The railroad industry plays an important and critical role in the economic growth of North America countries. Railroads in Canada, Mexico and the U.S. are inter-connected for seamless and efficient transportation of freight across the continent. Due to the vastness of the U.S. and Canada, railroads move a tremendous amount of goods and materials cheaply from one place to another.

From an investment perspective, railroad stocks are excellent for long-term investment since only a handful of the major dominate the entire markets of the two countries. Unlike other industries a new railroad company is almost impossible be launched. From an article I wrote in 2013, here are some of the reasons to invest in railroad stocks:

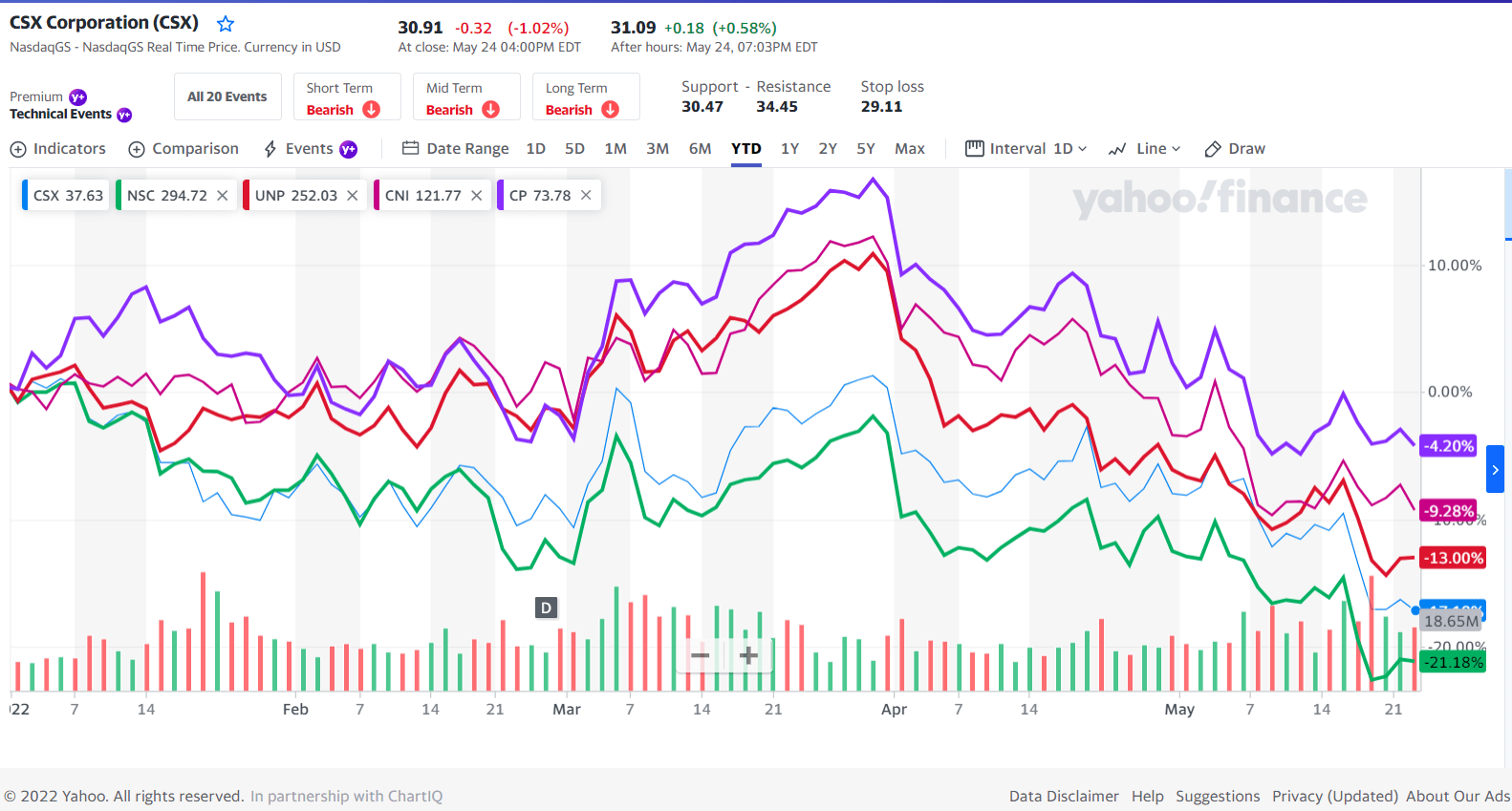

- “The railroad industry is a oligopoly as shown in the chart here.

- Railroads are the best form of transportation to transport natural resources such as coal, minerals, timber, etc.

- Other goods such as autos and petroleum products are also moved by rail in increasing quantities.

- Railroads have pricing

power since in many places only one railroad serves the area. For example, a former in Iowa may not have options to move his produce other than one single railroad serving his rural community.

power since in many places only one railroad serves the area. For example, a former in Iowa may not have options to move his produce other than one single railroad serving his rural community. - Automation and continued investments in technology and innovation makes the industry highly efficient.

- Railroads move goods economically across the vast distances of the country.

- The majority of the U.S. and Canadian railroads are involved in freight transportation and not on passenger traffic.”

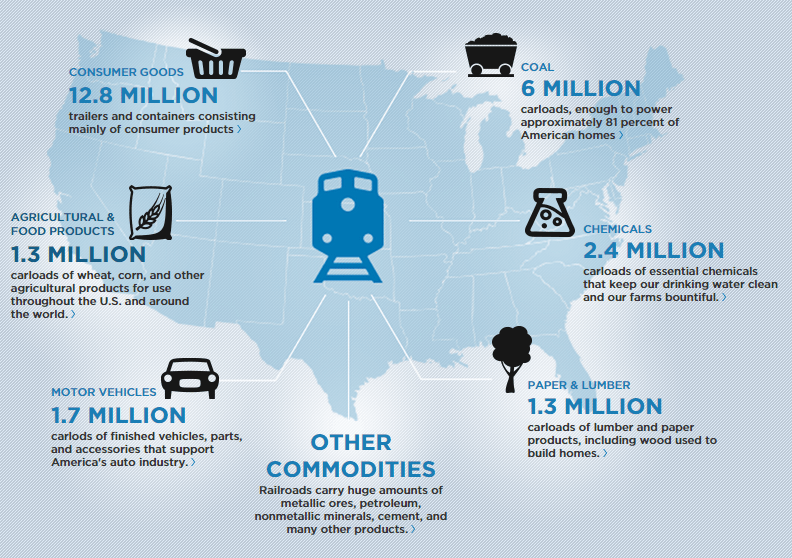

An interesting stat from American Association of Railroads:

U.S. freight railroads account for approximately 40 percent of intercity freight volume — that is more than any other mode of transportation. Each day, railroads deliver an average of 5 million tons of goods and serve almost every industrial, wholesale, retail, and resource-based sector of the economy.

Click to enlarge

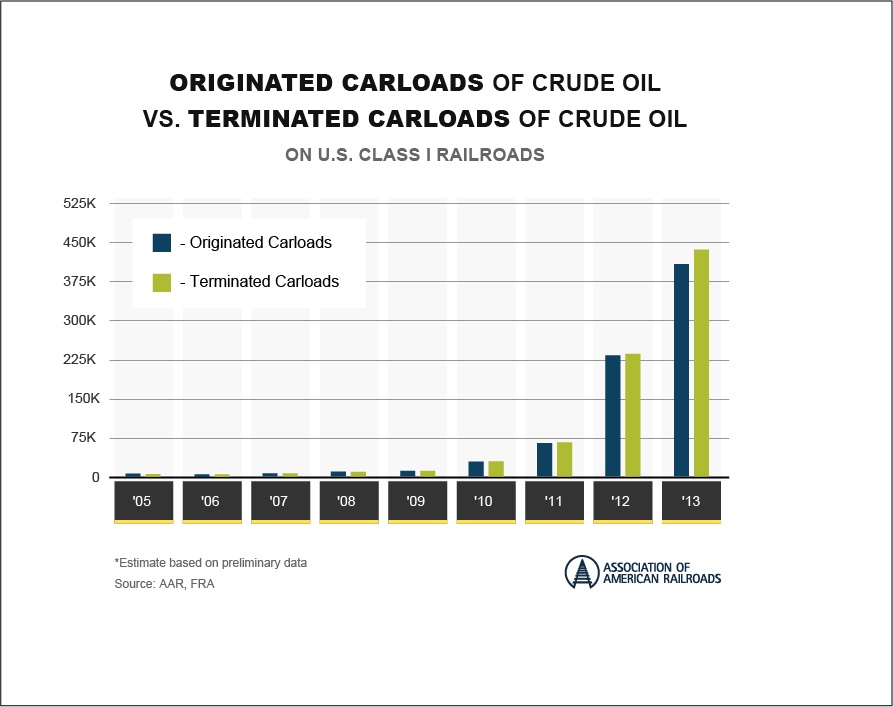

Crude by rail is another growth area that railroads are benefiting from in recent years. With the dramatic rise in shale oil production in the U.S. in the past few years and increased opposition to the construction of new oil pipelines, railroads are transporting a substantial amount of crude everyday.

Click to enlarge

Source: AAR

There are seven Class I railroads that control over 95,000 miles of track in the U.S. According to AAR:

Accounting for 69 percent of U.S. freight rail mileage and 90 percent of employees, America’s Class I freight railroads operate in 44 states across the country and concentrate largely on long-haul intercity traffic.

Of the 7 railroads only 6 are public companies since billionaire Warren Buffet took BNSF private in 2009.From an investment standpoint, investors should buy and hold railroad stocks for the long-term which is 5 years or so in order to earn solid returns on their investments.

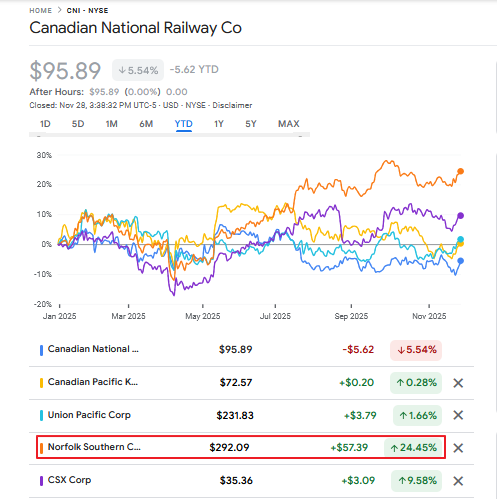

The Class I railroad stocks are listed below with their current dividend yields:

1.Company: CSX Corp (CSX)

Current Dividend Yield: 1.90%

2.Company: Kansas City Southern (KSU)

Current Dividend Yield: 1.17%

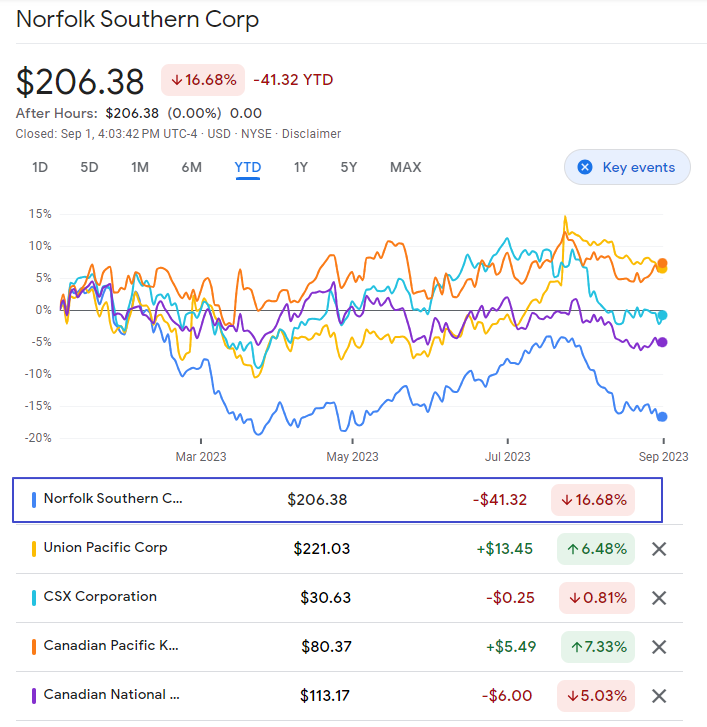

3.Company: Norfolk Southern Corp (NSC)

Current Dividend Yield: 2.27%

4.Company: Union Pacific Corp (UNP)

Current Dividend Yield: 1.68%

5.Company: Canadian National (CNI)

Current Dividend Yield: 1.47%

6.Company: Canadian Pacific (CP)

Current Dividend Yield: 0.65%

Note: Dividend yields noted above are as of Feb 4, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long CNI, CSX and NSC