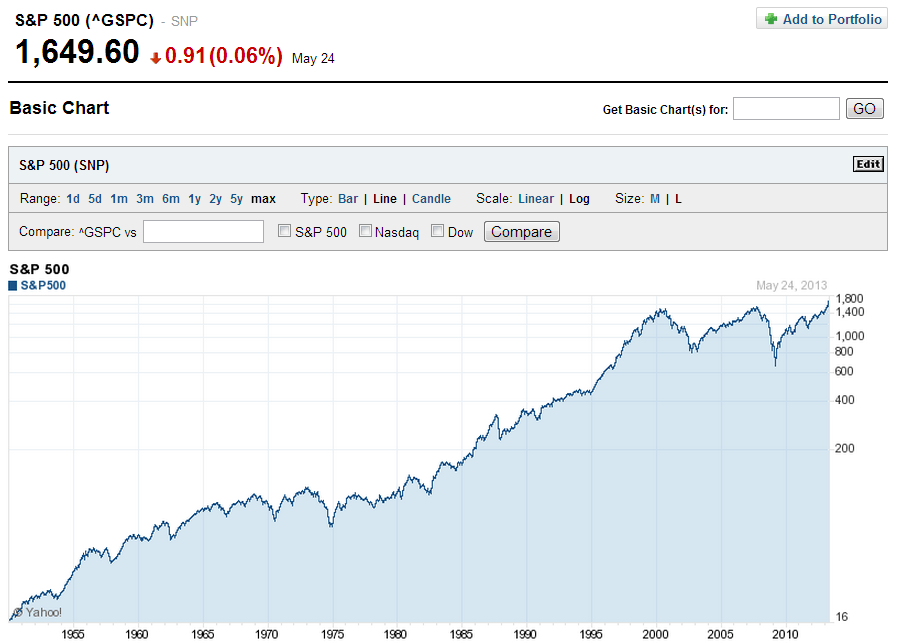

Major U.S. markets reached all-time highs last week. For example, the S&P 500 reached a record high of 1,687.18 surpassing the earlier high attained in 2007 before the global financial crisis.

Multi-year return of S&P 500:

Source: Yahoo Finance

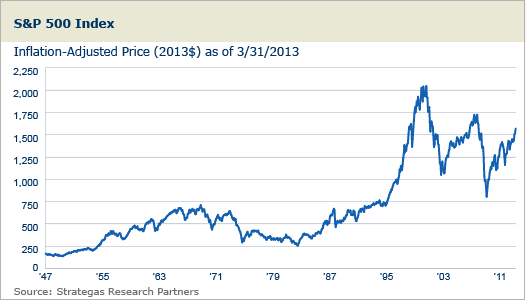

All the cheer and excitement that followed for reaching the milestones may be premature. This is because on an inflation-adjusted basis equities are still a long way from reaching new records.

According to a report by T.Rowe Price, at the end of first quarter the S&P 500 index stood 30% below the inflation-adjusted peak reached during the dot-com mania in 1999 (not including dividends).

Click to enlarge

Source: Real Returns Can Preserve Purchasing Power, T.Rowe Price

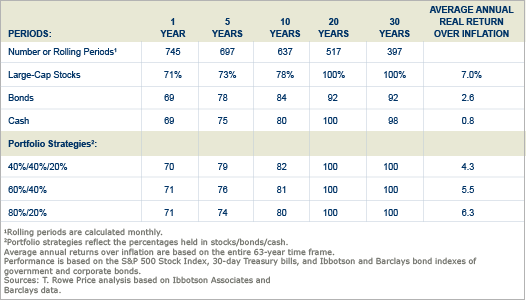

The same report noted that while in the short-term stocks did not yield an inflation-beating returns, in the long run such as 20-year or 30-year periods stocks beat inflation.

From the report:

The table below shows the percentage of rolling investment periods in which various assets beat inflation from 1950 through 2012. Over shorter investment horizons of one, five, or even 10 years, stocks failed to outpace inflation in more than 20% of the periods, but bonds and cash also had spotty records.

Percentage of rolling periods in which stocks, bonds, cash and selected portfolio strategies Outpace Inflation: December 31, 1949-December 31, 2012

Over 20- or 30-year periods, however, stocks beat inflation in every one, while bonds had positive real (inflation-adjusted) returns 92% of the time. This means that bond returns lagged inflation in 32 of the 397 rolling 30-year periods (calculated monthly), most of these occurring in the 30-year periods ending in the mid-1960s through the early to mid-1980s.

Also, the magnitude of the outperformance for stocks was significant. Over the entire 63-year period, large-cap stocks had an average annual real rate of return of 7.0% compared with about 2.6% for bonds and 0.8% for cash (30-day Treasury bills). Stocks also outperformed bonds on a real return basis in virtually all of the 20- and 30-year periods, usually by a wide margin. Of course, stocks are generally more risky than bonds, but the volatility of stocks is significantly reduced over longer-term periods.

It should noted that the actual return than an investor receives will be even lower than the inflation-adjusted returns since taxes, trading commissions, expenses and fees for ETF and mutual fund investments have to be taken into account when calculating the actual return on an investment. But dividends from income-generating assets may help offset some of these expenses. In summary, stocks are the best financial asset classes to own for generating an inflation-beating return over the long-term.

Related ETF:

- SPDR S&P 500 ETF (SPY)

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR S&P Dividend ETF (SDY)

- iShares Dow Jones U.S. Select Dividend ETF (DVY)

- PowerShares Dividend Achievers ETF (PFM)

Disclosure: No Positions