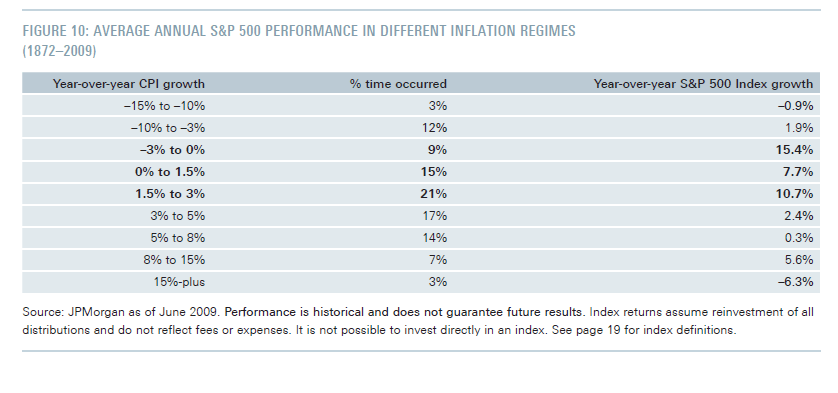

One of the reasons for investing in stocks including dividend-paying stocks is earn a return that keeps up with or even beats inflation. Historically stocks have performed well when inflation, as measured by the Consumer Price Index (CPI) ranged from -3% to 3% according to a white paper published by DWS Investments of Deutsche Bank Group in 2012.

Click to enlarge

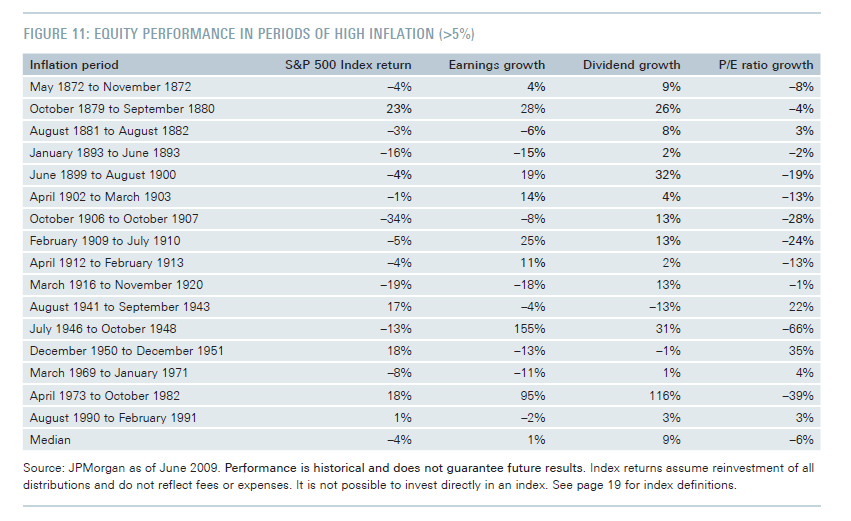

During periods of high inflation, equities tend to perform poorly due to the compression of P/E ratios as shown in the table below:

Source: Dividends: the case for income-oriented investors, DWS Investments

Dividends tend to grow more than equity prices during inflationary periods. In fact, dividends continued to grow even during periods of high inflation (> 5%). During the high inflation period of April 1973 to October 1982 dividend growth was significantly higher than prices.

The key takeaway from this article is dividend stocks are a good asset class to own during periods of moderate and high inflation.

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares Dow Jones Select Dividend ETF (DVY)

- SPDR S&P Dividend ETF (SDY)

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR Consumer Staples Select Sector Fund (XLP)

- SPDR Utilities Select Sector Fund (XLU)

Disclosure: No Positions