Trading volumes in both the New York Stock Exchange (NYSE) and NASDAQ (NAS) have increased since the start of the 21st century.Some of the the reasons for the rise in trading volumes include high volatility in the markets, investor anxiety, high-frequency trading (HFT), short-term trading by hedge funds, etc.While dramatic fall in share prices in the past few years have to be taken into account when analyzing trading volumes, that is not a major factor for the rise in trading.

In 2001, there were 4,109 companies listed on the NASDAQ. By the end of the decade the figure decreased to just 2,784. On the NYSE, the number jumped from 2,798 to 3,923 during the same period. But this jump was mostly due to the takeover of Amex by NYSE which added about 600+ companies in 2009.

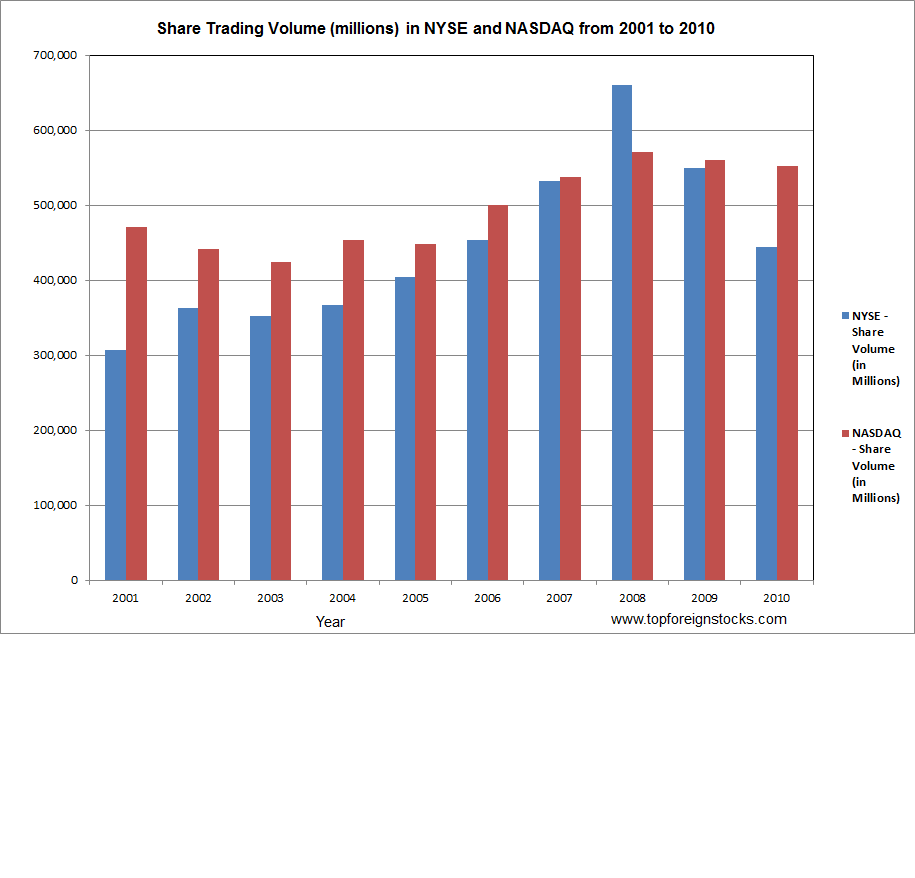

In 2001, about 307 billion shares were traded on the NYSE. By 2010 this number jumped to 444 billion (or) an increase of about 45%. Over at the NASDAQ, the total share trading volume was about 471 billion in 2001. This figure jumped to 552 billion in 2010 representing an increase of about 17%. In terms of the value of shares traded, the dollar amount increased from $10.4 Trillion in 2001 to $11.9 Trillion in 2010 at the NYSE. Currently the average daily volume on the NYSE and the NASDAQ are over 3.0 and 1.8 billion respectively.

The following graph shows the change in trading volume at NYSE vs. NASDAQ from 2001 to 2010:

Click to enlarge

Data Source:

New York Stock Exchange, Inc; American Stock Exchange LLC; The NASDAQ Stock Market, Inc; Securities Industry and Financial Markets Association;

via 2012 Financial Services Fact Book 2012 by Insurance Information Institute and Financial Services Roundtable.

While trading volumes have soared, the duration of stock holding stocks periods in the US has declined sharply in the past few decades.This situation does not bode well for the long-term strength of the US equity markets.

Related ETFs:

SPDR S&P 500 ETF (SPY)

PowerShares QQQ (QQQ)

Disclosure: No Positions

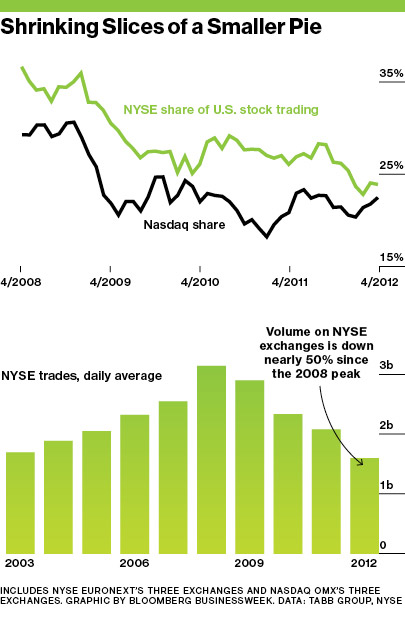

Update:

Source: Where Has All the Stock Trading Gone?, Bloomberg BusinessWeek