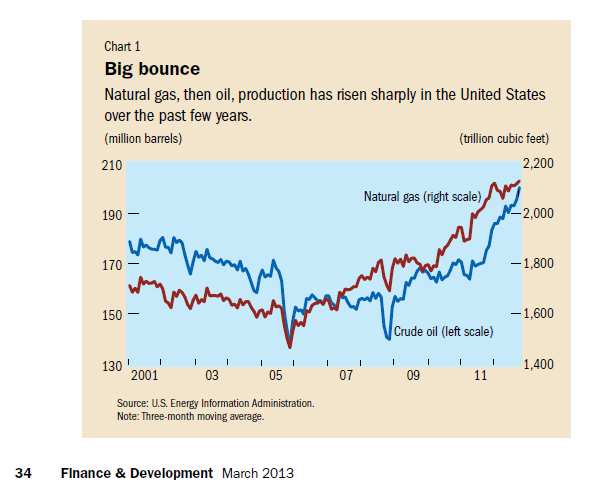

Crude oil and natural gas production in the U.S. has strongly rebounded in the past few years according to an article by Thomas Helbling in the latest edition of IMF’s Finance & Development magazine. As a result, natural gas prices are at a 20-year low. But gasoline prices have not followed natural gas prices and have actually reached closer to the $4.00/gallon mark in recent weeks. Today however the average national price is at $3.659 per the gasbuddy.com website.

Click to enlarge

The IMF article notes that high crude oil prices and new technology have allowed produced producers to cheaply extract these resources from unconventional geological formations. The process of “fracking” in which fluids are injected under high pressure into rock formations such as shale rock to release trapped fuels has revolutionized oil and gas production at prices that are profitable to producers.

From the article:

Production of crude oil from unconventional sources increased about fivefold in the United States between 2008 and 2012, reaching close to 1 million barrels a day by the end of 2012. On average, shale oil—or light tight oil as it is often called—was about 16 percent of total U.S. production in 2012 and accounted for almost three-fourths of the 1.3 million barrel rise in overall daily oil production in the United States over this period.

So far, much of the increase in oil production has reflected field development in the Bakken Shale, which spans the western states of North Dakota and Montana—although in 2012, production in the Eagle Ford Shale in the state of Texas also started expanding rapidly. Eagle Ford area production is expected to continue to expand, and new field development and extraction should start in other known shale rock formations. Expanding development to other formations is necessary if production is to increase further.

At this point, the ultimate oil extraction potential from shale rock and tight sand formations in the United States is uncertain.

The author also notes that employment in the oil and gas extraction and mining sectors has almost doubled over the past decade. Last year some 570,000 workers were employed in these two sectors. While employment levels in many other industries have declined in the past decade it is refreshing to hear that the energy and mining industries are creating jobs.

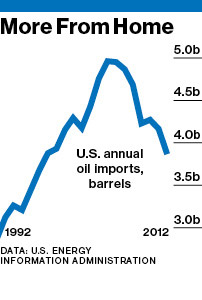

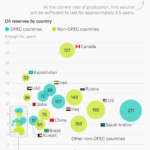

To be sure, the U.S. is still a net importer of oil. However U.S. EIA projects imports to shrink to from 8.3 million barrels per day to 6 million barrels per day at the start of 2014.

Back in January Bloomberg BusinessWeek published an article titled “Falling U.S. Oil Imports Will Reshape the World Crude Market“. From that piece:

If you had told an oil analyst seven years ago that by 2014 the U.S. would import only 6 million barrels of crude oil per day, or roughly a third of what the country uses, he would have been incredulous. Imports back then accounted for roughly two-thirds of U.S. oil consumption, according to the federal Energy Information Administration, and had been rising for 30 years. With all its major fields discovered and production dropping, America seemed destined to import more and more oil, especially from Canada, Mexico, Venezuela, Saudi Arabia, and West Africa.

Then came hydraulic fracturing—the technique of blasting water into shale to extract oil and gas—and the energy picture in the U.S. changed dramatically in a few short years. Now the International Energy Agency predicts that by 2020, U.S. oil production will exceed Saudi Arabia’s. This is altering decades of established trading patterns.

Related ETFs:

United States Natural Gas Fund (UNG)

United States Oil Fund (USO)

Disclosure: No Positions