In the past few weeks I wrote a number of bullish articles on European equities. You can find some of them here, here, here and here. Over the weekend The Wall Street Journal published an interesting piece on the same topic. The entire article is worth a read. From the article:

The Case of Europe

One recent sign of hope for European investors was the calm response to the recent triumph of the left-wing Syriza party in Greece, which wants to ease the terms of the European bailout.

Greece’s Athex Composite Share Price Index plummeted 15% in the first three trading days following the vote. But investors elsewhere shrugged, bidding the Stoxx Europe 600—akin to the S&P 500—to a fresh seven-year high in the days that followed.

There are other reasons for optimism.

The euro already has tumbled 19% against the dollar since March, and many analysts believe it has further to fall, particularly when the Federal Reserve raises interest rates, which could happen this year. A weaker currency should make European exports more competitive and boost revenues in euro terms.

European firms also are able to borrow on favorable terms due to low interest rates, and plunging oil prices have reduced energy costs in countries that often rely on imported fossil fuels.

“Recently, we seem to be running out of reasons to dislike Europe, and for us that signals that it’s time to buy,” says John Manley, the New York-based chief equity strategist at Wells Fargo Asset Management , a unit of Wells Fargo that oversees about $490 billion.

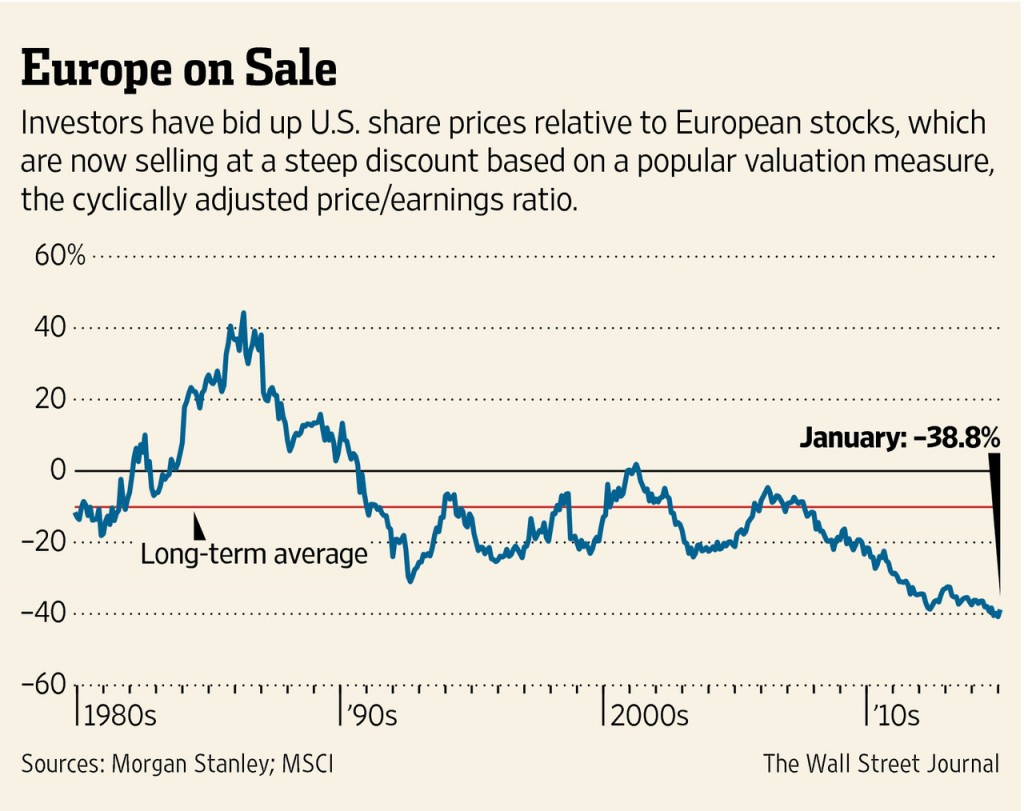

European stocks also are less richly valued than U.S. equities, which have appreciated more sharply in the aftermath of the financial crisis. European stocks currently trade at nearly a 40% discount to U.S. equities, according to Morgan Stanley, based on the cyclically adjusted price/earnings ratio—a valuation measure popularized by Nobel Prize-winning economist Robert Shiller that uses average inflation-adjusted earnings over the prior 10 years. The long-term average discount is 10%.

Click to enlarge

Morgan Stanley forecasts that European corporate earnings will outpace the U.S. for the first time since 2008, with 10% growth in 2015 compared with 6% to 8% in the U.S.

For many U.S. investors, the simplest and most convenient way to own European stocks is to buy a mutual fund or an exchange-traded fund offered by a major investment firm that focuses on Europe or includes a chunk of European stocks among its holdings.

Source: The Case for European Stocks Gets Stronger by Christopher Whittall, Jan 30, 2015, The Wall Street Journal

I agree with Chris on his view that an ETF or a mutual fund will be a better option to gain exposure to European equities. However for investors willing to build their own portfolio and monitor them for the long-term investment there are plenty of world-class companies that are based in Europe. European multinational companies are especially better since they gain from growth in both the domestic and emerging and other developed markets.

Investors can explore the following ten European multinationals from ten countries for potential investments:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.16%

Sector: Food Products

Country: Switzerland

2.Company: Siemens AG (SIEGY)

Current Dividend Yield: 3.58%

Sector:Industrial Conglomerates

Country: Germany

3.Company: National Grid PLC (NGG)

Current Dividend Yield: 4.95%

Sector: Multi-Utilities

Country: UK

4.Company: Valeo SA (VLEEY)

Current Dividend Yield: 1.63%

Sector:Auto Components

Country: France

5.Company: Telefonica SA (TEF)

Current Dividend Yield: 5.87%

Sector: Telecom

Country:Spain

6.Company: Novo Nordisk A/S (NVO)

Current Dividend Yield: 1.86%

Sector: Pharmaceuticals

Country: Denmark

7.Company: Anheuser-Busch InBev SA/NV (BUD)

Current Dividend Yield: 2.65%

Sector: Beverages

Country: Belgium

8.Company: Swedbank AB (SWDBY)

Current Dividend Yield: 6.45%

Sector: Banking

Country: Sweden

9.Company:Telenor ASA (TELNY)

Current Dividend Yield: 5.43%

Sector: Telecom

Country: Norway

10.Company:Reed Elsevier NV (ENL)

Current Dividend Yield: 2.90%

Sector: Media

Country: The Netherlands

Note: Dividend yields noted above are as of Jan 30, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long SWDBY