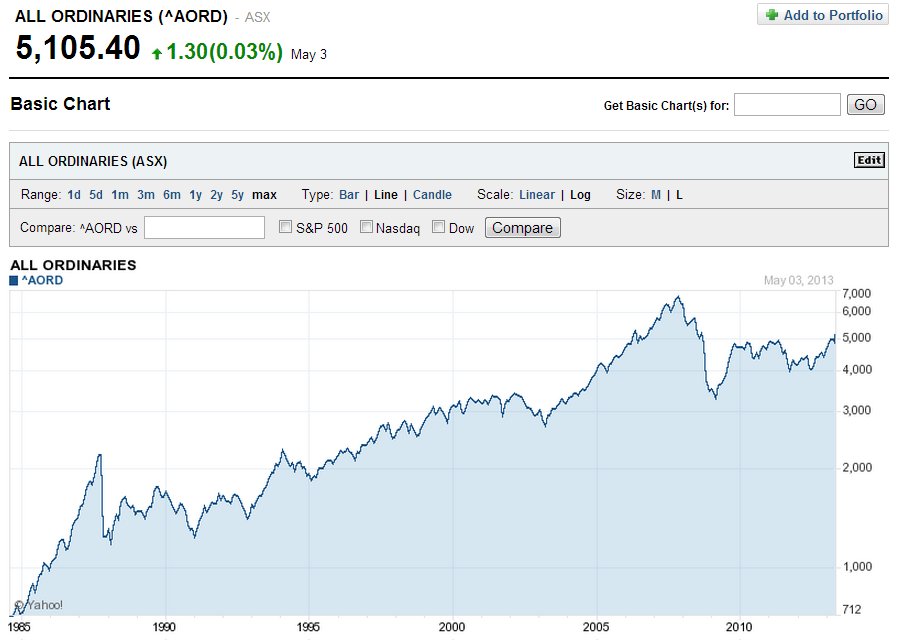

The Australian stock market has performed well so far this year. The benchmark S&P/ASX All Ordinaries Index is up 5.77% on a price basis and 9.67% on a total return basis YTD. Due to the fall in commodity prices the index has not regained the level reached before the global financial crisis. However the long-term return of the index since is pretty impressive as shown in the chart below:

Click to enlarge

Source: Yahoo Finance

The Australian economy is a resource-based economy similar to Canadian and South African economies. The country is called the “The Lucky Country” for the weather, lifestyle and history, it can also be said that the country is lucky due to the vast amount of natural resources available that can be exploited. For example, some of the major commodity exports of Australia are: coal, iron ore, gold, meat, wool, alumina and wheat.

Until last year, the Australia enjoyed 20 years of continued economic growth as a result of the boom in commodity and energy demand from Asia especially China according to CIA’s The World Factbook. During the 20 year period economic growth averaged 3.5% a year. The services sectors accounts for 70% of the economy with the rest split between manufacturing and agricultural sectors.

An economy based on simply digging up stuff from under the ground and selling to other countries has two major risks. First there must be demand for the stuff. Secondly the prices that buyers are willing to pay must be high enough to make a profit. If the demand declines and/or prices plunge then the economy will adversely impacted. The Australian economy is facing this scenario. The Australian’s economy’s high dependence on China makes it vulnerable to any slowdown in China’s growth.

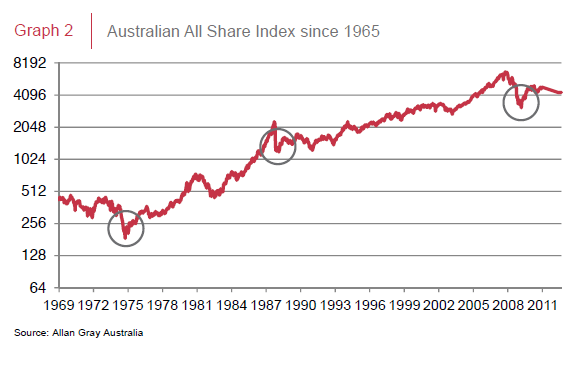

Though the Australian equity market has been on a upward trend for many years now the chances of a strong correction are high. When corrections do occur they can be very violent. The chart below shows that the FTSE Asfa Australia All-Share Index plunged 50% or more with little prior warning:

Click to enlarge

Source: Australian exposure: an interesting opportunity?, Gray Issue, April 26, 2013, Allan Gray, South Africa

Hence investors in Australian equities have to be cautious and monitor their investments. However depending on an investor’s profile and goal, a moderate to low exposure to Australia in a well-diversified portfolio would not hurt.

Five Australian stocks trading on the US markets are listed below for further research:

1.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 4.88%

Sector:Banking

2.Company: Australia and New Zealand Banking Group Ltd (ANZBY)

Current Dividend Yield: 4.72%

Sector:Banking

3.Company: National Australia Bank Ltd (NABZY)

Current Dividend Yield: 5.27%

Sector:Banking

4.Company:Commonwealth Bank of Australia (CMWAY)

Current Dividend Yield: 4.98%

Sector: Banking

5. Company: BHP Billiton Ltd (BHP)

Current Dividend Yield: 3.37%

Sector:Metals & Mining

Note: Dividend yields noted are as of May 3, 2013. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

The iShares MSCI Australia ETF (EWA) offers a simple and easy to invest in Australian stocks. The fund has total assets of over $2.60 billion and a distribution yield of 5.02%.

Disclosure: No Positions