When investing in stocks it is always a good strategy to invest for the long-term. Short-term investing is not investing but more must be more aptly called trading.Trading commissions and taxes eat away at any gains that can be made in short-term. Most of the retail investors are better off holding stocks for the long-term.

Trying to time the market is a fool’s game as nobody can predict what can happen from one day to the next. For example, during the month of October equity markets worldwide plunged suddenly for a variety of reasons. U.S. stocks fell by an astonishing 8% from September high to reach October lows.

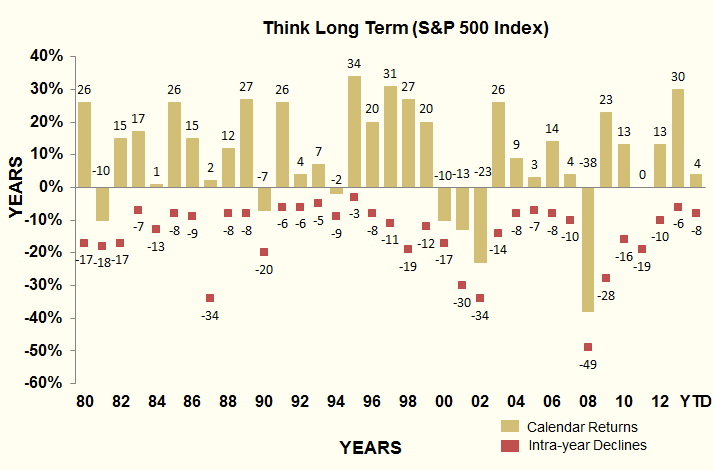

The following chart shows the Intra-year Declines and Calendar Year Returns for the S&P 500:

Click to enlarge

Data Source: Standard & Poor’s, Factset, J.P. Morgan

Source: Corrections are Normal, Market Intelligence – October 2014 Anil Tahiliani, Head of North American Equities, McLean & Partners

From the linked article:

As shown in Figure 1, the average decline is 15% in the last 35 years based on the U.S. stock market (S&P 500 Index). When we exclude the recessionary periods and the 1987 crash, the average decline is 10%. Using a longer time period, the average U.S. stock market correction since 1956 is 13% when excluding bear markets (corrections of 20% plus).

Thus this recent correction is in line with historical averages. Investors need to also keep in mind that the current stock market correction is the 19th correction since March 2009.

In 2013, the S&P 500 declined by 6% during the year but still ended the year with a solid return of 30%.Similar decline and rise occurred in most of the years shown as well.

Long-term investors can consider adding the following ten stocks from the S&P 500 index:

1.Company: Abbott Laboratories(ABT)

Current Dividend Yield: 2.10%

Sector: Pharmaceuticals

2.Company: Caterpillar Inc (CAT)

Current Dividend Yield: 2.99%

Sector: Machinery

3.Company: Mondelez International Inc (MDLZ)

Current Dividend Yield: 1.60%

Sector: Food Products

4.Company: General Dynamics Corp (GD)

Current Dividend Yield: 1.76%

Sector: Aerospace & Defense

5.Company: Emerson Electric Co (EMR)

Current Dividend Yield: 2.99%

Sector: Electrical Equipment

6.Company: Procter & Gamble Co (PG)

Current Dividend Yield: 2.76%

Sector: Household Products

7.Company: Fluor Corp (FLR)

Current Dividend Yield: 1.39%

Sector: Construction & Engineering

8.Company: T. Rowe Price Group Inc (TROW)

Current Dividend Yield: 2.01%

Sector: Investment Management

9.Company: Kimberly-Clark Corp (KMB)

Current Dividend Yield: 2.85%

Sector: Household Products

10.Company: Marathon Oil Corp (MRO)

Current Dividend Yield: 2.93%

Sector: Oil, Gas & Consumable Fuels

Note: Dividend yields noted above are as of Dec 23, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No Positions