In this post lets take a quick at five stocks from different industries and some of the reasons to own them:

1.Applied Industrial Technologies Inc (AIT)

Applied Industrial celebrated its 90th anniversary this month. Based in the mid-west the company is an industrial distributor selling products including bearings, power transmission components, fluid power components and systems, industrial rubber products, linear motion components, tools, safety products, and general maintenance and mill supply products. Applied has had strong in the past few years and the firm is growing with acquisitions and organic growth.

As a mid-cap company, the stock has performed extremely well in recent years with splits in 2004 and 2006. At current prices, it has a dividend yield of 1.91%.

2. Standard Parking Corp (STAN)

Standard Parking is a parking lot operator in the U.S. and Canada. The company merged with Central Parking, another large competitor last year and the combined company will have over 2 million parking spaces. In addition to operating parking lots, the company also provides ground transportation services to building owners, hospital,s hotels, etc.

The company currently has a market capitalization of $443.0 million and the stock does not pay a dividend.

3. Equifax Inc (EFX)

Equifax is one of the large credit bureaus offering credit information on consumers and businesses. Though the company has the majority of its businesses in the U.S. the potential to expand overseas is huge. Currently the stock offers a 1.22% dividend yield.

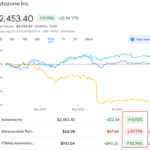

4. UnitedHealth Group Incorporated (UNH)

UnitedHealth is one of the largest health insurers in the country. In 2012, the company has revenues of over $110.0 billion. With the new health care laws taking effect slowly, health insurance companies are bound to benefit with millions are uninsured required to buy insurance.

5. Stryker Corporation (SYK)

Stryker manufactures medical devices such as hospital beds and other products including specialty surgical products focused on orthopedics. With sales of over $8.0 billion in 2012, the profit margin is about 15%. The new healthcare law should also help drive earnings higher as the health care will expand to provide services to millions of new consumers.

Note: Dividend yields noted are as of Jan 25, 2013

Disclosure: No Positions