Last year France became the first country to enact the Financial Transaction Tax (FTT) on stocks and other financial instruments. Other European countries were expected to follow this trend.

Last year France became the first country to enact the Financial Transaction Tax (FTT) on stocks and other financial instruments. Other European countries were expected to follow this trend.

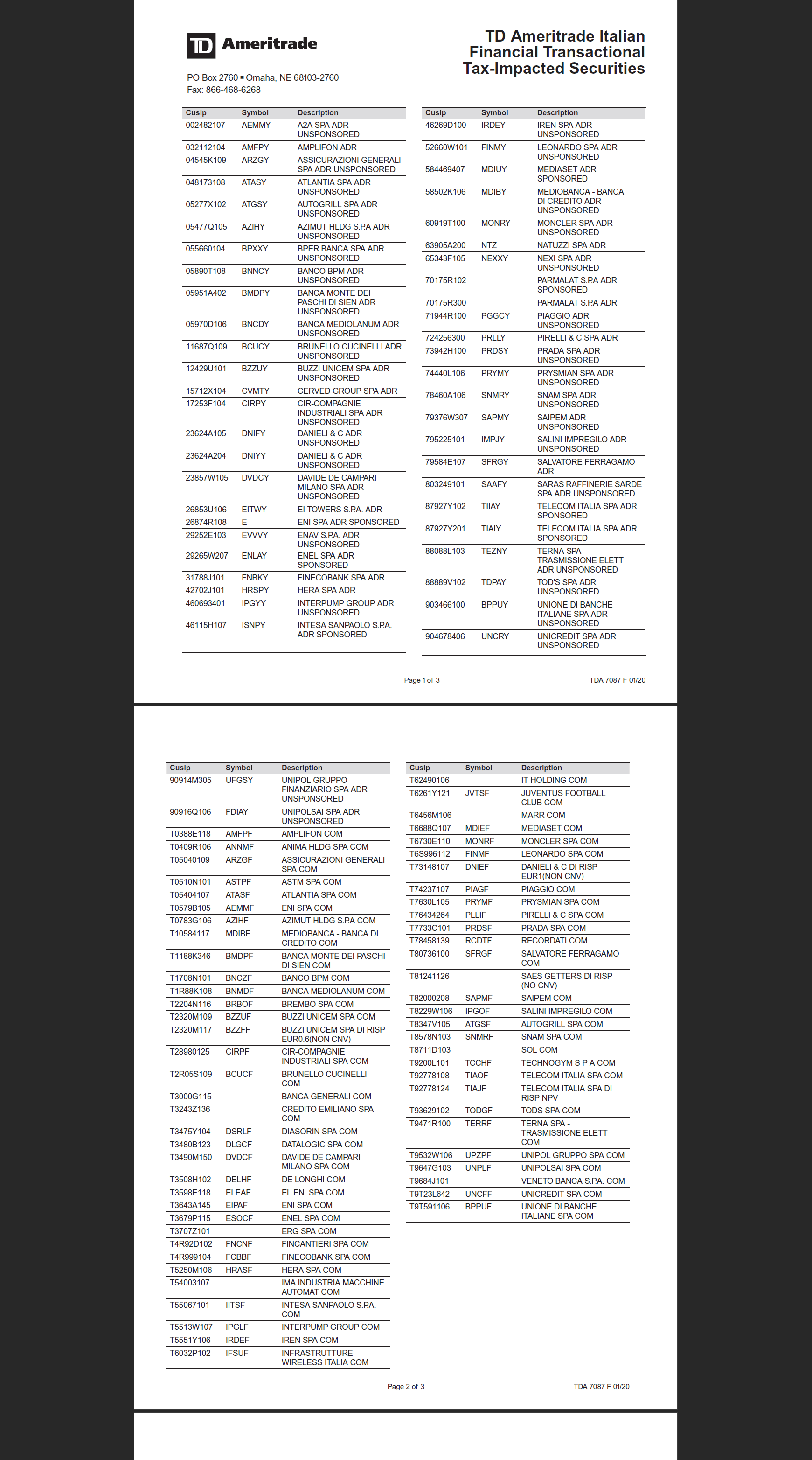

Effective March 1st, 2013, the Italian government has imposed a Financial Transaction Tax (FTT) on stocks and other instruments. Though it has not been confirmed by ADR issuers, this tax will most likely be applied to Italian ADRs as well. A few points to remember regarding the Italian Financial Transaction Tax:

- Effective March 1st Italian companies headquartered in Italy with a market capitalization of EUR 500.0 million or more will be subject to the FTT. Buyers of stocks in these companies will be levied a tax of 0.12% of the total purchase amount.

- In addition to the FTT, a High-Frequency Trading Tax (HFTT) of 0.02% will be levied on HFT orders.

- U.S. stocks brokers will be required to collect the new taxes and remit to the Italian government by the 16th of the month following the transactions.

For more related information please see:

Financial Transaction Tax in Italy (ABN Amro)

Italian financial transactions tax – Italy imposes Tobin tax on financial transactions (Norton Rose)

ITALY – Financial Transaction Tax – update 2 (RBC Investor Services)

Global FS tax newsflash: Financial transaction taxes — the Italian FTT takes shape (PWC)

Italy Introduces a Financial Transaction Tax as of 2013 (Harvard Law School Blog)

Financial-transaction taxes – Skimming the froth (The Economist, December 2012)