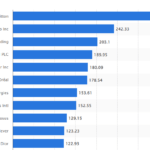

The French President Francois Hollande has introduced a tax on financial transactions effective August 2, 2012. This tax of 0.2% applies on all stock purchases of publicly traded French companies with market capitalization of over over one billion Euros.

France has become the first country to introduce this tax. While one goal of this tax is to raise revenues the other goal is to curb speculation in the markets. In the recent global financial crisis, stocks of European companies especially banks fell heavily and European governments have been trying novel and ineffective ways to prevent further crashes. At the height of the crisis some countries instituted short sales ban on some companies. Along the same line, the Financial Transaction Tax (FTT) has been instituted. Many European countries do not support the view of the new Mr.Hollande.

From a news article:

Sweden also opposes the idea, after a disastrous experience with a similar tax on financial transactions was introduced and then abandoned in the 1980s by the government in Stockholm.

The country set a 0.5% levy on all purchases and sales of equity securities in 1984, and then doubled the amount two years later after disappointing revenues.

The policy was abandoned after analysts revealed it had led to an exodus of traders.

Anders Borg, the Swedish finance minister, estimates that “between 90-99%” abandoned Stockholm and took their business to London.

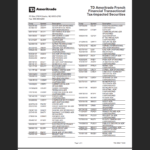

The new tax will be applicable to American Depositary Receipts (ADRs) of French companies as well. From a news release by BNY Mellon Depository Services:

Holders of American Depositary Receipts (ADRs) representing shares of the below listed BNY Mellon French ADR Programs are hereby notified that it has been announced that the French finance bill is being amended and that ADRs will be in scope for application of the Financial Transaction Tax (FTT) to ADRs, effective December 1, 2012 rather than August 1, 2012.

Accordingly, and notwithstanding previous Notices to the contrary, the ADR books will NOT be closed effective end of business July 31, 2012 for issuances, transfers and cancellations on the programs listed below.

It is not clear whether FTT may still be due and payable beginning on August 1, 2012 to transfers of shares for issuance or cancellation of ADRs. Investors and market participants should consult their brokers, and their legal and tax advisors for additional information.

Source: BNY Mellon

Related:

The List of ADRs Subject to the French Financial Transaction Tax

The full list of French ADRs can be found here.

It must be noted that France already taxes a hefty 25.0% Withholding Tax for Dividends paid to US investors. So this new tax is sure to make French stocks less attractive to invest.

Financial Transaction Taxes: International Experiences (Bank of Canada Report in pdf format)