In developed countries most publicly-listed companies are not controlled by families. In the U.S. less than one-third of the S&P 500 companies are family-owned businesses according to a study by McKinsey&Company. But in emerging markets many of the large public companies are owned by families. This is similar to the situation that existed in the U.S. in the 19th century when much of the economy was dominated by a handful of powerful families like those of the Carnegie, Morgan, Vanderbilit and Rockefeller families.

The U.S. equity market has performed extremely well this year also following a solid performance in 2013. Among the emerging markets, most of them have been poor performers this year with the exception of India and China which have posted double-digit returns. As a result of the strong returns of U.S. stocks two years in a row and poor returns of emerging markets, investors may be tempted to avoid emerging markets.However there are many reasons to invest in emerging stocks one of which is the family ownership of public companies. From an article by David L. Ruff, CFA of Forward Management, LLC:

Why should family ownership be a recurring investment theme? We see some examples of publicly traded family businesses in the U.S. — think of Walmart and News Corp.— and even more in Europe. The family-run model is most common in Asia, where research has found it to be “an important pillar of Asian economies.”1 According to a 2011 Credit Suisse study, family businesses account for 50% of all listed companies and 32% of market cap across 10 Asian countries. Moreover, listed family businesses outperformed local benchmarks in seven of those 10 countries between 2000 and 2010 with those in China, Malaysia, Singapore and South Korea showing the strongest performance.2

We’ve found that an ongoing family presence can contribute positively to a company’s dividend culture. Where families retain a controlling interest or have a significant minority stake, they generally want to keep paying themselves a dividend. Such companies seem to be more focused on long-term stewardship of the enterprise, more patient when investing in expansion projects and less inclined to boost short-term results through the use of leverage or accounting tricks. Family members are also more likely to object to questionable expenditures like over-the-top executive compensation or an ill-advised acquisition.

1 Credit Suisse Emerging Market Research Institute, Asian Family Businesses Report 2011, October 2011.

2 Credit Suisse Emerging Market Research Institute, Asian Family Businesses Report 2011, October 2011.

Source: Family-Owned Businesses: One More Reason Not to Neglect Emerging Markets, Dec 17, 2014, David L. Ruff, CFA,Forward Management, LLC

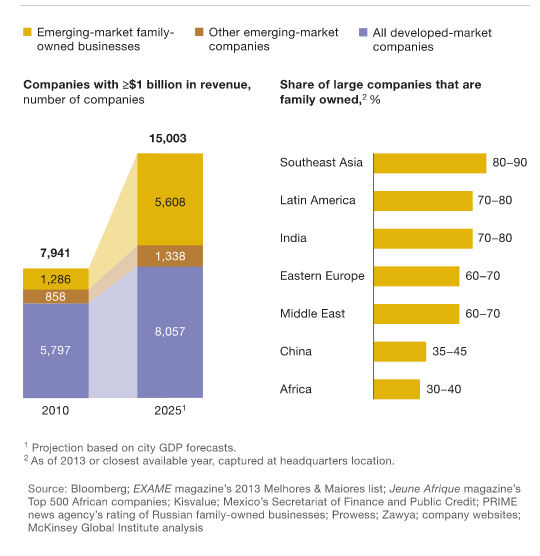

The McKinsey report noted that the significance of family-owned businesses with revenues of over $1.0 billion to their national economies in emerging countries is projected to increase in the coming years.

Click to enlarge

Family-owned companies have many advantages over non-family owned companies. From the report:

They can also work fast. As one executive at such a company told us: “All the world is trying to make managers think like owners. If we put in one of the owners to manage, we don’t need to solve this problem.” An owner–manager can move much more rapidly than an executive hired from outside. There’s no need to pass decisions up a chain of command or to put them in front of an uncooperative board, and many of the principal–agent challenges that confront non-family-controlled companies are neutralized. Family-owned businesses can therefore place big bets quickly, though of course there’s no guarantee that they will pay off. Still, manager–owners are largely relieved of the quarter-to-quarter, short-term benchmarks that can define—and distort—performance in Western public companies, so they’re freer to make the hard choices necessary to create long-term value.

Source: The family-business factor in emerging markets, Dec 2014, McKinsey Quarterly

While conventional wisdom holds that families that control public companies may not be shareholder-friendly, it is not always true as discussed above. One of the key takeaways from this post is that when investing in emerging markets investors have to dig deep into the ownership structure of companies and should not avoid public companies that are majority controlled by families. I have written in my earlier posts on how high state ownership in some emerging firms actually is a good thing for investors since they are more likely to payout a higher portion of their profits as dividends.Along the similar line, it is also not a bad idea to invest in family-owned firms in emerging countries.

Related ETFs:

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Emerging Markets ETF (VWO)

- iShares MSCI Malaysia ETF (EWM)

Disclosure: No Positions