The performance of Cyclical stocks is directly related to the state of the economy.So if the economy is in contraction mode cyclicals do not perform well. But if the economy growing then they also grow. Cyclicals include the Industrial, Consumer Discretionary, Information Technology and Materials sectors. For example, during recessions restaurant companies will suffer as consumers cut back on their discretionary spending such as eating out, going to the movies, taking vacations, etc.

Defensive stocks, as the name suggests, are great for all economic and market conditions. These stocks perform well not only during adverse economic conditions but also during periods of economic expansions. This is because even in a recession people have to spend money on life’s necessities such as food, water, electricity, soap, etc. Unlike the cyclicals defensive stocks offer stable growth during recessions and expansions though they do not very high growth during expansions. Either way defensive stocks are a must in an investors’ portfolio as they provide stable and growing dividends and decent price appreciation over the long-term. Defensive sectors include the Consumer Staples, Utilities, Health Care and Telecom.

I came across an interesting article by authors at Societe Generale that clearly explained the concept of cyclical and defensive stocks’ performance using a simple example. From the article:

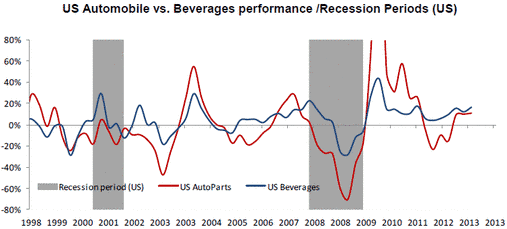

The graph below provides a concrete example on how Cyclical and Defensive stocks behave. We have chosen the automobile (Cyclical) and beverages (Defensive) sectors in the US and compared their performance. We have also highlighted the main recession periods.

Click to enlarge

We obviously notice at a first sight the higher amplitudes of the automobile sector against the beverages, but the most important thing that this chart illustrates, is the behavior of these sectors in a period of contraction. As we can see in the 2008 crisis for example, the decline in prices in the performance of the automobile sector is way larger than beverages. This means that the investor holding an automobile stock like Ford would have suffer larger losses.

Source: Cyclical vs. Defensive Stocks, Societe Generale

Even though European and the U.S. economies are in recovery it is still a wise strategy to allocate some portion of a portfolio to defensive stocks. Should the current recovery stall for some reason these stocks will offer a “cushion” effect to a portfolio that declines due to adverse market conditions.

Some of the foreign defensive stocks are listed below for investors to consider for further research:

Consumer Staples

Healthcare

- GlaxoSmithKline (GSK)

- AstraZeneca PLC (AZN)

- Novartis AG (NVS)

- Novartis AG (NVS)

- Roche Holding AG (RHHBY)

- Fresenius Medical Care AG & Co (FMS)

Utilities

- Edp Energias De Portugal SA (EDPFY)

- National Grid PLC (NGG)

- Electricite de France SA (ECIFY)

- Empresa Nacional de Electricidad SA (EOC)

- Iberdrola SA (IBDRY)

- Gas Natural SDG SA(GASNY)

Telecom

- Philippine Long Distance Telephone Co (PHI)

- Telenor ASA (TELNY)

- Vodafone Group PLC (VOD)

- Telefonica SA (TEF)

- BCE Inc. (BCE)

- Telstra Corp Ltd (TLSYY)

- Orange (ORAN)

Disclosure: No Positions

Washington DC, USA

I don’t understand. If utilities go down in price when interest rates go up, wouldn’t that increase the dividend yield on them? Most of the long time payer would at worst not raise the dividend, but not drop them either, raising the yield if the stock price tumbled…. Please advise.

Yes.Thats correct.When interest rates go up utilities go down in price usually and that will increase the dividend yield since the yield remains the same. Utilities won’t raise the dividends because their borrowing costs go up when interest rates rise.However their earnings will remain the same or may be even decrease. Since dividends are paid out of earnings most the players tend to maintain the dividend as opposed to increasing or decreasing it. Either way if you are a long-term holder short-term price declines shouldn’t bother you since you can accumulate additional shares cheaply with the new dividends, provided you reinvest dividends. One of my holding DTE has a 3.51% yield now since the price fell from over $92 recently to $80 now. If it falls to $50 the yield will soar but that is unlikely.

Also, you may want to read this interesting article from WSJ:

Tightening the Case Against Utility Stocks

Hope this helps.