In an article in December last year I wrote why U.S. investors may want to diversify by holding foreign stocks. Quoting from that piece:

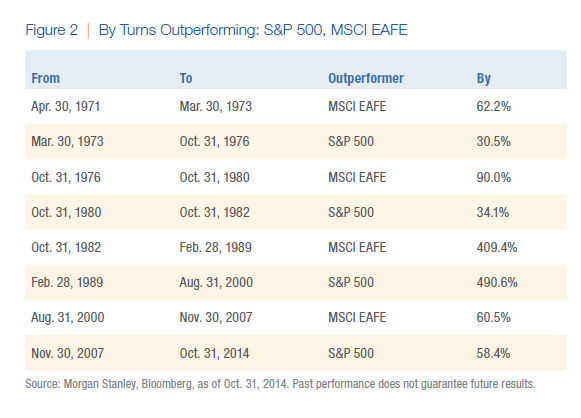

For example, though the U.S. stocks have done very well in 2013 and this year, there is no guarantee they will continue to outperform other markets in the future. No country has been the top performer consistently every year as shown in the following Periodic Table of Investment Returns for Developed Markets 2013:

Click to enlarge

So it turns out that European stocks have outperformed U.S. stocks at least so far this year. We will have many months to go.Hence we cannot predict if this trend will continue thru the rest of the year.

The question on some investors’ mind is if European stocks can maintain their current bull run.

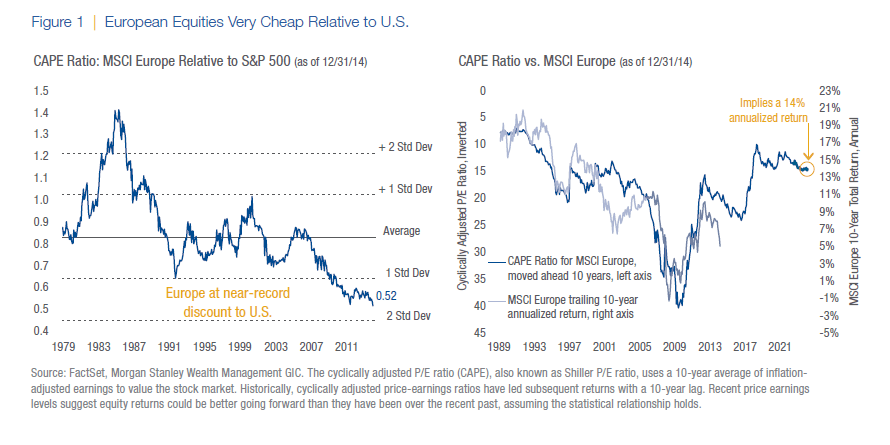

According to a research report by Thornburg Investment Management, U.S. stocks and their European counterparts have taken turns in outperforming each other in the past. The following table illustrates this fact using the S&P 500 and the MSCI EAFE Index:

Click to enlarge

By moving into attractively valued stocks with more upside potential, there’s also more downside protection, as Benjamin Graham’s “margin of safety” precept has long suggested. This common sense investment principle may be why the S&P 500 Index and the MSCI EAFE Index have taken turns outperforming each other over the last four-and-half decades. So while the S&P 500 beat the MSCI EAFE by 58% from November 30, 2007, through October 31, 2014, the MSCI EAFE outperformed the S&P 500 by 60% over the preceding seven years (Figure 2).

Though past performance does not predict future results, in the period from 2000 to 2007 the MSCI EAFE had a strong run beating the S&P 500.

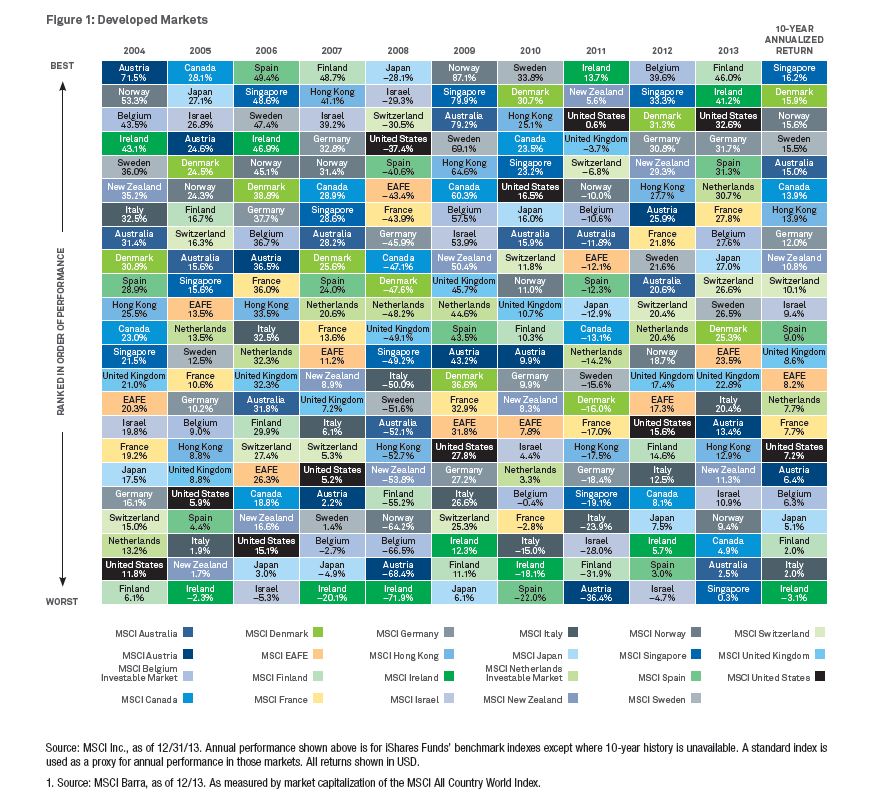

At end of 2014, European stocks were trading at very cheap levels compared to American stocks. However with the current rise of European equities they are not very cheap now but there is still room to grow.

Click to enlarge

NOTE: The above chart is based on data as of 12/31/14.

Source: Margin of Safety:Tactical Rebalancing and Strategic Allocation in Overseas Equities, Feb 2015, Thornburg Investment Management

The key takeaway from this post is investors need not dump their European holdings now.Rather they can wait for additional growth as the ECB’s stimulus program has just started. Also any new investments can be made very selectively in a phased manner.

Related ETFs:

Disclosure: No Positions