Diversification is an important strategy to follow when investing in equity markets. It is especially important for retail investors who can least afford to lose hard-earned money. To be sure even professional money managers who run other people’s money for a living use diversification to reduce risks. For example, many equity mutual fund managers hold 50 or even 100+ stocks in their fund portfolios to take advantage of diversification. However whether diversification can be only be achieved by holding that many stocks is beyond the scope of this article. In general, it is a wise idea to diversify one’s portfolio across sectors, countries, asset classes, etc. This is especially important for long-term investors monitor their holdings but not trade often based on the gyrations of the market.

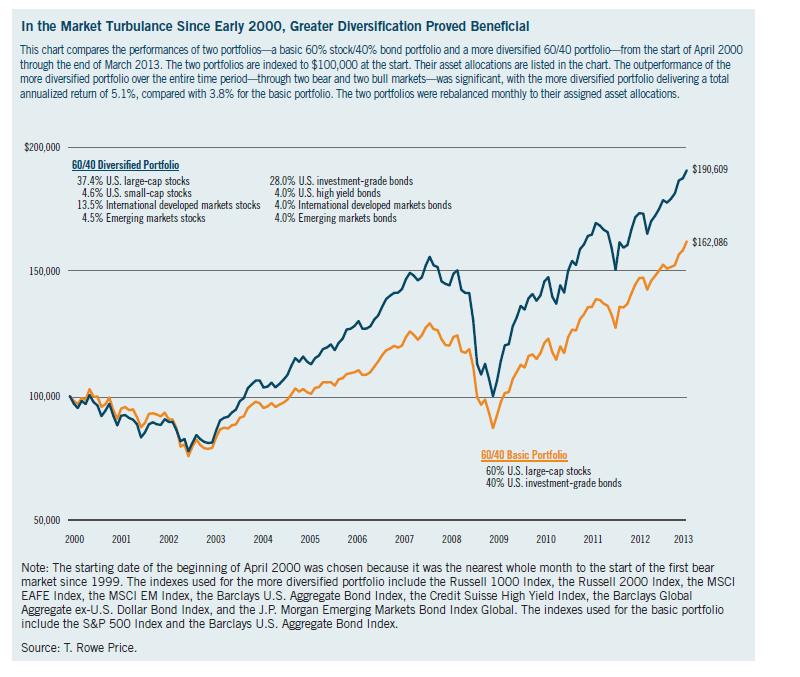

In order to fully gain the benefits of diversification it is important to hold a mixture of stocks and bonds of various types. An article by T.Rowe Price quoted an in-house study showed that a well-diversified portfolio easily outperformed a basic portfolio by a significant margin. The basic portfolio held just U.S. large cap stocks and investment-grade bonds.

From the Spring, 2013 edition of T.W.Rowe Price Report:

Over the entire 13-year period, the total annualized return of the more diversified portfolio was 5.1%, compared with just 3.8% for the basic portfolio.

That 1.3-percentage-point annual gap in performance meant that $100,000 invested in each of these portfolios at the start would have grown to $190,609 with the more diversified portfolio, compared with $162,086 for the basic portfolio.

In other words, greater diversity would have translated to a total gain of roughly 46% more than that of the more basic portfolio.

Click to enlarge

Even when the study period was extended to all the way to January 1994 when all the index data was available, the well-diversified portfolio generated a total annualized return of 7.8% versus 7.3% for the basic portfolio.

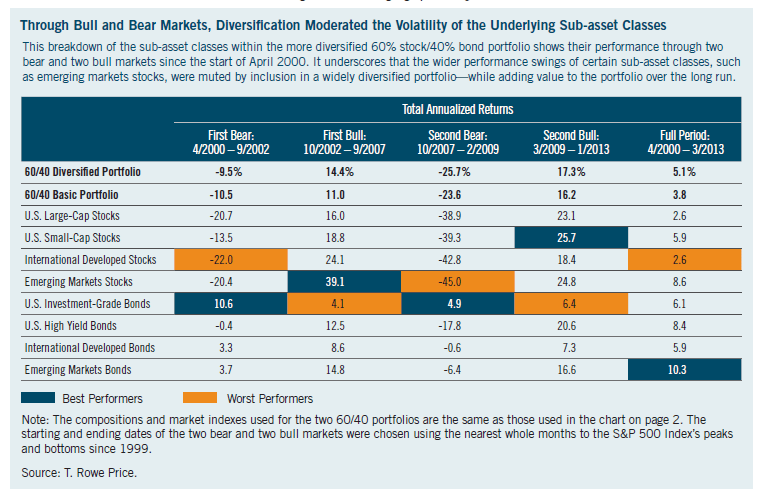

The well-diversified portfolio also outperformed the basic portfolio in both bull markets and in one of the two bear markets as shown in the chart below:

Source: T.Rowe Price Report, Spring 2013, T.Rowe Price

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR S&P Dividend ETF (SDY)

- iShares Dow Jones U.S. Select Dividend ETF (DVY)

- SPDR Gold Shares (GLD)

- iShares iBoxx $ Invest Grade Corp Bond (LQD)

- SPDR KBW Bank ETF (KBE)

- SPDR KBW Regional Banking ETF (KRE)

Disclosure: No Positions