When investors think of Latin American countries for investment they usually tend to gravitate towards Brazil and Mexico, two of the largest economies in the region. However Brazilian equities have been average to poor performers in the past few years and the Mexican economy is highly related to the performance of the U.S. economy.

Instead of focusing mainly on Brazil and Mexico, investors can consider some of the other countries in the region. Particularly they can expand their horizon to opportunities in the Andean countries of Chile, Colombia and Peru collectively known as the “Pumas”.

Some of the reasons to invest in “Pumas” are:

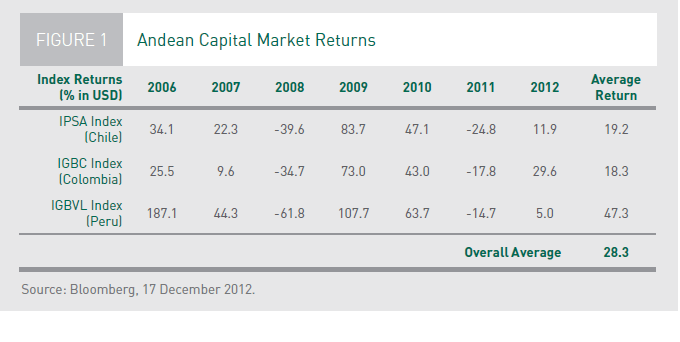

- The equity markets of these countries have performed well in the past few years. The table below shows their returns from 2006 to 2012:

In 2013 Chile was up by down by 14% and Colombia was down by 8%.

In 2013 Chile was up by down by 14% and Colombia was down by 8%.- The pumas have implemented private pension fund systems which offer a growing and captive local investor base.

- Andean markets are well diversified. For example, the benchmark indices of IPSA, COLCAP and IGBVL are diversified across the major sectors. In comparison, the Mexican IPC does not have representation from the utility and energy sectors.

- The three markets provide plenty of liquidity with over 600 companies listed on the exchanges.

- Political stability which has been an issue in the past is no longer a problem in these countries. For example, the FARC rebels and Colombia have agreed to a ceasefire and the country is slowly getting back to normality. Similarly Chile re-elected its leader recently and is largely a stable country for many years now.

- The average dividend yields in the Puma firms are attractive. For example, Chile is one of the few countries where companies are required by law to distribute a portion of their profits as dividends to their shareholders.

Source:Latin America Equity – Dispelling the Myths of the Andean Pumas, Pinebridge Investments

Five stocks from the three Andean countries are listed below for further research:

1.Company: Credicorp Ltd (BAP)

Current Dividend Yield: 1.31%

Sector: Banking

Country: Peru

Note: Credicorp is incorporated in Bermuda as a holding company.

2.Company: Ecopetrol SA (EC)

Current Dividend Yield: 14.49%

Sector: Oil

Country: Colombia

3.Company: Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.12%

Sector:Electric Utilities

Country: Chile

4.Company: Bancolombia SA (CIB)

Current Dividend Yield: 3.29%

Sector: Banking

Country: Colombia

5.Company: Banco de Chile (BCH)

Current Dividend Yield: 5.56%

Sector:Banking

Country: Chile

Note: Dividend yields noted above are as of Jan 16, 2015. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BCH