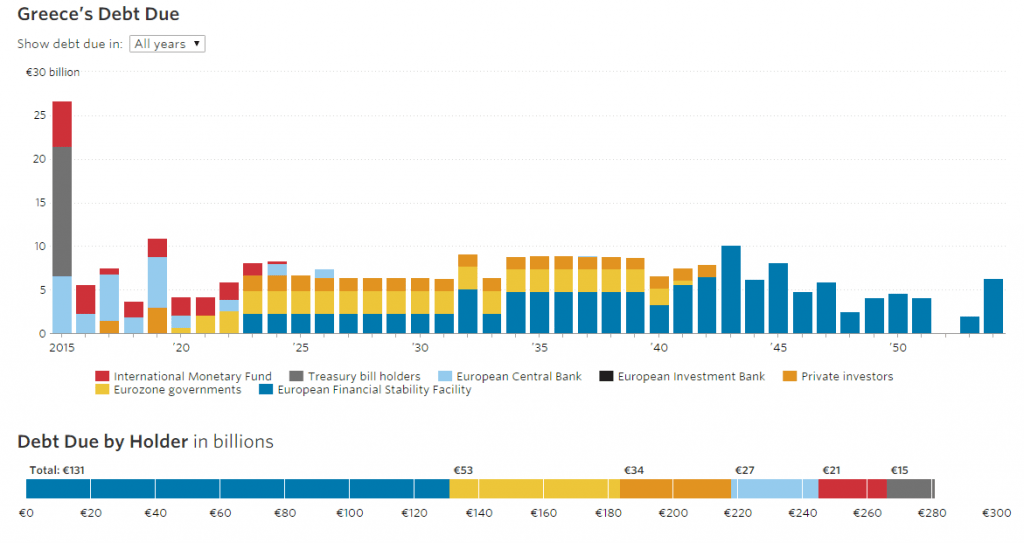

A cool interactive graphic from The Wall Street Journal:

Click on the image or link below to go to the graphic.

Source: Greece’s Debt Due: What Greece Owes When, WSJ

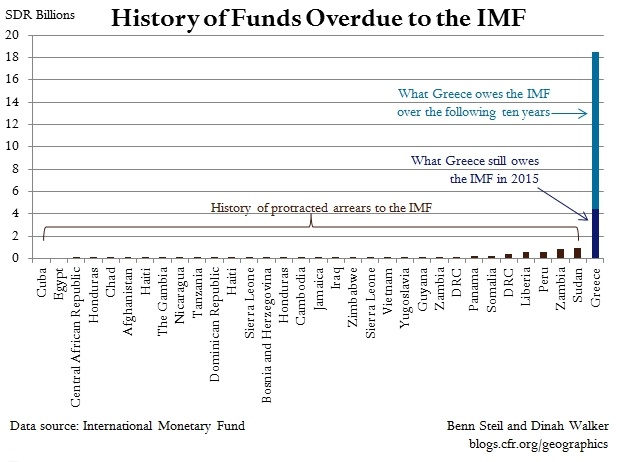

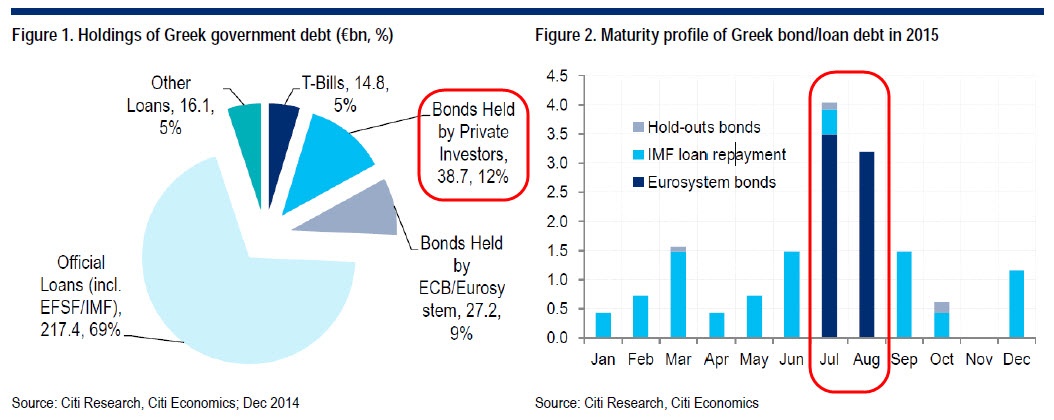

Click to enlarge

Source: A Full Greek IMF-Debt Default Would Be Four Times All Previous Defaults Combined, CFR

Source: Greece debt crisis: IMF payment missed as bailout expires, BBC

Source: Greek debt crisis: Who has most to lose?, CNN

Source: How Greece’s debt has shifted since the last bailout, WEF

Source: Zerohedge

Click to enlarge

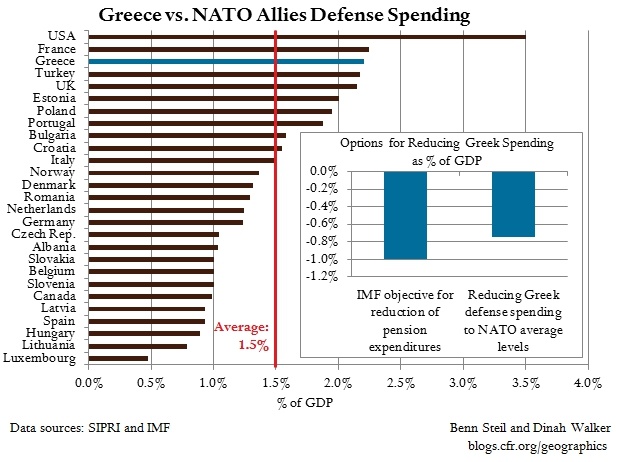

IMF Chief Economist Olivier Blanchard has said that Greece needs to slash pension spending by 1% of GDP in order to reach its new budget targets. The Greek government continues to resist, arguing that Greeks dependent on pensions have already suffered enough. But it has yet to put a compelling alternative to its creditors.

What depresses us is how little attention has been paid to one major area of Greek government spending that seems ripe for the ax: defense spending. Greece spends a whopping 2.2% of GDP on defense, more than any NATO member-state save the United States and France. Bringing Greece into line with the NATO average would alone achieve ¾ of what the IMF is demanding through pension cuts.

Greece has long argued that its defense posture is grounded in a supposed threat from Turkey – also a big spender on things military. But surely the United States and the major western European powers can keep a cold peace between NATO allies at much lower cost.

So why don’t they? German and French arms-export interests surely explain the silence on the creditor side: Greece is one of their biggest customers.

Source: Greece and Its Creditors Should Do a Guns-For-Pensions Deal, CFR

Source: The Fate of Greece: Decision Time for Tsipras and Merkel, Der Spiegel

Related: