Many global investors avoid investing in Russian equities. Despite the country holding democratic elections and the legalization of private property rights since the fall of communism in 1991, Russia remains a pariah for most investors for good reason. Some of the factors that work against Russia include the widely-held beliefs that it violates human rights, jails opponents questioning the state, arbitrarily takes over private enterprises, suppresses the media, arbitrarily prosecutes company executes and throws in prison without due process, etc. The list of factors that one can document seem to be endless. Hence Russia is unable to attract high foreign investment in Russian equity markets like other emerging markets are able to.

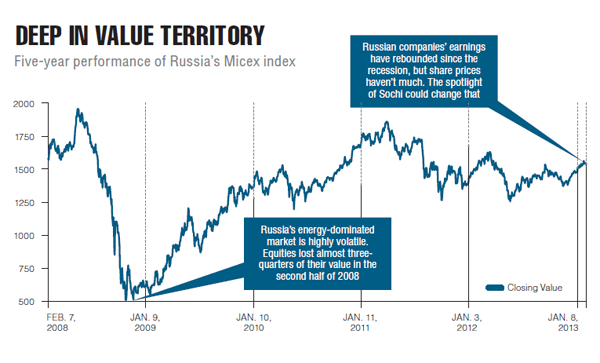

Russia will host the 22nd Winter Olympics from February 7th to the 23rd of next year in the city of Sochi. By hosting this high-profile event, Russia hopes to present a positive image to the global investment community. Already investors are warming up to Russian stocks with the benchmark index up 5% YTD.

From a recent article titled Russia’s image problem in the US in FT beyondbrics blog:

Chris Osborne, Head of Sberbank CIB USA, would be the first to admit that Russia has an image problem among American investors.

“Selling Russia can be a challenge,” he told beyondbrics. “For people who are not already investors in Russia, the image of the country is very negative.”

Indeed, despite being the world’s ninth largest economy with a rising middle class that’s driving a boom in everything from car sales to malls to e-commerce and holidays in Spain, Russia hasn’t been getting much love from investors.

Last year Russian equity and fixed income funds attracted a combined $8.8bn of inflows according to EPFR, which tracks fund flows. While this is a leg up from 2011 – when Russia suffered an outflow of $2bn – the amount is still far less than the $12.9bn that investors pumped into Brazilian assets and the $16.5bn attracted by Chinese assets in 2012, according to EPFR.

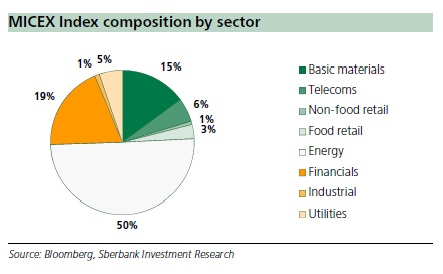

Composition of Russia’s MICEX Index:

Source: Russia’s image problem in the US, FT beyondbrics blog

As shown above, the Russian equity market is heavily dominated by the energy industry. This is not surprising since the country is blessed with all types of natural resources including crude oil and natural gas. As a result, the movement of Russian stocks is highly correlated to the price of oil.

Source: Diversifying Russia, Harnessing regional diversity, European Bank for Reconstruction and Development

The Russian stock market appears to be dirt cheap as per an article in Canadian Business magazine. From the article:

For years, money has shunned the country, mostly because of uncertainty. There’s always a threat of nationalization, a sudden tax hike, arbitrary executive prosecutions and weird policies such as forbidding Americans from adopting Russian orphans.

Those fears, paradoxically, have made the country incredibly attractive from a value perspective. The Russian stock market is currently trading at around 5.5 times earnings, barely half the price-to-earnings ratio of other emerging markets. “It seems logical that a market trading that cheaply doesn’t have a lot of downside,” says Michael O’Flynn, the Massachusetts-based managing director and global head of business development for UFG Asset Management. A decade ago, Russia was trading at a 50% premium to its Brazil, one of its BRIC peers; today it trades at a 50% discount.

That discount could easily diminish. For starters, the events that most spooked investors are fading from memory. The state takeover of Yukos, a massively successful oil company, happened a decade ago. Former CEO Mikhail Khodorkovsky may be out of prison by Olympic time.

Russia’s middle class is growing too—and the country’s GDP per capita is about US$18,000, much higher than that of other emerging markets. There’s also been talk of privatizing government assets, which “foreign investors should be applauding,” Elena Shaftan, manager of the Jupiter Emerging European Opportunities Fund, wrote in a recent report.

Source: The Russian bear turns bullish, Canadian Business

Investors looking to add exposure to Russia can consider adding stocks in the consumer and manufacturing sector due to the rising middle class and growing consumption. The energy sector is highly volatile and can be avoided. However Chris Osborne, Head of Sberbank CIB USA quoted in the FT beyondbrics article that not many companies in the consumer and industrial sector are listed and hence investing in those sectors is a challenge.

The best way to invest in Russian equities is via the Market Vectors Russia ETF (RSX). This fund has about 42% of the assets in the energy sector.However investors can access the consumer staples, consumer discretionary industrials and other sectors with this ETF. The two consumer sectors and the industrials account for about 7% and 1.3% respectively The asset base of the fund is $1.6 billion which is low relative to the assets held by other emerging market country-specific ETFs such as iShares’ Brazil ETF (EWZ) with assets of over $9.0 billion.

Investors who prefer to buy individual Russian stocks in any sector can consider the following five companies. These firms trade on the OTC market and were the largest traded depository receipts in 2012 according to a report by BNY Mellon:

1.Company: Gazprom (OGZPY)

Current Dividend Yield: 6.28%

Sector: Natural Gas Producers

2.Company: Lukoil (LUKOY)

Current Dividend Yield: 5.60%

Sector: Oil & Gas – Integrated

3.Company: Rosneft(OJSCY)

Current Dividend Yield: No regular dividends paid

Sector: Oil & Gas – Integrated

4.Company: Norilsk Nickel(NILSY)

Current Dividend Yield: 6.84%

Sector: Metal Mining

5.Company: Sberbank(SBRCY)

Current Dividend Yield: 1.78%

Sector: Banking

Note: Dividend yields noted are as of Feb 22, 2013

Disclosure: No Positions