The term “emerging markets” has lost its meaning over the years due to many reasons. Some countries categorized as emerging countries are actually well developed. For example, MSCI considers the developed countries of Taiwan and South Korea to be emerging countries for technical reasons. The political and economic systems of these countries are equal if not better than those in most Western countries. In addition, frontier markets are also sometimes added with emerging markets making the term “emerging markets” even more confusing for investors.

Recently I came across an interesting report titled “Emerging Markets as ASTERISCS” by Alexander V.Kozhemiakin of UK-based fixed income asset management firm Standish, a unit of BNY Mellon. The following are some of the key takeaways from the report:

- The term “Emerging Markets” coined 30 years ago does not help to clearly differentiate between countries of different wealth, risk, and stages of development. Hence a new term called “ASsets Tied to Economies of RISky Countries,” or ASTERISCS can be used to define these countries.

- Antoine van Agtmael, an economist at the International Financial Corporation coined the term “emerging markets” in the early 1908s as an attractive name for “third-world equities”. Since that time trillions of dollars have been poured into funds that have the term in their name.

- As of June 30, 2011, the market capitalization of emerging market equities, as measured by the MSCI EM, is over four Trillion US dollars and is only about one third of that of the S&P 500. Hence there is potential for further growth in the financial markets of emerging markets.

- A decade ago emerging markets such as Mexico, Brazil, Russia were considered as speculative based on credit ratings. However today many emerging markets (Brazil, Russia, India, China, Mexico, Malaysia, Poland, South Africa, Chile, etc.) are rated investment grade.

- Country risk is an important factor to consider when investing abroad.For example, Greece is mired in fiscal problems and South Korea faces the threat of military aggression by the North. So when adding the world-class electronics maker Samsung Electronics to a portfolio, an investor must also put a mental asterisk next to it as a reminder that it is a South Korean company.

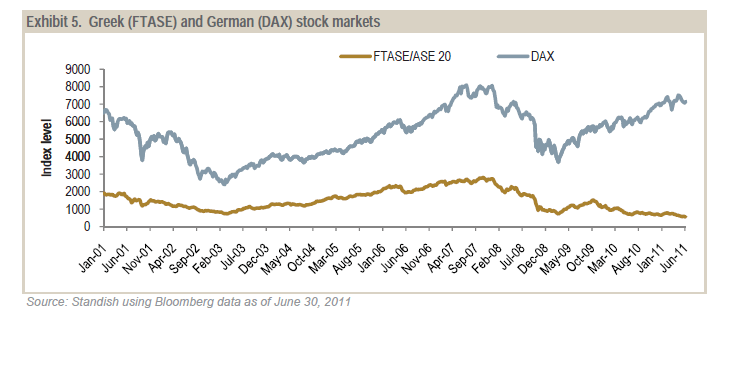

- Developed markets can regress back to the status of emerging markets due to risk of debt defaults and implied credit worthiness. Defaults on public debt is a country risk since it can adversely impact the performance of all asset classes. For example, credit rating of Greece was cut several times in the past few years from investment grade to junk levels which led to the disastrous performance of the Greek equities.The chart below compares the returns of German and Greek equities. While German stocks rebounded swiftly since 2009 Greek stocks plunged to new depths.

Click to enlarge

- Allocating assets to ASTERISCS poses an extra challenge as countries grouped as “emerging makets” differ widely in many charasterics. For example, though Chile and Pakistan are emerging countries, they are both literally and figuratively worlds apart.

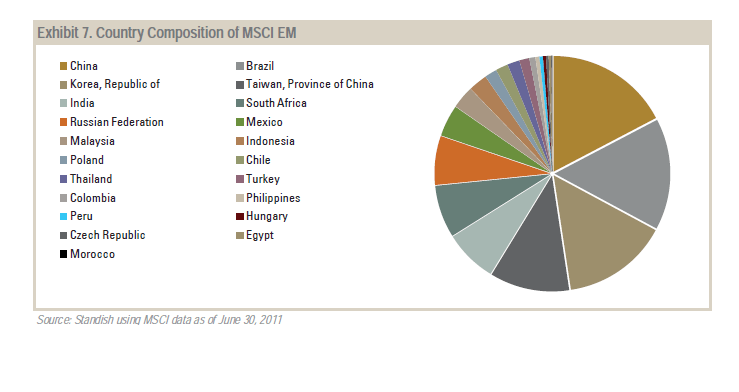

- Diversifying country exposures is not an easy task in emerging equities. Just eight countries comprise approximately 80% of the market capitalization of MSCI EM Index, with the top four (China, Brazil, South Korea, and Taiwan) accounting for more than a half.

- One solution to the country diversification problem in emerging markets is to add frontier markets. However adding asset classes of all types in those markets is not easy. For example, the frontier market of Kazakhstan does not have a large equity market but offers relatively liquid US dollar-denominated bonds. Similarly, the emerging market of India offers a highly liquid equity market but the local debt market is closed to foreign investors.

Source: Emerging Markets as ASTERISCS, Standish

In conclusion, when selecting countries for investments one should not make decisions based on catchy names alone. Even the BRIC acronym that was coined by Goldman Sachs does not adequately do justice to group them together since all the four countries vary widely. Brazil is a democracy with plenty of natural resources the world needs, China is a communist state with a huge population and lack of significant natural resources, Russia is a dictatorship with large natural resources and a small population and India is the world’s largest democracy with a messy political system, a large educated population and lack of natural resources.

In 2005, Goldman created the term “N-11” (Next Eleven) to represent countries with the highest potential to become the next BRICs. This list is also comprised of countries which share nothing much in common. For example, Bangladesh – one of the world’s poorest countries – is grouped with South Korea and Turkey.

CIVETS (Colombia, Indonesia, Vietnam, Egypt, Turkey and South Africa) is another acronym that was added to investors’ vocabulary in 2009 by Robert Ward of the Economist Intelligence Unit (EIU). This group is believed to share many characteristics such a dynamic and diverse economy and a young growing population. However Egypt just recently experienced a dramatic revolution that toppled the previous regime and Turkey has been relatively stable democracy for many years now with a vibrant economy.

So instead of focusing on N-11, BRICs, CIVETS, “emerging markets”, “frontier markets” and other monikers investors have to evaluate each country individually and then make well-informed decisions.

Related ETFs:

SPDR S&P 500 ETF (SPY)

SPDR DJ Euro STOXX 50 ETF (FEZ)

iShares MSCI Emerging Markets ETF (EEM)

Vanguard Emerging Markets ETF (VWO)

Disclosure: No Positions

Many Thanks for enlightment