One of the factors that investors consider when investing in emerging market equities is the stability of local currency against the US dollar. Generally currency depreciation is assumed to have an adverse impact on equities in an emerging country. However that assumption is not always correct and does not apply to all emerging markets. According to a research report published by AXA Investment Managers, the impact of currency depreciation varies based on the “openness” of the market in question and the sector composition of equity indices. In other words, some emerging markets are more domestic than others meaning that companies generate more of their revenues domestically than from foreign countries. Hence such companies are unable to leverage the fall in exchange rate to increase their market share by selling goods cheaper to their overseas customers. So companies that are more dependent on foreign revenues are sensitive to currency gyrations than the ones that are mostly domestic-oriented.

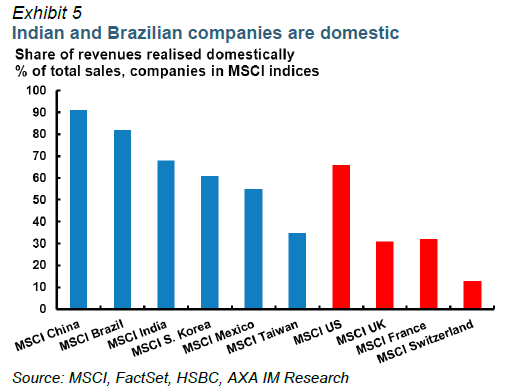

The share of revenues generated domestically is higher for the companies in the MSCI indices of China, India and Brazil than their peers. Public companies in Taiwan and South Korea for example, generate a larger share of their revenues overseas. Hence their earnings are affected by volatility of currency movements.

Incidentally when many emerging market currencies including the Indian Rupee plunged earlier this year on fears of the Fed winding down its monthly $85 billion asset purchases, the Indian equity market barely fell.

Click to enlarge

Source: FX depreciations are not necessarily good news for EM earnings, AXA Investment Managers

From the report:

In the case of Brazil and India, the large share of domestic revenues is to some extent explained by the substantial weight of financials in their respective equity indices (28% and 31% of MSCI Brazil and MSCI India’s total market capitalisation, respectively). EM financials are usually strongly domestic – 98% of the revenues of MSCI Brazil financials are domestic, while the figure is 96% for MSCI India financials. Moreover, financials are relatively immune to FX movements. Similarly, companies in the energy sector in Brazil (representing 17% of the MSCI Brazil’s market capitalisation) earn 88% of their revenues in Brazil. Given that a large part of their production is also local, they are naturally hedged against exchange rate fluctuations.

Hence from an investment standpoint, Brazilian and Indian financials will mirror the performance of the domestic economy and may not be highly impacted by outside factors such as currency rate fluctuations, the policies of the US Federal Reserve, the state of developed world economies, war in Syria, etc. Brazilian and Indian banks trading on the US exchanges are listed below with their current dividend yields for further research:

1.Company: Itau Unibanco Holding SA (ITUB)

Current Dividend Yield: 2.96%

Sector: Banking

Country: Brazil

2.Company: Banco Bradesco SA (BBD)

Current Dividend Yield: 0.90%

Sector: Banking

Country: Brazil

3.Company: Banco do Brasil S.A. (BDORY)

Current Dividend Yield: 8.72%

Sector: Banking

Country: Brazil

4.Company: Banco Santander (Brasil) S.A. (BSBR)

Current Dividend Yield: 3.62%

Sector: Banking

Country: Brazil

5.Company: ICICI Bank Ltd. (IBN)

Current Dividend Yield: 1.80%

Sector: Banking

Country: India

6.Company: HDFC Bank Ltd. (HDB)

Current Dividend Yield: 0.73%

Sector: Banking

Country: India

Note: Dividend yields noted are as of Nov 1, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long ITUB and BBD