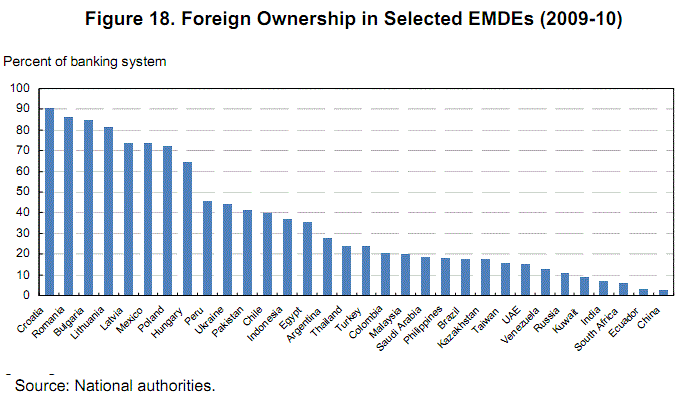

Foreign banks have a strong presence in some emerging countries. In a few of those countries they dominate the local banking market more than the domestic banks.

The following chart shows the foreign ownership in select Emerging Market and Developing Economies (EMDEs):

Click to enlarge

It is interesting to note that foreign banks own more than 50% of the market share in the Central and East European countries noted above. Some of the foreign banks with heavy exposure to these countries include Austria’s Erste Bank (EBKDY) and Raiffeisen Bank (RAIFY) , France’s Societe Generale (SCGLY), Holland-based ING Group (ING), etc. However in the BRIC countries they account for a small part of the total banking system.

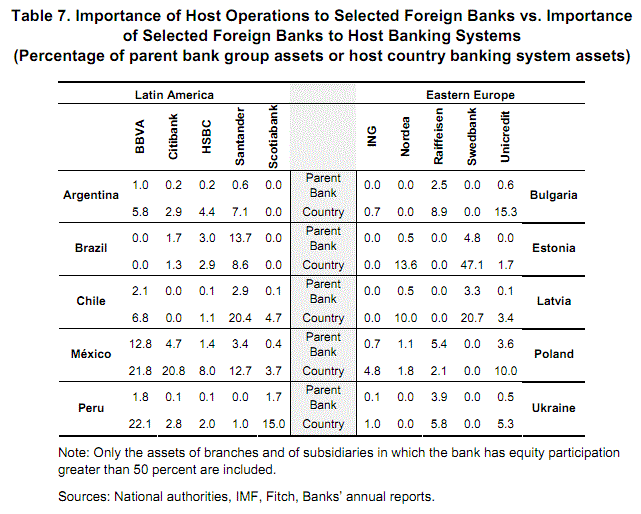

The following graphic shows the importance of select foreign banks to the host banking system and vice versa:

Source: Won’t somebody think of the emerging sovereigns?, FT Alphaville

From the FT Alphaville article:

Argentina, Chile and Mexico have big “exposure” to Santander, but each country is a relatively small proportion of the bank’s own assets. On the other hand, Brazil’s importance to Santander, far outweighs the reverse.

Over in Europe look at, say, Bulgaria and Unicredit, or Latvia and Nordea. Or Peru and Scotiabank… in all these cases, the bank accounts for 10 to 15 per cent of the host country’s banking system assets.

From an investment perspective, because some of these banks have high exposure to emerging markets, their earnings are more diversified and may be better investment options than banks that solely focus on the home markets.

Disclosure: Long BNS, ING, SCGLY, EBKDY, SAN