Investing in stocks produces the best return especially in the long-term. However when inflation is taken into account the return may not be the highest. Despite the best efforts of the U.S. Federal Reserve to combat inflation, it continues to grow year after. Inflation growth is particularly high in certain service industries such as health care, tax preparation, banking, asset management, real estate brokerage, etc.

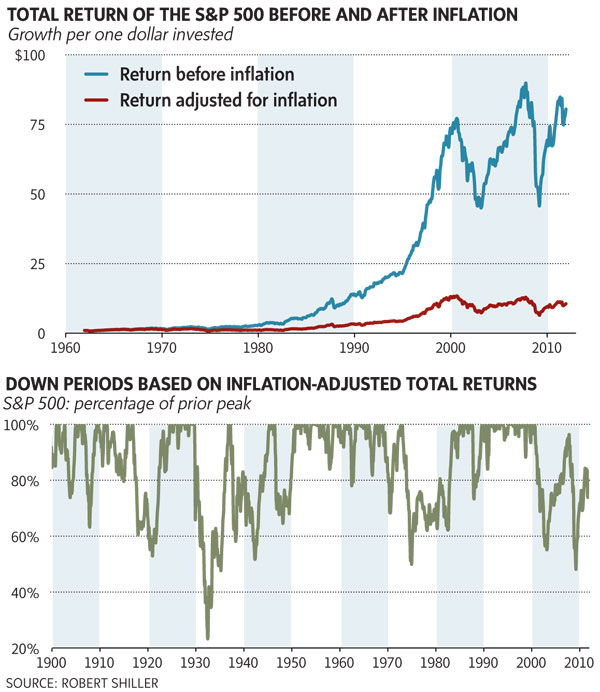

The following chart shows the total returns of S&P 500 since the early 1960s with and without adjustment for inflation:

Click to enlarge

Source: The scourge of inflation, The Globe and Mail

The total return on the S&P 500 since the early 1960s is an average of 9.6% per year. However when adjusted for inflation, the rate of return falls to just 4.8% per year. Since inflation affects taxes, asset management fees and others, the actual rate of return an investor earned during the period shown in the chart is only 1.3% when those factors are included in the rate of return calculation. Clearly 1.3% per year is not a great return for investing in stocks.

The takeaway from this post is that investors should diversify their portfolio among various asset classes in order to earn an inflation-adjusted higher return. This would mean investing in stocks (in developed emerging markets), bonds (corporate, municipal and treasury), real estate, CDs, etc.

Related ETFs:

SPDR S&P 500 ETF (SPY)

SPDR DJ Euro STOXX 50 ETF (FEZ)

Disclosure: No Positions