The U.S. housing market is highly different than housing markets in other countries.For example, unlike in most countries mortgages in most of the U.S. are are non-recourse loans which means borrowers can default on their loans and simply walk away free while the lender takes the loss.

I wrote a post back in 2012 comparing the housing markets of U.S. and Canada. A similar comparison can be made between the housing market in the US and Australia, Germany, France, UK, etc. I came across an interesting article in the Vanguard Blog for Advisors showing how the U.S. housing market is different than the housing market in China. For many years now, many people have predicted the collapse of the Chinese housing market. For example, in 2011 the “ghost” city of Ordos in Inner Mongolia became a popular media story on the Chinese housing bubble.

Click to enlarge

“Empty” City of Ordos, Inner Mongolia, China (in 2011)

Photos Source: Der Spiegel

From China won’t export housing crisis by Joe Davis of Vanguard:

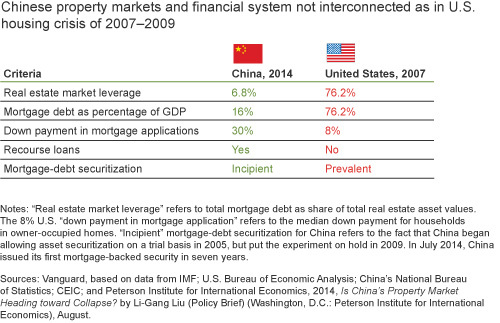

In the United States, many investors took out speculative loans on houses they could not afford. In China, lending standards have not loosened. Subprime mortgage loans with minimal down payments do not exist there. Chinese homebuyers must put down at least 30%—and often more than that for a second home. They also can’t walk away from their debts easily because they lack the no-recourse loans that allowed underwater U.S. borrowers to wash their hands of their housing debt. Mortgage securitization, a major factor in the global financial crisis, is also less prevalent in China than in the United States. Overall, the Chinese housing boom is missing the leverage that accelerated the housing bonfire here.

Furthermore, compared with the housing market in the United States, China’s housing market is relatively young and represents a smaller part of the economy. Homeownership took root only in 1998, when Chinese officials began eliminating the state-run housing system.

Finally, the key difference in China is that most of the risk lies with real estate developers and local governments, who have borrowed excessively and left many cities with an oversupply of housing. In fact, revenue from land sales is about one-third of local government revenues, and many local government funding vehicles use land as collateral for their borrowing. Bad loans could emerge in the future if banks tighten lending, and housing and land demand slows.

Mr.Davis makes many compelling arguments above. Investors waiting for a collapse of the Chinese economy due to a crash in the real estate market are mistaken. China’s market is nowhere near the levels of the craziness that occurred in the US housing bubble. Shocking stories of some illegal in California with barely any income getting a mortgage for $500,000 with $0 down payment is not unheard when the bubble crashed. Such scenarios are unlikely to occur in China.Chinese banks have strict lending standards even for local citizens.